Dear Reader,

You might have seen plenty of mutual fund advertisements. But what do you remember specifically about these ads? Maybe you remember the following lines, mumbled at top speed at the very end of the ad:

Mutual fund investments are subject to market risks; read the offer document carefully before investing.

Regardless of products or companies, all mutual fund and stock market-related advertisements are bound to have this disclaimer as mandated by the Securities and Exchange Board of India (SEBI), the country’s capital market regulator. In fact, SEBI went to great lengths and issued instructions regarding the font size (for print media ads), visual space and the duration of this disclaimer.

“But when it comes to crypto-assets that are inherently more volatile, more vulnerable to supply and demand and have a lot of technicalities involved, the clarity is not there,” said Aayush Shukla. The Delhi-based lawyer has already filed a petition in the Delhi High Court, seeking regulatory instructions for crypto ads. There should be some appropriate advertisement-related guidelines that crypto companies must adhere to, he added.

Speaking to Inc42, petitioner Shukla said, “The plea is for mandating guidelines and rules in this space. It is for directing respondent No. 4 (SEBI) to frame appropriate guidelines and rules related to advertisements of crypto assets that are being run by respondents No. 1, 2 and 3 (WazirX, CoinDCX and CoinSwitch Kuber, respectively).”

Calling the petition completely misconceived, SEBI has argued that the Reserve Bank of India, responsible for regulating the financial market, should also be made a respondent in the case.

Asked whether a mandatory disclaimer is required for crypto ads, three out of four Indian crypto startups agreed, while the fourth supported the idea of self-regulation.

“Yes, definitely, there should be one. As crypto is a dynamic space, there is a possibility of information asymmetry, which bad actors could potentially exploit. Hence, well-designed standards are crucial to protect investors and build the ecosystem. As a user-focussed company, we are all for it,” said Darshan Bathija, cofounder and CEO, Vauld.

Tweet Of The Week

Is there something cooking between Unacademy and Polygon? We leave it to you to find out.

For Binge Reading

Centralised e-Yuan: People’s Bank of China (PBoC), the country’s central bank, has released a white paper on its upcoming fiat cryptocurrency called e-CNY. The document on its progress report features various use cases and the role it will play across banking and retail. However, the centralised e-CNY will co-exist with the existing physical yuan. Read the white paper here.

A Crypto Crash Game Plan You Need To See: Clem Chambers, CEO of ADVFN and Online Blockchain, has come up with an interesting study on the recent crypto crash and identified a number of constant factors such as halvening the mother cycle of bitcoin, the FOMO (fear of missing out) wave and media frenzy, which impact the value of crypto. “Crypto is going down, in the short-to-medium term that is; in the long term, it is going up a long way. This is my model, and to illustrate the cycle, here are the boom, bubble, and bust cycles of bitcoin,” says Chambers. Read the blog here.

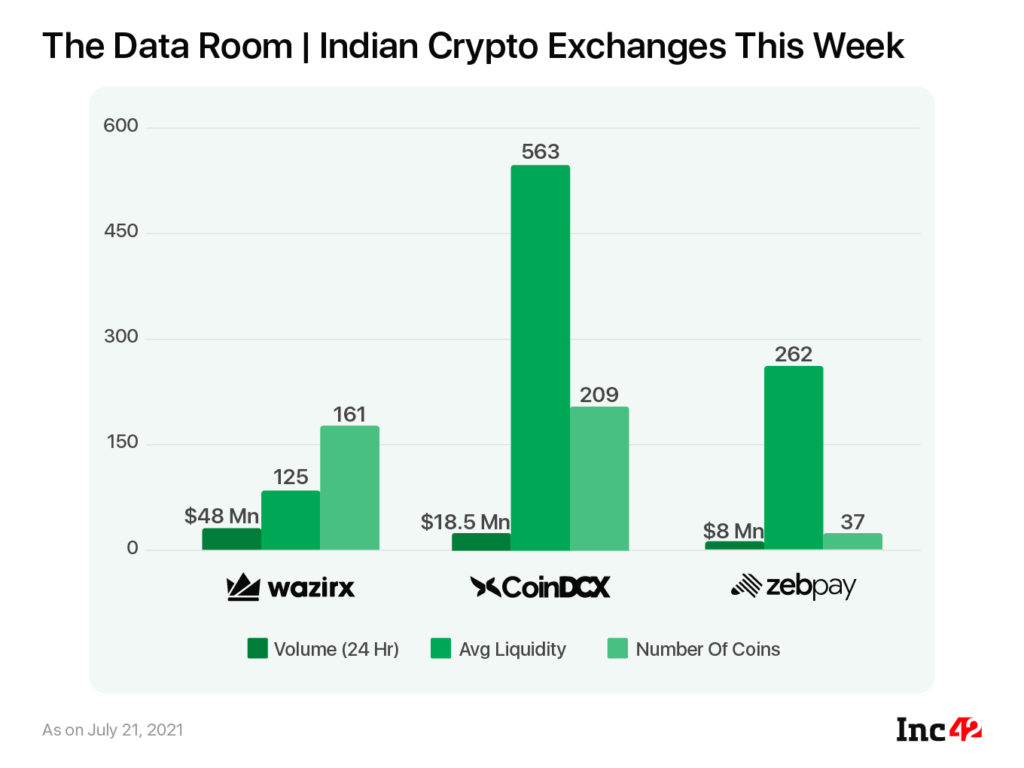

Crypto This Week | News Doing The Rounds

US Investors Are Targeting Serbia Instead Of India

US investors, who were earlier keen to put their money in the Indian market, are now investing in Serbia, said Serbia’s prime minister Ana Brnabić, boasting about how US investments are now getting redirected to her country.

“People said that they would come to Serbia, that they would redirect the investments they planned to other parts of the world, such as India, to Serbia.”

Some of these key investments mentioned in her recent press conference included the IT sector, startup companies, biotechnology and blockchain. Incidentally, Gilded, a Louisiana-based invoicing, payment, and accounting software company, is one of the blockchain companies that intend to invest in Serbia.

Will ED Hinder India’s Crypto Boom?

The WazirX-Enforcement Directorate row may not be limited to one company and is likely to impact the entire crypto market in India, fear some of the crypto exchange founders. The ED’s method and the line of questioning have gone way beyond one or two exchanges and involve many, according to an ET report that cited an exchange official.

Maharashtra To Roll Out Blockchain-Powered Educational Credentialing System

The government of Maharashtra has partnered with Bengaluru-based blockchain startup LegitDoc to issue 1 Mn tamper-proof diploma certificates. LegitDoc will use Ethereum, an open-source blockchain, for verification and issuance of these digital diploma certificates for students of Maharashtra State Board of Skill Development and cover academic years from 2016 onwards.

NFTically Raises Seed Funding, Launches White-Label NFT Marketplace

NFTically, a global marketplace and a B2B SaaS player, recently launched a white-label NFT Marketplace. The platform also raised undisclosed seed funding from a clutch of angel investors, including Polygon (MATIC) CEO Jaynti Kanani and others.

A Record $900 Mn Fundraise At $18 Bn Valuation

US-based crypto derivatives exchange FTX has raised a record $900 Mn in Series B round of funding at an $18 Bn valuation. This is the highest ever fundraise by any crypto startup so far. Among the prominent investors who participated in the funding round are Paradigm, Sequoia Capital, Ribbit Capital, Third Point, Lightspeed Venture Partners, Coinbase Ventures and Softbank.

$1.5 Mn Open Call For Blockchain-Based Applications

Launched by the European Commission in 2020, ONTOCHAIN, a next generation internet initiative has asked internet innovators to apply for its second open call and co-develop a new software ecosystem for trusted, traceable and transparent ontological knowledge management. 12 shortlisted projects will get grants up to €145K (equity-free funding), free coaching and free access to top infrastructure (iExec and MyIntelliPatent), according to the project statement.

While China is now aggressively planning to promote its e-CNY, the US and the EU are also coming of age in crypto regulations and promoting crypto innovation. However, India, one of the largest markets globally, has failed miserably on both fronts. The country is still lagging in blockchain/crypto innovation, and regulating the same seems a far cry.

Till next time,

Suprita Anupam