Auditing our finances is often considered a tedious task that many people avoid. Auditing in general can be a long process that requires difficult brain work, and auditing ourselves can give us hard wake-up calls that we don’t necessarily want.

But it doesn’t have to be that difficult! There are many positives to auditing your finances. Mainly, it is about getting to know your spending habits better.

Auditing your finances and keeping better track of your expenses can relieve a lot of hidden stress and anxiety, help us feel better, more secure, and feeling positive about the future.

Why Audit Your Finances?

Completing an audit of your finances gives you a birdseye view of your spending. Rather than counting every nickel and dime, generating a monthly balance sheet lets you see the risk of overspending, and helps you avoid any financial pitfalls.

Financial audits are a great way to get you motivated to save money or pay off debt. Many people save or pay off debt a little bit at a time with whatever money they may (or may not) have left in the bank. This method is more time-consuming and costly in the long run.

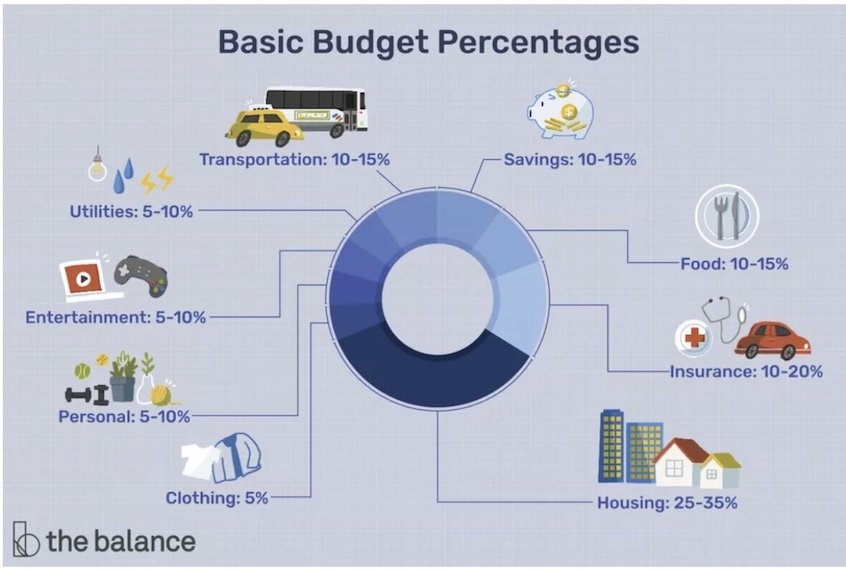

Instead, if you can evaluate your spending, see how much goes on necessary and unnecessary items, you will be in a better position to set an achievable budget.

Here is a guide on how to easily audit your personal finances, without any stress or headaches along the way.

A Guide to Auditing Your Finances

Auditing needn’t be a scary or daunting process. With just a few tips you can quickly audit your finances and get back on track with your finances.

All you need is a little time, honesty, and a copy of your bank balance and you’ll get your money on track in no time.

Take Time Out

Make sure to schedule a dedicated time slot for auditing. Often it is easy to get distracted by daily tasks and other responsibilities and that personal audit sheet is left half complete for not started at all.

Carving out protected time for your finances is a healthy move. Many people find themselves mentally going over their daily or weekly spending, and keep themselves awake at night with worry.

https://learn.stash.com/5-tips-for-a-personal-finance-audit-before-summer-ends

https://www.theconfusedmillennial.com/personal-financial-audit/

Taking time to sit and investigate your spending takes away the stress of the unknown or uncertain.

Taking time during the day to get to know your bank balance in more detail means that you go to bed with a calm mind, get a better night’s sleep, and look forward to a brighter tomorrow.

Investigate Your Habits

We are all habitual spenders. However, some forms of habitual spending can be more harmful than others.

That morning coffee on the way to work may not seem like a lot, but when you tally up the cost over the year it can amount to quite a bit of cash that could probably be better used elsewhere.

Review receipts, check your bank statements, and get a monthly copy of your online account transactions and add up the balance in total.

It is very easy to forget that you bought a dress or new pair of shoes on eBay if the financial record is hidden in your PayPal account. Check out even more from Well+Good.

Credit Spending

Habitual spending on your credit card can be disastrous for your finances. Having a credit card is no bad thing if you use it wisely, but using it for small, unnecessary purchases or luxury items can lead to ruin if you do not clear the debt off immediately.

Payday

Payday is another obstacle to saving money. Seeing your balance refresh itself every month can give you a false sense of security.

There is nothing more tempting than having a large sum of cash deposited into your account, even if most of it is already reserved for important payments

So, watch out for spikes in spending around the payday period, and estimate how far into the month you normally get before you start to worry about paying the bills.

Organize Your Records

The length of an audit will depend on how you’ve organized your bills and budget. It is great if you have saved all of your receipts, but stuffing them away in a draw means that you have the time-consuming job of reorganizing them when it comes to the audit.

Instead, make files or categorize your receipts, statements, and other spending records in a way that makes it easy for you to access them.

Alternatively, you could do a regular mini-audit, where you summarize your in-goings and out-goings on a monthly or weekly basis. Do this so that when the big annual audit rolls around, the process will be far quicker and easier.

Mini audits also mean that you don’t have to wait until next year’s big audit to make changes to your spending plan. If you see an unhealthy spending pattern start to emerge, you can nip it in the bud before it starts getting out of control.

Money Tracking Apps

Signing up for a money tracking service is an easy way to assess your spending without much personal effort. Most money tracking applications are straightforward to use, all you have to do is tell them how much you earn and input the amount every time you spend.

Many of these apps allow you to set savings targets and will notify you if you are reaching your limit. However, they do rely on complete honestly to work. You will need to do some deep-diving into your financial situation to set up the app correctly, but it can save you tons of time on future audits.

So many people find money tracking applications useful that many banks are setting up their own money management apps and offering them to customers for free.

They are attached to your bank account, so if you make most of your purchases by Chip and Pin, a money management app will track most of your spending, especially those impulse purchases!

Strategize

Having an end-game is a psychologically effective way of rethinking your finances.

Strategy and planning is the purpose of personal auditing. Once you have evaluated all your spending and have identified the strengths and weaknesses of your budget, you must put a realistic and achievable plan in place.

Finding ways to save and cut back on spending is always a good thing. Whether you want to save a huge sum, like for buying a house, or for something smaller like a new television, strategizing your savings towards a goal makes the processes easier and a lot faster.

Even if you don’t have a particular savings goal in mind, setting yourself a savings plan or debt clearance deadline is a great motivator.

Conclusion

Managing your money by auditing your finances is beneficial to your bank balance and your mental health.

Money is one of the biggest priorities in life, and top of the list of reasons why many people around the world lose sleep at night.

Money worries don’t just affect where you can live or if you can afford to eat. The stress caused by poor money management can harm relationships and your health.

Ignoring your finances can have devastating results. Money problems do not get better all by themselves, they need time, attention, and careful thought. Habitual record-keeping, honest budgeting, and realistic goal setting are all you need to address most of the financial problems you may have or want to avoid.

The good news is that if you take action with your finances and audit your finances regularly, you will start to see your money situation improve, and at a faster rate than you might think.

![Read more about the article [Funding alert] Skillmatics raises $6M in Series A round led by Sequoia India](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Imageqpit-1624277569691-300x150.jpg)