Indian startups have raised 82% of $11.5 Bn funding that was raised in 2020

Tiger Global was one of the most prominent VCs, with eight unicorn deals in 2021

Fintech dominated the Indian startup funding scene by raising

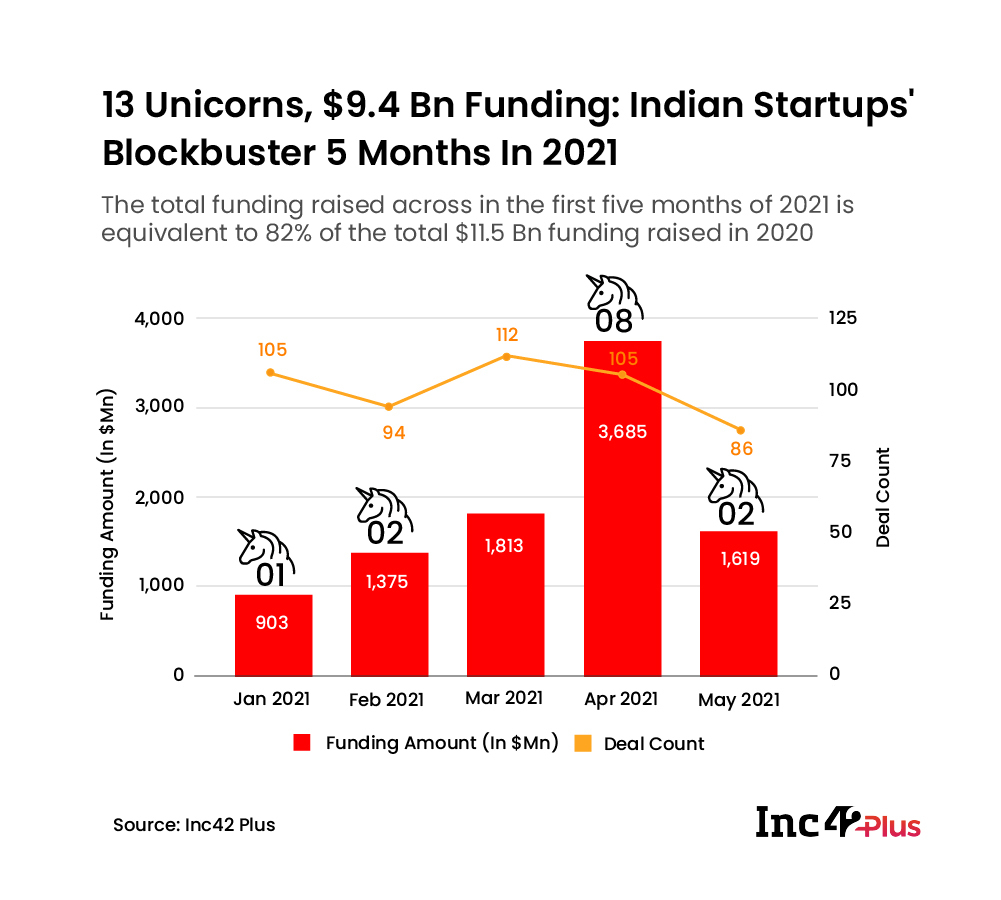

The Indian startup ecosystem has been flourishing despite the massive impact of Covid-19 on the country’s economy. According to Inc42 Plus’ analysis, Indian tech startups have raised a whopping $9.4 Bn (disclosed) in the first five months of 2021, between January 1, 2021 to May 31, 2021. This translates into 82% of $11.5 Bn (disclosed) funding that startups raised in 2020.

While Inc42 Plus’ previous report estimated that Indian startups would reach its historical peak with total funding of $13.7 Bn in 2021. The total funding amount is now expected to be much higher than the previous estimates if the ecosystem continues to grow at this pace, all thanks to the influx of unicorn rounds in 2021. In the first five months of this year, 13 startups have made it to the unicorn club compared to 11 unicorns in 2020.

Compared to the first five months of 2020 (January to May), the Indian startup funding has grown almost 96% from $4.8 Bn to touch $9.4 Bn in 2021 (Jan-May). Meanwhile, the deal count has risen almost 50%, from 335 to 502 in the same time period. Overall, 924 deals were struck in 2020, which means the ecosystem has already covered half of those between January to May 2021.

Despite the horrors of the pandemic, the trust in the Indian startup ecosystem continues to grow with major investments coming in this year. When talking about the influx of investments, there is no way one can skip Tiger Global, which has taken a giant leap in terms of its Indian portfolio.

The New York-based VC firm has been participating in one unicorn round after another, helping India inch towards its target of 100 unicorns much faster. Out of the 13 startups that have become unicorn this year, Tiger Global has been an investor in eight of them including Infra.Market, Innovaccer, CRED, GupShup, ShareChat, Groww, Chargebee, and Moglix. Overall, it is an investor in almost half of the 55 Indian startups that have entered the Indian unicorn club to date.

Sectors That Outperformed Others

Like last year, Fintech continues to dominate the Indian startup funding scene by raising almost 22% of the capital infused this year. The sector has raised more than $2 Bn in 2021 so far, representing a 4X increase from $495 Mn raised in the first five months of 2020. Some of the prominent deals in this segment were CRED’s $296 Mn fundraise across Series C and D round, Groww’s $83 Mn Series D round, Zeta’s $250 Mn Series C round, and BharatPe’s $108 Mn fundraise, among others.

The segment was followed by edtech startups that raised $1.3 Bn representing a 2.9X hike from previous years’ $447 Mn. Once again, the segment was led by edtech giant BYJU’s that raised $460 Mn and became the second most valued startup in India.

Both fintech and edtech sectors have reached the funding amount they had raised in 2020, between January to December, even before completing the first half of 2021. While fintech has been the top choice for investors since 2016, edtech wasn’t even considered in the list of top five segments prior to 2020 when it came to fundraising amount or deal.

Fintech made up for almost 17% or 88 of all the 502 deals cracked in 2021 till May 29, 2021, this represented a 60% hike from 55 deals cracked in the same time frame last year. Edtech, on the other hand, cracked 60 deals versus 39 deals in 2020 and is only 41 deals short of meeting the overall deal count of last year.

Media and Entertainment, Ecommerce and Consumer Services are other top funded sectors of 2021. While the capital raised by Media and Entertainment grew 13.5X to $1.2 Bn across 48 deals, Ecommerce grew 2.4X to $1.08 Bn across 63 deals and funding Consumer Services grew 1.5X to $883 Mn across 26 deals in 2021.