Online up-skilling platform Upgrad has concluded another funding round of $40 million (about Rs 290 crore) from the World Bank arm IFC, bringing down the promoters’ holding in the firm to 75 percent.

It had recently secured a $120 million funding from Singaporean investor Temasek Holdings,

The equity infusion of $160 million in two quick rounds takes the Mumbai-based startup closer to unicorn status, valuing the around six-year-old company at $850 million. This is the second external funding for the company.

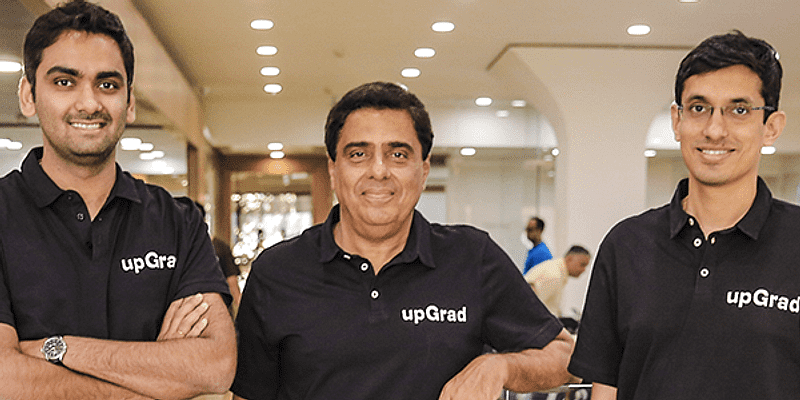

Phalgun, Ronnie & Mayank of upGrad

Upgrad was founded by Ronnie Screwvala, Phalgun Kompalli, Mayank Kumar and Ravijot Chugh in 2015 by investing over Rs 170 crore, most of which was from Screwvala.

The work we do has been well-acknowledged by the $160 million funding from two of the very reputed global investors this week — $120 million from Temasek this Monday and $40 million from the IFC today. That the International Finance Corporation (IFC) has chosen to invest in us is a big reflection of the work we do, chairman and co-founder Screwvala told PTI on Thursday.

The IFC funding also reflects the great synergies between their investment philosophy and our work, he said.

Screwvala said it may take six more weeks for the investment to conclude and currently, they are completing the legal formalities. The IFC had in January itself made the customary intimation to the government (foreign ministry).

Ruchira Shukla, regional head, PE/VC funds and disruptive technologies at IFC India and South Asia could not be reached for confirmation immediately.

Screwvala parried the question of when does he expect Upgrad to be formally labelled a unicorn, saying our focus is not on such labels, but continuous improvement and increased focus on what we do. Such status gives us a good headline, but we are not focused on headlines but our work.

On the equity dilution through the two funding rounds, Screwvala said the three promoters (excluding Ravijot Chugh ) still retain almost 75 percent, of which he owns 60 percent, and the other two co-promoters will hold almost 15 percent and two external investors between them the remaining 25 percent.

Asked whether Upgrad could meet the target for FY21 with a monthly revenue run rate of Rs 100 crore, Screwallah answered in the affirmative, saying the FY21 numbers are over Rs 1,200 crore. It had closed FY20, with a revenue run rate of Rs 230 crore only.

The higher top line numbers are because they could more than double the student base to over 1 million, boosted by the pandemic-induced work-from-home that has made professionals seek a lot of re-skilling and up-skilling to meet the changing demand from work.

Screwallah ruled out taking the company public saying at Rs 1,200 crore of revenue run-rate, we are too small for the equities market.

I know both the advantages as well as the disadvantages of running a publicly-traded company and I feel one need to have a critical mass to take a company public (his UTV was acquired by Disney at an enterprise valuation of $1.4 billion in 2013). And therefore, we are focused on further building our growth in the coming years, he said.

From around 5 lakh professionals who took to its learning and upskilling between 2015 and March 2020, the nine lockdown months alone saw the same crossing 1 million by December, co-founder and managing director Mayank Kumar had said in January.