While creating business opportunities is one of the tedious tasks for an entrepreneur, a big headache is managing all kinds and sizes of transactions. For small and medium businesses (SMBs) and startups, it generally becomes difficult to manage invoices, filing taxes and other compliances in absence of in-house resources. Further, miscalculations or inaccuracy in book-keeping can put the founders in a financial mess.

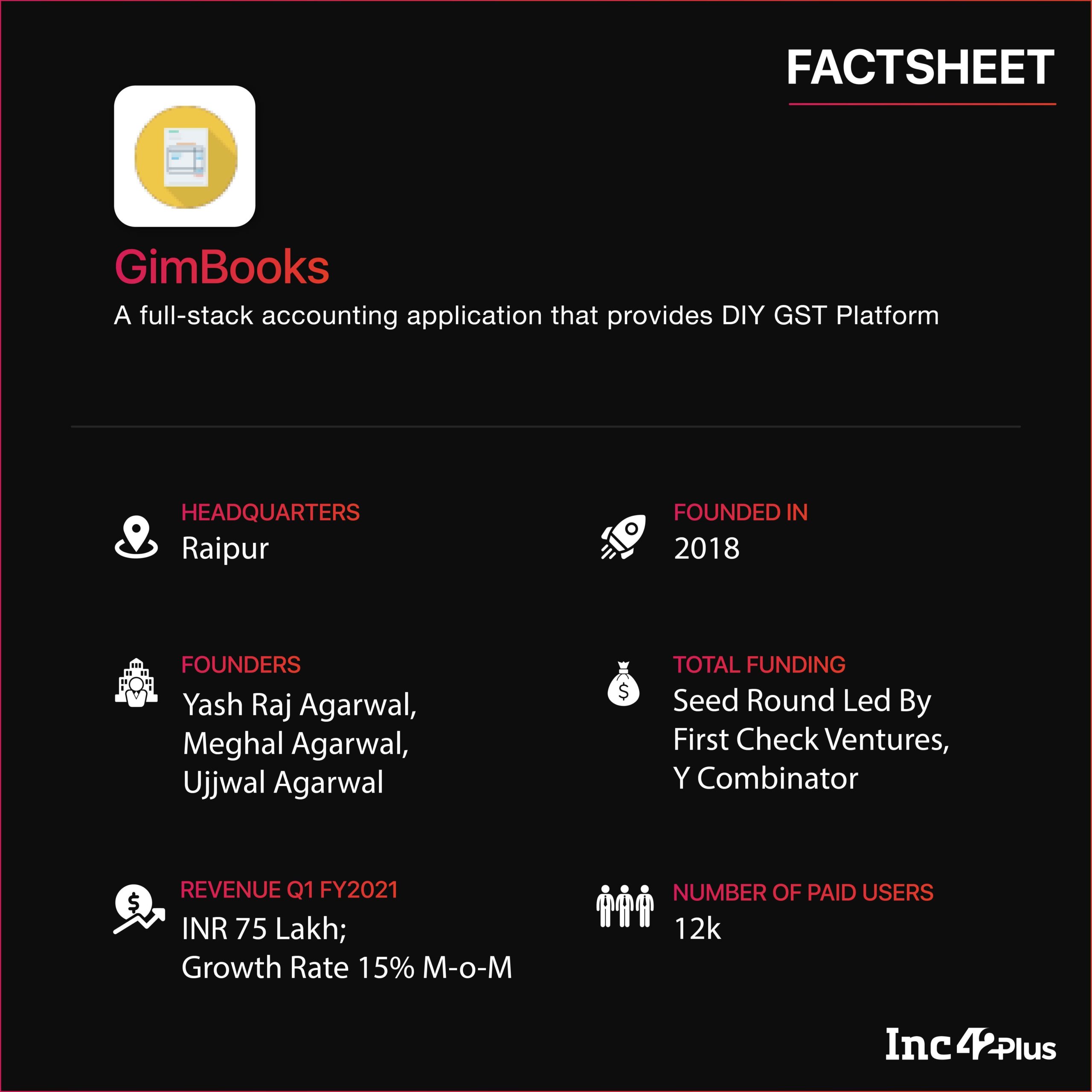

Founded in 2018 by Yash Raj Agarwal, Meghal Agarwal and Ujjwal Agarwal, Raipur-based fintech startup GimBooks is solving these pain points for startups via an app-based book-keeping, accounting, lending, and digital business management platform.

From DIY GST Invoicing To Fulfilling Financial Needs

Yash tells Inc42 that the startup began as a GST Invoice Management (GIM) provider and has recently forayed into a full-stack accounting platform for SMBs. “Now, we enable SMBs to manage their invoices, all product documentation like quotations, purchase orders, payments and ledgers — whole bookkeeping to empower India’s MSME and SMBs entrepreneurs,” Yash added.

Through an integrated website, the startup allows users to digitally create customised GST-compliant invoices, waybills, purchase orders, challans, etc based on the industry — pharma, electronic retail, manufacturing, transportation industry etc. Currently, it provides customisation to eight industries and plans to expand to three more industries by the end of September.

Further, since the users are already filling in the GST details such as purchase receipts, payment receipts, HSN codes manually, an integrated GST-filing feature will be added to the app by the end of September. Additionally, the startup also aims to launch an ITR filing feature and TDS filing.

However, though the company started with its focus on invoice management, it is now focussing on lending marketplaces, connecting borrowers with undisclosed partner lenders through the mobile app as apart from managing accounts, a big pain point for SMBs and startups is raising funds.

GimBooks also enables businesses to manage payments — pending payments, reminders, sending links for collecting money through cards or other instruments.

Talking about the idea behind the startup, Yash said: “I have traded on various industrial products, and to manage the invoices, we would use Tally which is very complex, for a layman planting a bottleneck when an accountant is not around. So, the trigger points here were the need for a ‘Do-It-Yourself’ mobile-based app, and the roll-out of GST in 2017, which encouraged us to have a complete solution without a learning curve.”

Securing A Place In $8.7 Bn SMB Opportunity For SaaS Startups

In India, there are 50K+ DPIIT-recognised startups, and, there are approximately 63 Mn SMBs in India as per the official estimates. Out of these, 44 Mn or about 70% are unregistered, whereas the remaining 19.5 Mn are officially registered. According to Cisco’s 2020 Asia Pacific SMB Digital Maturity Study, 69% of SMBs in the Asia-Pacific were accelerating their digitalisation rates to address COVID-19 challenges.

The low technology adoption makes SMBs less efficient compared to tech-adoptive businesses despite their significance to the economy. Besides the onset of the Covid-19 pandemic has played an important role in digitisation to increase the overall productivity of the sector.

Traditionally, SMBs would have to connect with various departments to fulfil separate needs — banks for personal finance, CAs for tax filings, in-house accountants for managing ledgers, among others. Now, enterprises are changing themselves with the evolution of SaaS startups.

The total market opportunity for horizontal SaaS solutions in the SMB space is estimated to be $8.7 Bn, as per DataLabs by Inc42 Plus analysis on the various sectors that make up the overall SMB market.

GimBooks runs on a freemium model and claims to have 12K+ paid users, aiming to reach 25K+ plus users by the year-end. The revenue model of the startup is subscription-based — six months to lifetime and commission on the disbursal of the loans. It is also in a pipeline to start charging commissions on payment collection. The startup claims to have reduced the payment collection time by half for an average SMB.

GimBooks claims to have clocked a revenue of INR 75 Lakh in Q1 of FY2021 on the track of crossing INR 1 Cr in the current quarter with a growth rate of 15-20% (MoM).

Validation For A Small-Town Startup

GimBooks recently raised seed funding of an undisclosed amount led by First Check Ventures. Y Combinator also participated in the round pumping $125K into the fintech startup.

The funds will be utilised for product development and customer acquisition via increased marketing spends. Yash told Inc42 that while the product still caters to SMBs only in India, the startup is planning a global launch in October-November.

GimBooks is also in advanced stage talks with international investors to close a pre-series A round by the end of this year.

After AtmaNirbhar Bharat Innovation Challenge win, Y Combinator’s funding was another milestone for the startup, enabling it to have conversations with other investors to pump funds in the full-stack book-keeping platform.

“We do not come from Bengaluru or Mumbai, but from a very small town altogether, where the startup ecosystem is not very well connected. From a strategic and partnership point of view, it helped us establish connections with banks much easier than before. The milestone provides a much-needed validation to a small-town startup internationally,” Yash added.

The “Big Four” in the accounting services market are PWC, Deloitte, KPMG, E&Y, while GimBooks competes with startups such as Y Combinator-backed Clear (formerly ClearTax) that last raised $50 Mn Series B, publicly-listed (on NYSE) Avalara with a market cap of $222 Mn and Zoho Books, the GST-compliant accounting solution from tech company Zoho.

The accounting software market is projected to grow at a CAGR of more than 14% during 2016-2021, further, according to a NASSCOM report, the SaaS market is expected to grow at 36% per annum and touch $3.3-3.4 Bn by 2022.

The post How Y Combinator-Backed Fintech Startup GimBooks Empowering SMBs With Do-It-Yourself GST Accounting appeared first on Inc42 Media.