As India rides the wave of digital transformation, new trends in technology and business growth are emerging across sectors and geographies. Leading the charge around this transformation are Software-as-a-Service (SaaS) companies, which have been leveraging the power of cloud technology in innovative ways to chart new frontiers of growth.

To showcase and understand the changes that the new India is undergoing, YS is hosting the SaaS DNA Fireside Chat Series, in association with AWS, featuring experts from across India’s SaaS ecosystem who will share their unique insights around this digital transformation and how it will shape the ecosystem.

In this episode<Hyperlink the video>, Praveen Sridhar, Head, ISV Segment, Amazon Internet Services Private Limited (AISPL), gets in conversation with Dr. Ram Ramdas, Founder and Chief Evangelist, WonderLend Hubs; Rajesh Iyer, its Co-founder and Chief Business Officer; and Anusha Jathanna, its Co-founder and Head of Solutions.

WonderLend Hubs is a born-in-the-cloud SaaS-based company that seeks to become the credit gateway for 500 million underserved citizens in the financial sector. They discuss their solutions for credit lending, their unique socio-economic profile credit score platform and the challenges they face while making inroads in the sector.

Bringing simplicity, agility and efficiency to a complex sector

According to Ram, while catering to the credit needs of the underserved was the primary motive to form WonderLend Hubs with his Co-founders, they also sought to bring simplicity in a complex sector with the help of technology.

“We derived our inspiration from Amazon, and AWS in particular. We seek to consume complex technologies, convert them into easily consumable services, and deliver them commercially in a transparent, pay-per-use model,” he said.

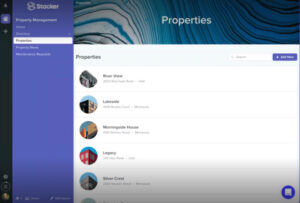

Rajesh said that their offering is essentially a no-code, and driven by front-end configuration. “It allows the business users of the client to build their credit flows, variables, score cards, orchestrate multiple workflows, which enables agility and on-going optimization as they are running their business in a live format” he says.

The Opex is a subscription-based module that allows clients to onboard the solution without the prohibitive upfront costs that are normally associated with such solutions. Citing an example of a leader in the non-banking financial corporation (NBFC) space, Anusha recounted how WonderLend Hubs’ solution significantly improved the volume of their two-wheeler loan segment.

“Our platform being a low-code/ no-code solution and a business user configuration-driven platform, enabled us to deploy very quickly. They (the client) were able to give the borrower the final approval at the point of sale in an average of 20 seconds per application. It propelled their volumes by 3x to 1 lakh applications per month. During the peak festive season, the client was able to maintain this rate of processing applications when loans reached 200,000 per month,” she said.

The role of cloud in releasing such solutions:

Explaining the socio economic profile credit scoring platform, Rajesh said that it was a unique, alternate data-based credit scoring platform that uses publicly-available macroeconomic data to create a credit profile of the underserved borrowers, “Using the borrower’s residence location as the only anchor, we help lenders predict delinquency better, and book more business. These borrowers are normally those who do not have the adequate financial records, or are first time borrowers,” he says.

He noted that delivering tailored credit solutions to this low-ticket, large volume segment, requires a lot of moving parts. This is where cloud technology assumes significant importance. “You need a fairly agile platform to stitch all of this together with very low tech dependence. And we embraced cloud technology so that we could continuously upgrade our platform and ensure that our clients are working on the latest version of the product,” he says.

Towards a new era of credit lending

The team noted that the implementation of such innovative technology solutions is yet to become mainstream in the industry. “Many lenders are still warming up to the idea of a digital lending wave, and cannot see the need to overhaul their existing technology,” says Anusha. “We are still seeing a lot of conservative decision-making at the top.”

When asked for advice for entrepreneurs looking to enter this dynamic space, Ram said, “(If you focus on) delivering a presence-less, paperless, contactless and cashless kind of a model, a whole lot of innovation can be spurred.”

Quoting Mahatma Gandhi, he said, “Find purpose, the means will follow,” before signing off.