Indian startups managed to raise only about $1.1 Bn in funding in July 2022, down 60% month-on-month and 90% year-on-year

Funding in late-stage startups reduced to $280 Mn from $9.33 Bn in July 2021, down 97% YoY

Fintech remained investors’ favourite sector, as startups in the segment raised $410 Mn, followed by deeptech and ecommerce

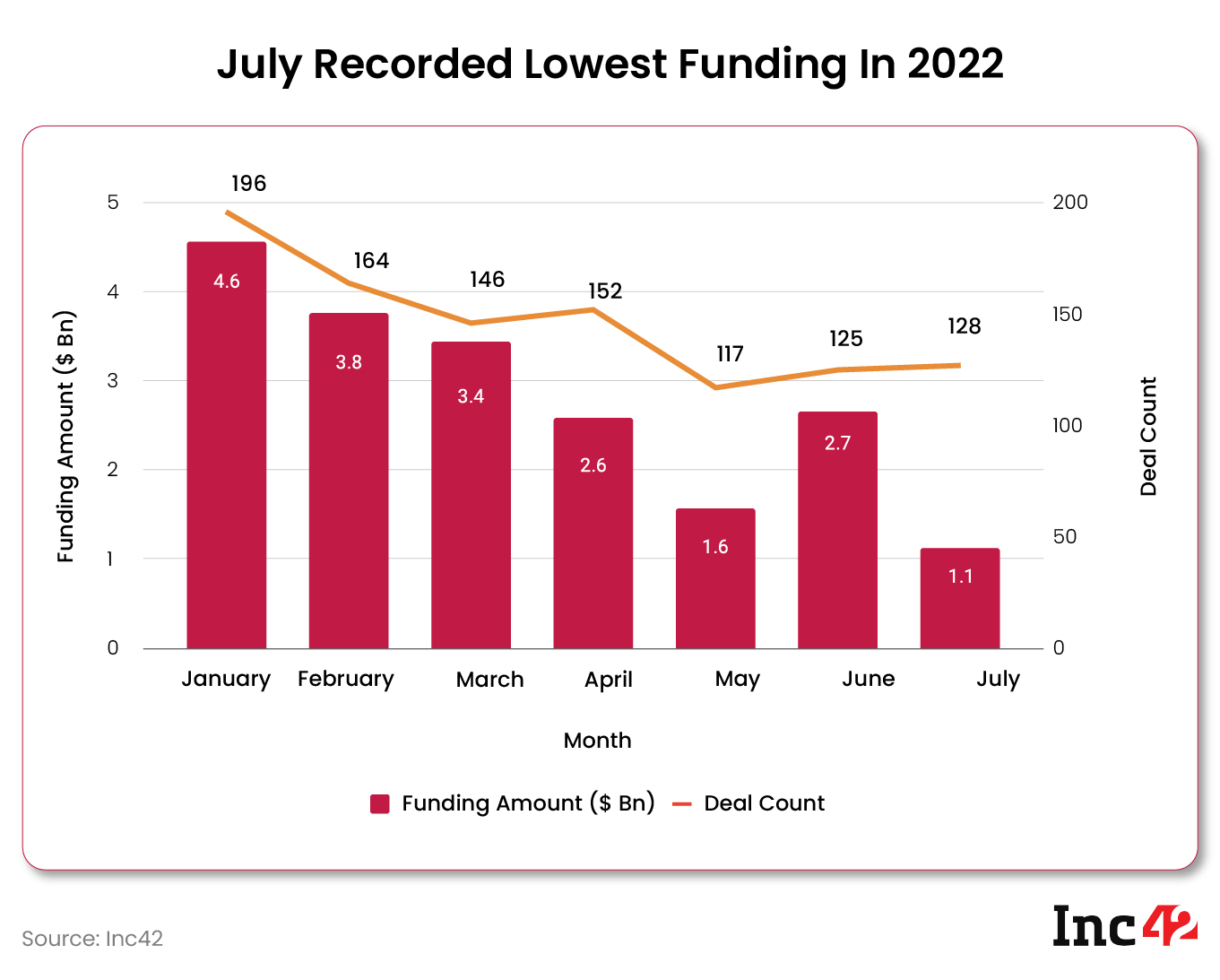

Indian startups managed to raise funding of only about $1.1 Bn in July 2022, making it the worst month of 2022 so far in terms of funding raised, according to Inc42 data. July 2022 was the worst month over the last 17 months, with January 2021 being the last month with lower recorded funding.

Amid whispers of a funding winter, the cumulative funding raised by Indian startups in July was over 60% lower than the $2.7 Bn raised in June 2022.

The funding raised by Indian startups had declined for four consecutive months from February to May, falling over 65% to $1.6 Bn in May from $4.6 Bn raised in January 2022.

However, June proved to be the best month for the startup ecosystem in terms of funding raised. Indian startups raised $2.7 Bn in June, a rise of 69% month-on-month (MoM). However, the hopes of a reversal in funding pattern didn’t last long as July saw a plunge in funds raised by startups.

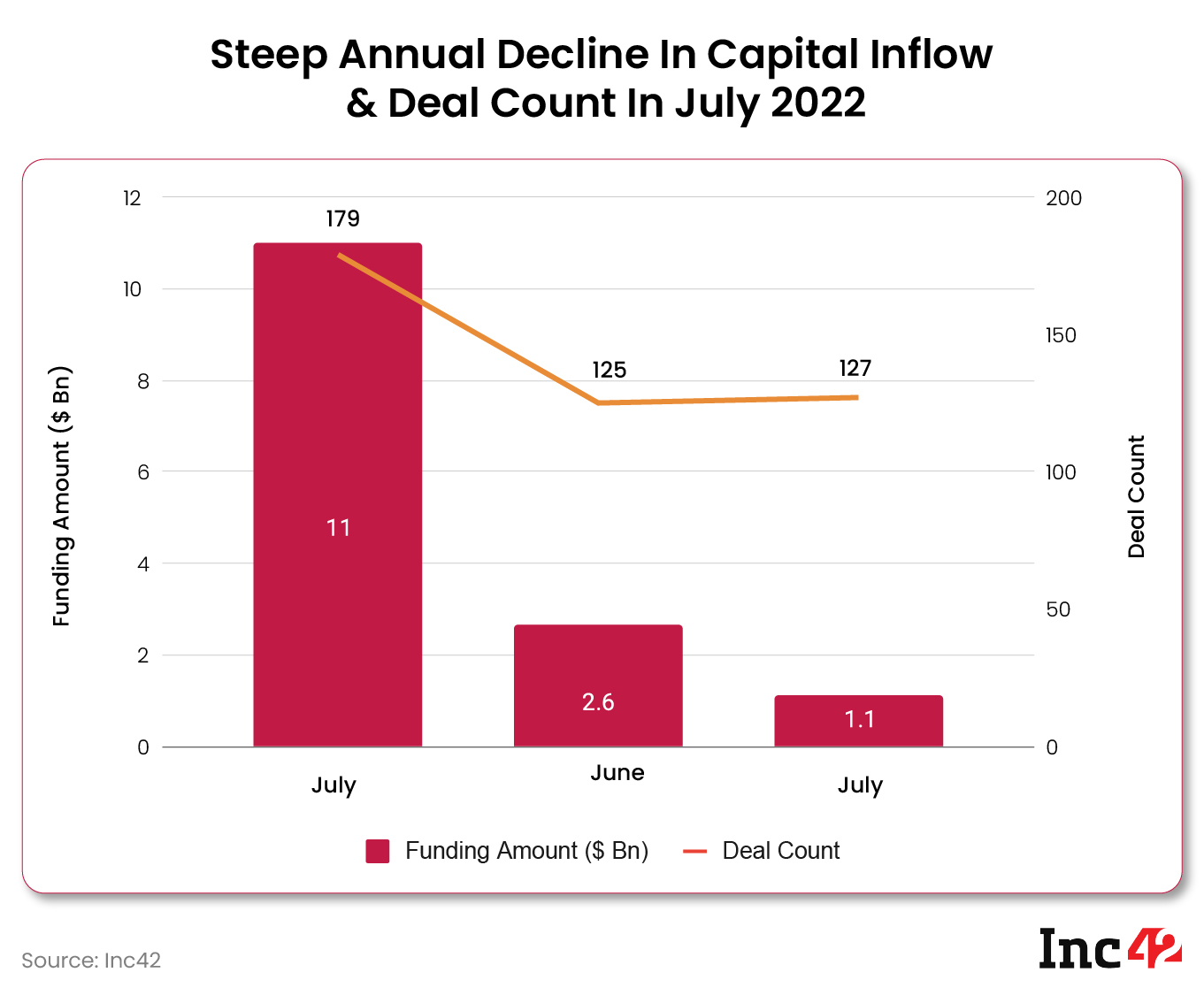

The numbers are even stark on a year-on-year (YoY) basis. Indian startups had raised upwards of $11 Bn in funding in July 2021, more than a quarter of the total funding raised that year. The July 2022 funding amount represents just a tenth of the funding raised in the corresponding month last year.

However, it must be noted that July 2021 saw arguably two of the biggest funding rounds ever in the Indian startup ecosystem, with Flipkart raising $3.6 Bn and Swiggy $1.25 Bn.

The sheer scale of the deals can be realised by the fact that 127 startups combined, including two unicorns, did not raise in the entirety of July 2022 what Swiggy raised alone in a single deal. Flipkart raised more than double that.

Excluding the two outliers, July 2021 still saw $6.15 Bn being poured into Indian startups, 5.6X the total funding raised in July 2022.

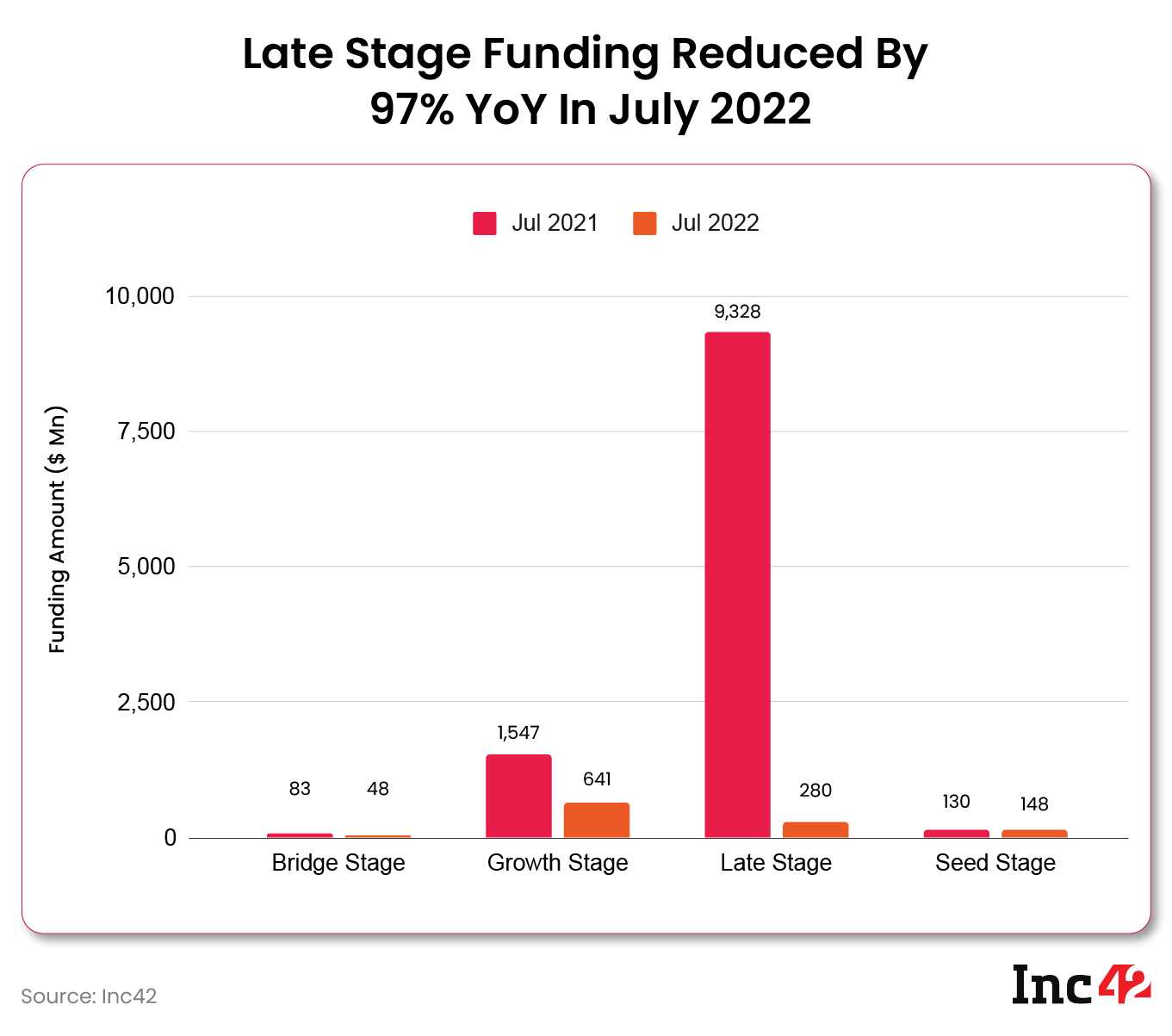

The biggest hit was taken by late-stage startups in July 2022, with funding plummeting 97% to $280 Mn from $9.33 Bn in July 2021.

Even growth-stage funding took a strong hit. Indian growth-stage startups raised just $641 Mn during the month, almost 60% lower than the $1.55 Bn raised in July 2021. Meanwhile, seed-stage funding registered a 13% YoY growth at $148 Mn in July 2022 as against $130 Mn in the year-ago month.

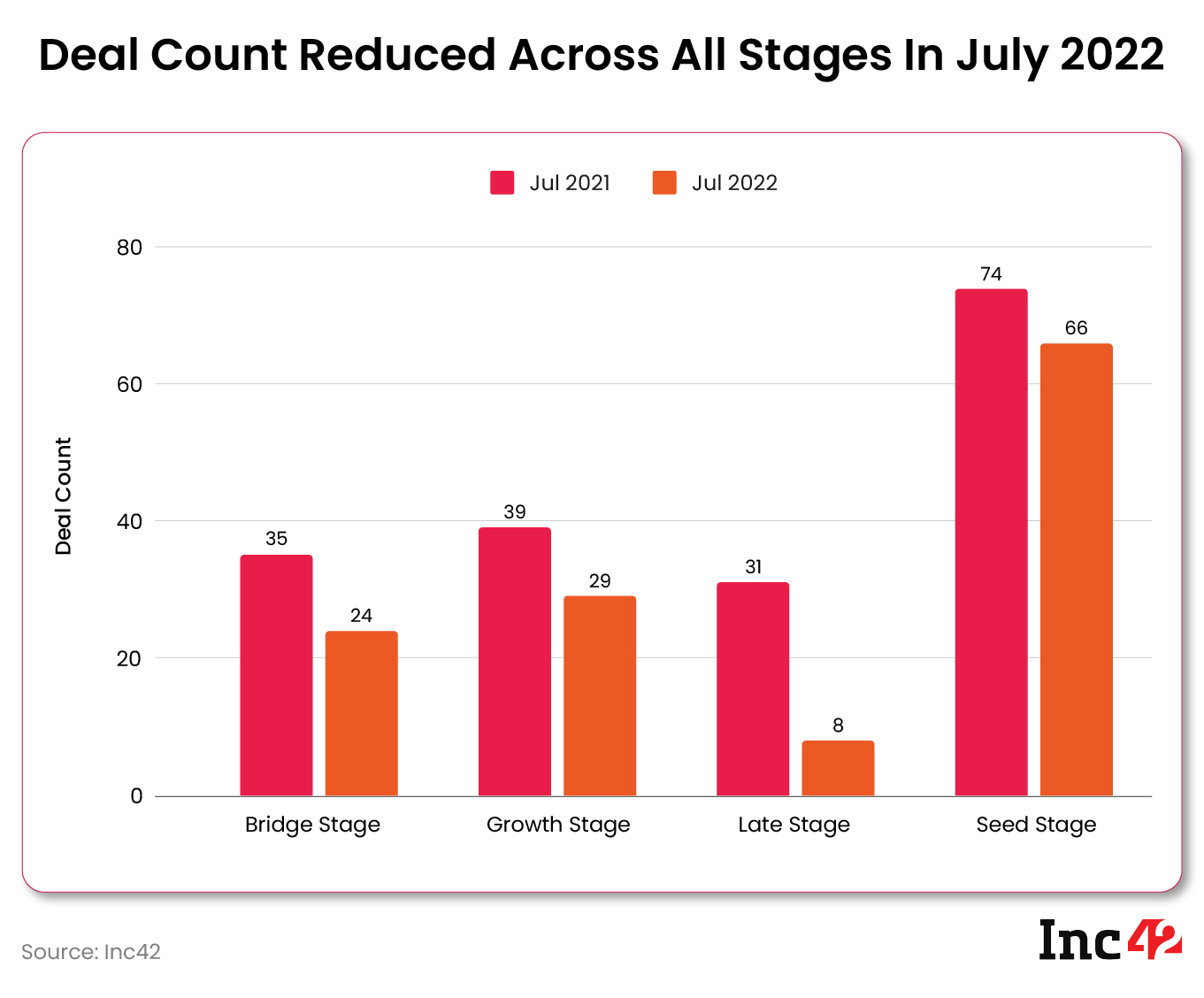

However, the deal count across all stages suffered a decline YoY. In particular, late-stage funding deals went from 31 in July 2021 to just 8 this year, a decline of 74%.

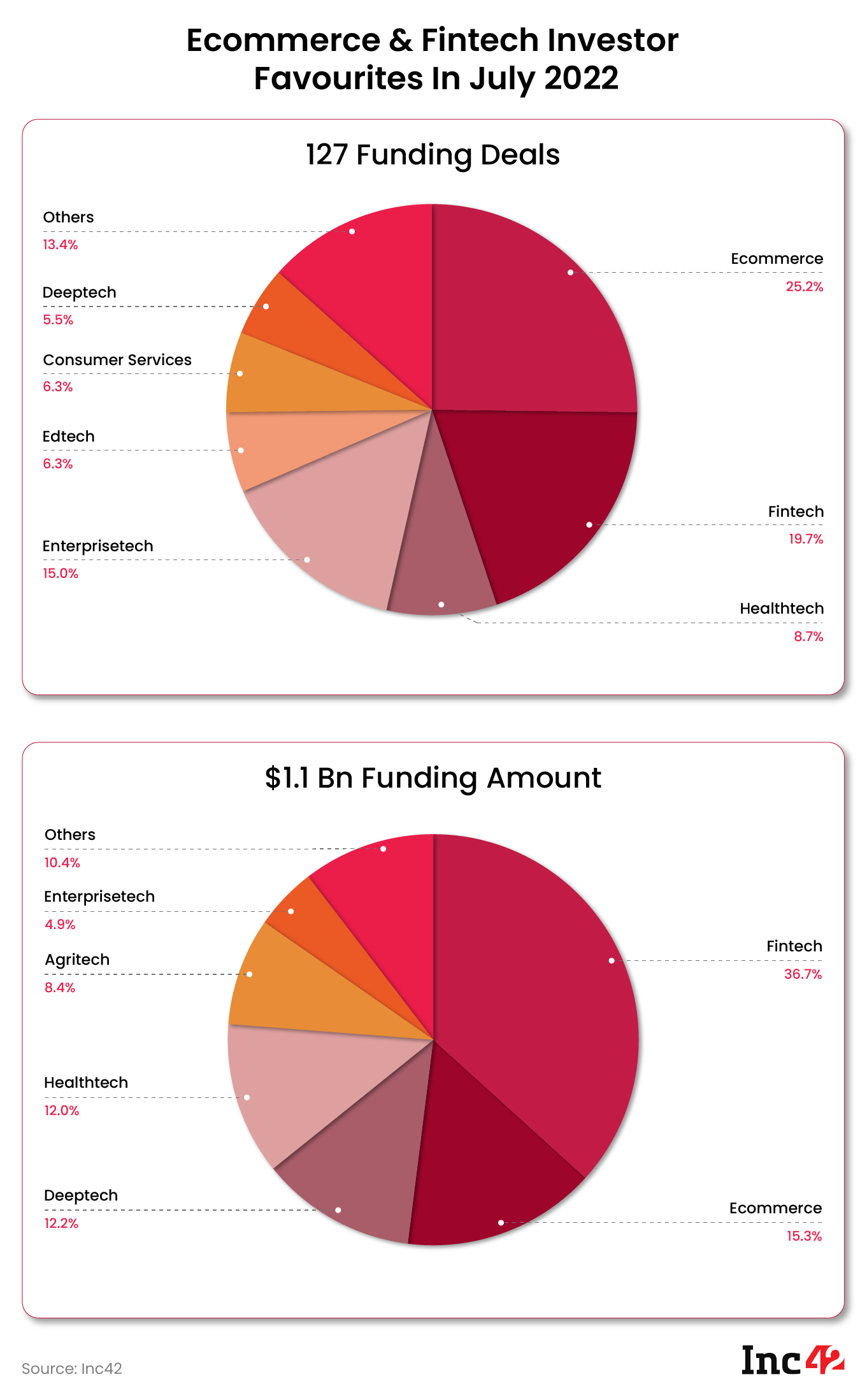

In terms of investor preference, fintech remained the favourite as startups in the segment raised $410 Mn, over 36% of the total funding in the month.

Ecommerce and deeptech were at the second and third spots, raising $170 Mn and $137 Mn, respectively. In terms of funding deals, ecommerce saw the most deals at 32, followed closely by fintech (25) and healthtech (11) sectors.

What Next For The Indian Startup Ecosystem?

It seems that a widespread funding slowdown is well and truly underway, with Indian startups hard-pressed to raise funds and extend their runways.

While the big startups have managed to raise some amount of funding, the problems are slowly unravelling. The slowdown in funding, among other factors, has resulted in more than 11,360 startup employees being laid off by 34 startups in 2022 so far, according to Inc42’s Indian Startup Layoff Tracker.

Another curious case has been the increasing consolidation in the startup ecosystem. The first six months of 2022 saw 165 mergers and acquisitions (M&As), the highest ever in a single half.

Many marquee investors have been busy warning their portfolio startups to gear up for a funding slowdown. From Sequoia to BEENEXT to Y Combinator, investors have issued warnings and guidelines for their portfolio startups.

It will be interesting to see if 2022 sees a repeat of 2021, with funding increasing towards the end of the year, or if India’s startup ecosystem is set for further downturns.

![Read more about the article [Year in Review 2021] Meet the top 10 techies we celebrated this year](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/collage4-1639196680900-300x150.png)