Four Indian banks have gone live with the account aggregator (AA) framework with more expected to join within the next month

Conceptualised in 2014, AA framework will facilitate a consent architecture to help users share financial and transaction data with different financial entities

Talks are on to bring telecom payments data within the purview of AA to facilitate alternate credit scoring

The Indian government’s much-awaited account aggregator framework that was conceptualised in 2014 to facilitate smoother and safer access to financial data has gone live with four Indian banks coming on board today.

HDFC Bank, ICICI Bank, Axis Bank, Federal Bank, Kotak Bank, State Bank of India (SBI), IDFC and IndusInd Bank are in various stages of implementation of the framework.

At the launch event, the Reserve Bank of India’s (RBI) deputy governor M Rajeshwar Rao stated that the AA framework will enable faster decision making across financial services such as wealth management, credit, insurance among other areas. More than 7,000 accounts have already been linked so far and nearly 6,000 customers have used AA to share data, according to estimates.

The central bank had approved a new class of NBFCs in 2016 to act as account aggregators. The main responsibilities of the account aggregator are to provide services based on the explicit consent of individual customers or clients. RBI had then strictly asked account aggregators to not collect any financial information of the customer shared by the financial information providers.

“Disruptions due to the pandemic have worsened the credit gap and AA can act as an intermediary to provide accurate data for credit approval with user consent within a shorter time span. It will assist in decision making for various financial use cases while eliminating paper trails,” said Rao.

The Reserve Bank Information Technology Private Limited (ReBIT) has released application programming interface (APIs) and technical standards that the AA service providers will have to adhere to in order to ensure security and authenticity of data. Rao added that MSMEs will benefit greatly from this framework as it will help to collate their financial data which is otherwise cumbersome to document when they need to avail credit.

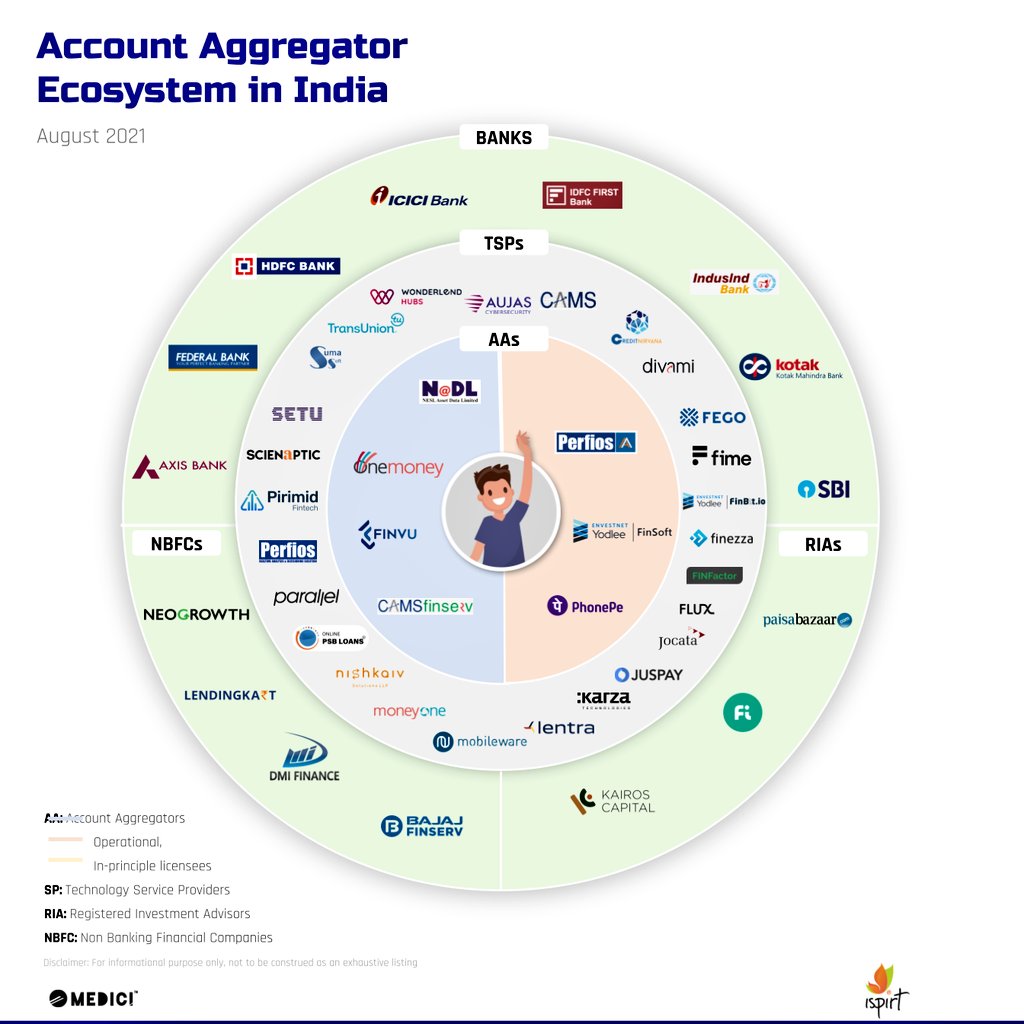

The AA Ecosystem

The AA value chain includes financial information providers (FIP) who are banks, asset management companies, pension funds among others and financial information users (FIU) which are companies that will leverage this data to provide services. FIUs and FIPs must be registered with either the RBI, Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDAI) or Pension Fund Regulatory and Development Authority (PFRDA). Entities have to be ready to share data as FIPs before they can apply to be FIUs.

Much like the unified payments interface (UPI) which revolutionised digital payments, industry stakeholders believe the AA framework can help streamline lending infrastructure. In addition to accessing financial data through bank accounts linked to the AA platforms, telecom data could soon be incorporated in the account aggregator consent framework, said Nandan Nilekani, Infosys chairman speaking at the event. He has been closely involved with the entire India Stack ecosystem of which AA is said to be a critical piece.

“Talks are on to get telecom data on this network too. Meaning, tomorrow somebody who has a great track record of making their prepaid mobile phone bill payments on time can use that data to get a loan using the AA system,” he added.

Currently, AAs that have been licensed to operate the framework include CAMSfinserv, Finvu, NADL and Onemoney. Other companies including Perfios, PhonePe and Yodlee have in-principle approval. The AAs can only transfer encrypted data which the FIP and FIU can read.

The Account Aggregator Consent Layer

In theory, the account aggregator system will reduce the time taken to verify documents. Associated data can only be shared with FIUs only if a user provides the consent, and only the data that has been consented to share will be shared. Users can choose the accounts they wish to link with AA and select the ones they need to share with an FIU and for what duration of time they want to share. Access to data can also be revoked by users. However, extensive user education will be required for this initiative to succeed, say industry stakeholders.

“Consumer awareness is also needed about their rights, their data and how they can define the duration during which they need to provide consent. It will be essential for building product awareness as well,” said Naveen Kukreja, CEO of IPO-bound Paisabazaar during a discussion following the launch event.

While the AAs do not solve the problem of collections, it will reduce the cost of providing credit and improve chances of credit approval because multiple financial, transaction data sources can be used for underwriting purposes, say stakeholders, which will lead to better use cases for AAs.

“We know that users have multiple bank accounts, so when they leverage a feature like Ask.Fi, and ask for example how much they’ve spent, or how much they’ve saved, Fi can now give them an answer that scans all their accounts instantly. With the successful demonstration of the framework today we are excited to have all our users experience the power and convenience of the AA integration once it’s rolled out to all users,” said Sumit Gwalani, cofounder, Fi, a neobank that is in the process of implementing the AA as an FIP/FIU.