The first quarter of the calendar year 2022 has started with a flurry of activities in the startup ecosystem, setting a number of records along the way, already in the first three months.

Post the funding rush of 2021, the first quarter of 2022 saw a significantly higher number of deals as well as funding amounts than the same period in 2021. As per Inc42 data, Indian startups raised more than $11.8 Bn across 506 funding deals in Q1 2022.

Essentially, funding grew almost 186% this quarter compared to the corresponding period last year. The deal count also soared by a mammoth 64% in the first three months of 2022 against Q1 of 2021.

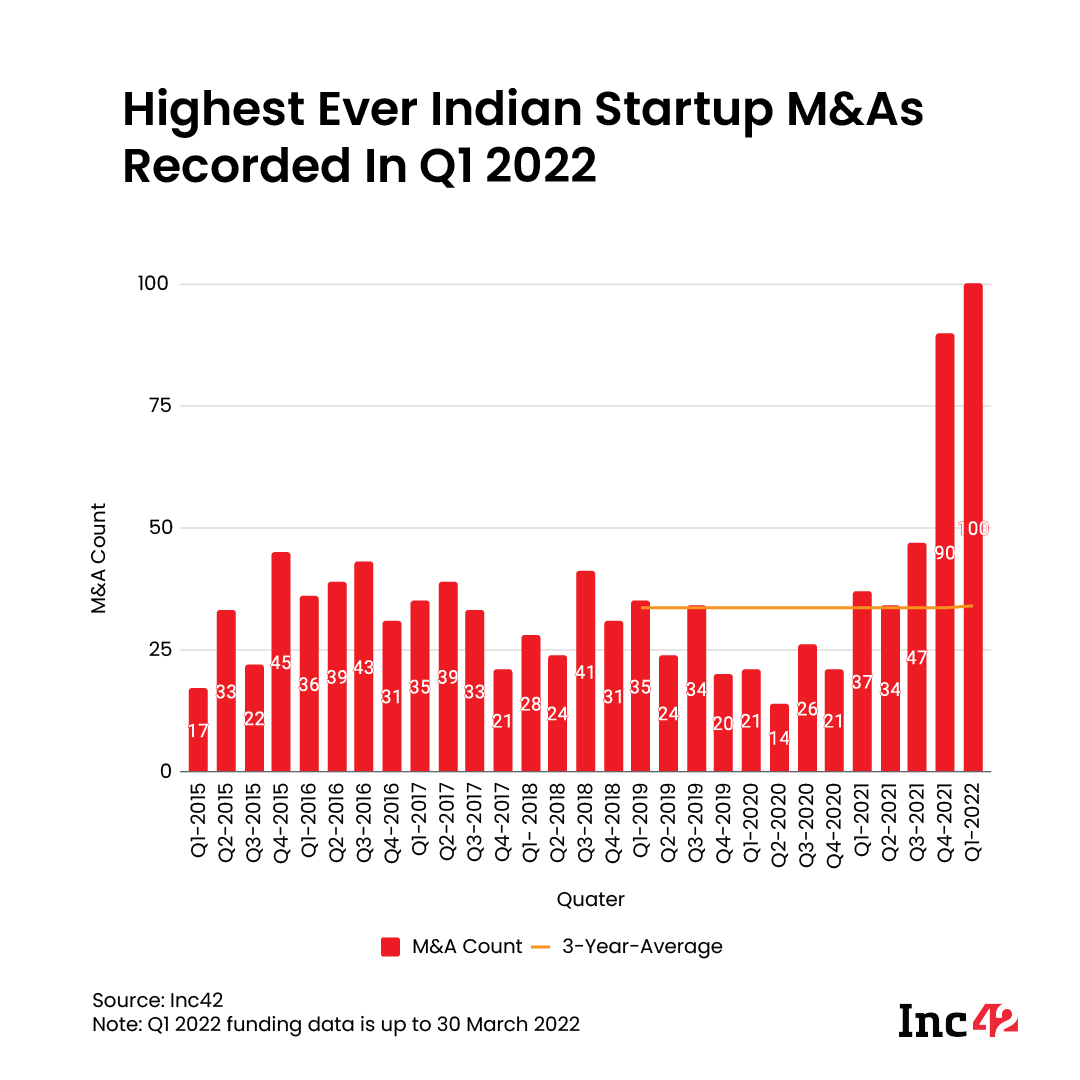

At the same time, against the backdrop of market uncertainty, the Indian startup ecosystem has moved towards market consolidation. This has led to record-shattering mergers and acquisitions in the startup market this first quarter.

In all, during the first quarter of the calendar year 2022, 100 mergers and acquisitions have been completed in India’s startup ecosystem. These M&As happened across multiple sectors, with seven sectors claiming almost half of the M&As this quarter.

Enterprisetech topped the list with the maximum number of mergers and acquisitions–26 deals in Q1. Interestingly, enterprisetech also was the segment with the most funding in the time frame, seeing the completion of 109 funding deals worth a cumulative $2.03 Bn.

Ecommerce took the second spot, claiming 23 deals during the first quarter. Apart from healthtech, fintech, edtech and consumer services, other fields claimed 14 mergers and acquisitions through the Q1 CY2022.

The number of M&As that happen this quarter alone is more than thrice the three-year average of the startup ecosystem and is also about 10% more than the quarter before.

More impressively, the mergers and acquisitions that happened in the last quarter alone were 21% more than the M&As that happened in the entirety of 2020.

If the data is seen closely, the wave of consolidation started in the third quarter of 2022, which saw 47 M&A deals go through. The momentum continued throughout the end of 2021, resulting in 90 M&A transactions going through, and setting a record for the highest number of M&As ever closed during the last quarter of the year.

Enterprisetech – The M&A Hotspot

Powering this wave of consolidation in India was the enterprise sector, which saw a record 26 transactions go through.

Most of the enterprisetech takeovers have been to augment the acquiring company’s house of brands or to allow them to acquire new-age technologies these startups are developing.

For instance, when CAMS acquired B2B fintech startup Fintuple Technologies in early March this year, it did so for the latter’s API suite.

Fintuple’s portfolio includes technology offerings in the areas of client digital on-boarding, KYC, fund data, fact sheets and analysis and other digital support solutions for AIF and PMS, and CAMS, being a financial infrastructure and services provider for mutual funds, AIF and PMS, took the opportunity to take up a majority stake.

Similar examples of such acquisitions can be seen when PhonePe acquired GigIndia for enterprise payments, and when conversational engagement platform, Gupshup, acquired cloud-based telephony startup, Knowlarity. Both the acquisitions went through because of the acquirer’s interest in the startup’s technology.

While most startups are acquired for acquiring either their technology or customers or both, there are acquisitions that are done for building new lines of business altogether, too.

When Good Glamm Group announced the stealth mode acquisitions of influencer marketing platform Winkl and video analytics startup Vidooly, they had the same aim in mind.

As a part of boosting its content strategy, the Good Glamm Group has spun off and consolidated four of its acquisitions (Plixxo, MissMalini, Winkl and Vidooly) into a creator economy-focused brand — the Good Creator Co. It has also pumped INR 200 Cr in the new venture, to scale it from present 250K+ creators to 1 Mn+ by CY22.

More examples of the same could be seen when Reshamandi acqui-hired software development firm Hashtaag to strengthen its product offerings.

Enterprisetech saw acquisitions mostly for the said motives, and while no one likes to divulge financial details of the same, the size of the deal can be guessed at by looking at the corpus of stakes acquired and the valuation of the startup at the time of the deal.

For instance, when Shiprocket acquired D2C startup Wigzo Technologies in January, they acquired a 75% stake in the startup for an undisclosed amount. However, sources had reported that the deal was estimated to be worth around $20-25 Mn, valuing the company at $25-30 Mn.

Ecommerce – Consolidation Aplenty

According to Inc42 data, ecommerce was the single largest segment in terms of mergers and acquisitions in 2021, with a total of 55 deals out of the total 208 M&As that happened last year, or more than 26% of the total deals.

This year, the sector has seen 23 deals go through so far, only three deals behind enterprisetech.

D2C is the fastest-growing ecommerce subsegment, with a total market opportunity worth $302 Bn by 2030, growing at 23.8% CAGR during the time period. The ecommerce market will be worth $400 Bn by 2030, which means more than 75% of the market opportunity lies in D2C.

As such, there have been multiple D2C deals throughout the quarter in question.

One of the largest such deals was Reliance Retail’s acquisition of Clovia, a D2C brand catering to women’s intimate wear. The Mukesh Ambani-led company has already acquired the likes of Zivame and Amante under its innerwear segment, and Clovia makes for the third acquisition in the same field. The deal was worth INR 950 Cr, as noted by Reliance Retail.

In a similar vein, Honasa Consumer, D2C startup Mamaearth’s parent company, has acquired the hair colour brand, BBLUNT, from Godrej Consumers. The deal has been pegged at around INR 134 Cr. This marks the unicorn’s foray into the hairstyling and the hair colouring industry.

This represents the first trend in terms of acquisitions: acquiring a potential business opportunity. Along with that, Mumbai-based D2C brand aggregator Evenflow Brands announced the acquisition of four consumer brands to strengthen its product portfolio.

Most of the ecommerce acquisitions happened in the D2C segment. The ecommerce rollup model or more popularly known as the Thrasio model is a concept that has gained popularity in India in a short period of time.

The Thrasio model is named after Massachusetts-based startup Thrasio which is at present valued in the range of $3-$4 Bn within three years of operation. Thrasio consolidates third-party sellers on Amazon in the US and helps them to scale further.

We have already seen two Thrasio style ventures – GlobalBees and Mensa Brands achieving unicorn status within a year of inception.

These mechanized war machines have been on a roll, with Mensa Brands recently acquiring gardening startup Trustbasket, aromatherapy D2C brand, Florona and leather brand, Estalon.

The Thrasio model represents an industrial-scale version of the D2C acquisition segment, with multiple brands under one ecommerce rollup startup. Right now, the Thrasio model is on the rise in India, with eight startups working in the segment, driving the wave of consolidation.

Why The Wave of Consolidation?

Market uncertainties have marked the last two years, and 2022 is no exception to that. With the current geopolitical situation, markets across the globe are forced into sell-offs and that has resulted in plummeting stock prices of listed tech startups like Paytm.

Therefore, the safest bet is to acquire either potential competitors or potential business opportunities, and those have been the two trends for consolidation throughout the industries going through the M&A wave.

Will this trend continue? Looks, most likely. Though the momentum might slow down as this quarter’s record feels like a peak more than anything, it is still difficult to predict what the next quarter’s M&As landscape will look like.