The rise of banking-as-a-service (BaaS) has transformed the way financial products and services are created, distributed, and accessed; thereby changing the core role played by each stakeholder in the open banking ecosystem. Fintech companies, banks, and other key ecosystem players are witnessing the next phase of digitisation in banks and banking services.

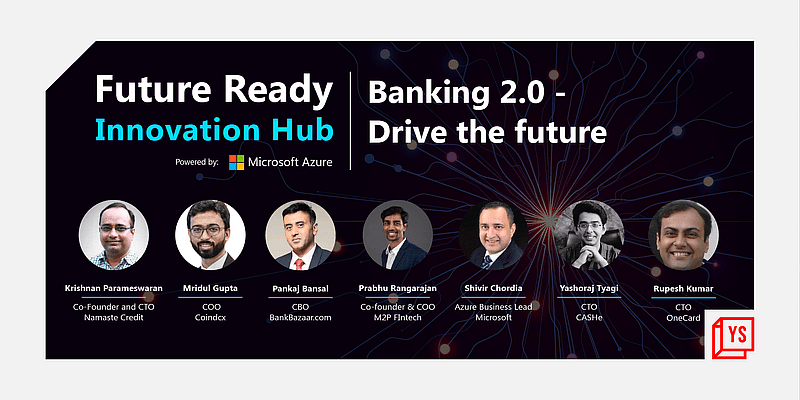

To understand the role APIs are playing in revolutionising the financial sector, along with the trends that will propel the growth of the sector in the coming years, Microsoft and YourStory co-curated a roundtable discussion titled ‘Banking 2.0 – Drive the future’. Yashoraj Tyagi, CTO, CASHe; Krishnan Parmeswara, Co-founder and CTO, Namaste Credit; Neeraj Khandelwal, Co-founder and CTO, CoinDCX; Pankaj Bansal, CBO, BankBazaar; Rupesh Kumar, Co-founder, OneCard; Prabhu Rangarajan, Co-founder & COO, M2P Fintech; and Shivir Chordia, Azure Business Lead, Microsoft India shared their thoughts on lending ecosystem, blockchain, hyper personalisation, embedded finance, and more.

Banking 2.0

“Technology is disrupting a lot of facets of banking,” quipped Shivir speaking about the changes in the way banks are reimagining their processes. He added, “A lot of it is driven by the customer experience. Today, 20-year-olds are the decision makers. They have larger incomes, they are taking financial decisions on property, loans, credit, investments, and are very well-informed about products and services. All of this is leading banks to think disruptive.”

BankBazaar’s Pankaj highlighted how the changing landscape of the partnership between banks and fintechs has evolved from being disruptive to collaborative. He also credited the exponential growth of the financial sector to the digital infrastructure being envisaged and supported by the government. “Today, data is a big repository [of information]. Financial players need to marry data with technology and offer suitable products. Data underwriting along with the technology will be the next game changer,” he added.

Talking about the innovations and trends in the lending ecosystem in India, Yashoraj of CASHe said, “Lending is not a modular activity. Lending is and will always be a feature. Loans are a section of lending and will continue to be important but in India today, lending has become a convenience activity as much as a credit activity.” He also added that hyper personalisation of financial products and services wherein companies will have to work towards will emerge as a key trend of the financial sector in the country.

“There are artificial intelligence-driven models to understand the customer, and make sure that the platforms you have built are secure, data is protected, etc,” added Krishnan from Namaste Credit on how the emergence of open banking platforms has brought in usage of more APIs. He further mentioned, “Consent driven architecture is poised to change things for credit, lending, and risk and monitoring space in India.”

Crypto adoption in India

A recent report by a blockchain data platform ranked India second in terms of global crypto adoption in 2021. “Trends that’ll affect the crypto currency market in India are more in terms of acceptance not only from investors but also from regulators, government, payment gateways, etc. Positive acceptance of crypto assets will drive more investor awareness and will lead to more investors participating in the ecosystem,” said Mridul from CoinDCX. He further identified the rise of blockchain developers in India as many edtech companies are seen giving blockchain-specific coding courses, as another key trend in this space.

“Democracies across the world are accepting regulation, transparencies on crypto assets transactions which means that more people, institutions, and treasury are getting comfort when it comes to investing in crypto assets,” added Mridul stressing on how crypto assets are quite transparent contrary to popular assumption.

Other noteworthy trends

Rupesh from OneCard spoke about the importance of understanding and acknowledging trust, regulations and compliance to deliver a better customer experience. He reiterated that elements such as double entry accounting, fraud risk management, etc should be inculcated in the product at the design stage itself and shouldn’t come across as an afterthought. “You need to make sure that you are on top of how regulations are evolving and ensure that your product is designed in a way that it can take changes in regulations [into account] and that’ll require startups to write their own codes,” added Rupesh.

Much like the adoption of digital payments in the country, he said, digital services such as savings, investments, credits, insurance are set to unlock massive customer adoption.

Speaking about the emergence and transition towards “an embedded finance kind of model,” Prabhu from M2P Fintech reiterated the need for simplifying solutions for users to make access and usage of products easier across various sections. Talking about the global trends that India should latch onto, Rupesh pointed out that one click checkout experience, the buy-now-pay-later wave, and account aggregation are set to make for an exciting new phase of fintech.

“India is also about the heartland – its Tier II and III cities and towns – so it’ll be an interesting change [in the financial landscape of the country] when all these trends and innovations will reach to the heartland of India,” opined Shivir while signing off.

![Read more about the article [Weekly funding roundup May 29-June 2] VC funding rises sharply](https://blog.digitalsevaa.com/wp-content/uploads/2022/11/funding-roundup-LEAD-1667575602969-300x150.png)

![Read more about the article [YS Exclusive] DFAN and SCV announce co-investment partnership with a corpus of Rs 100 Cr](https://blog.digitalsevaa.com/wp-content/uploads/2022/01/dfan-1641712765851-300x150.png)