The round also featured leading tech leaders like CRED founder Kunal Shah, LivSpace founder Ramakant Sharma, Ofbusiness co-founders Asish Mohapatra and Ruchi Kalra, among others

The company plans to use the funds to continue to build a strong team, launch and scale their invest-tech product platform

The platform will also provide a unique Integrated Portfolio Approach (IPA) which will help users maximise returns while controlling the downside, with the right portfolio mix and also unlock access to new asset classes

Investment tech platform Dezerv has raised $7 Mn in a seed funding round co-led by Elevation Capital and Matrix Partners India, with participation from investors such as Whiteboard Capital and Blume Founders Fund.

This round also featured leading tech founders including CRED founder Kunal Shah, LivSpace founder Ramakant Sharma, Ofbusiness co-founders Asish Mohapatra and Ruchi Kalra, Meesho cofounders Vidit Aatrey and Sanjeev Barnwal, Acko CEO Varun Dua, OneCard cofounder Anurag Sinha, and BharatPe’s Shashvat Nakrani and Suhail Sameer, among many others.

The company plans to use the funds to continue to build a strong team, launch and scale their investtech product platform.

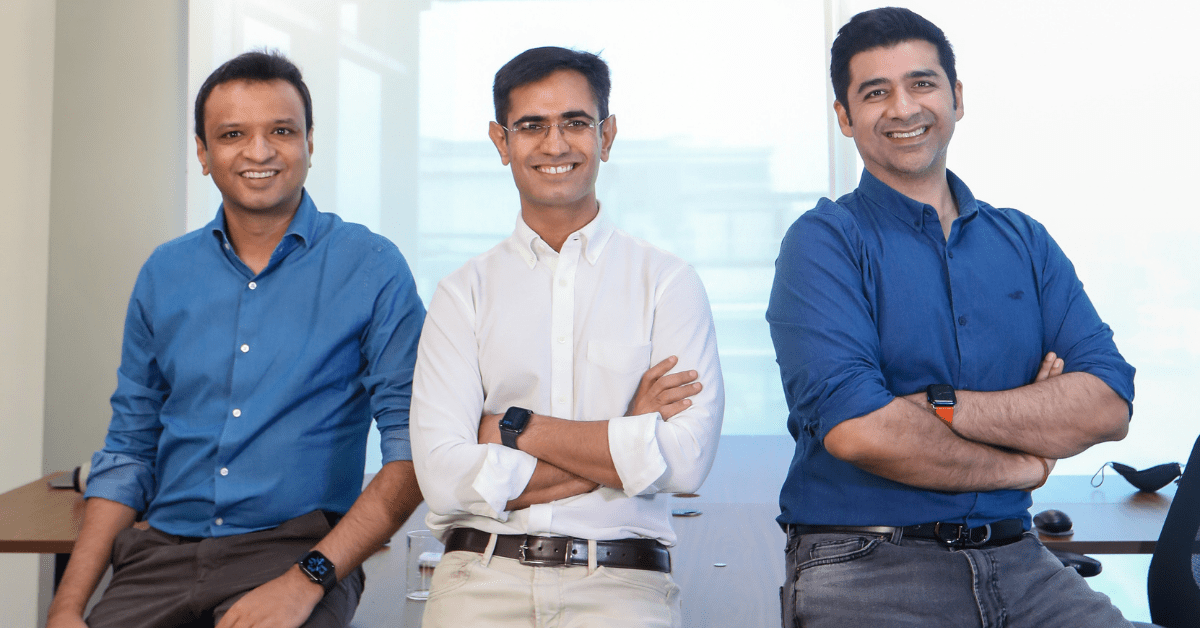

Founded in April 2021 by former IIFL Wealth senior managing partners, Sandeep Jethwani, Vaibhav Porwal and Sahil Contractor, Dezerv helps Indian professionals access investment expertise primarily for mutual funds investments.

The platform will also provide a unique Integrated Portfolio Approach (IPA) combined with white-glove expert advisory. This will help users maximise returns while controlling the downside, with the right portfolio mix and also unlock access to new asset classes, which the company claims are currently available only to high net-worth individuals such as curated, well-diligenced high yielding bonds and emerging high growth startups.

According to a company statement, more than 80% of large cap mutual funds are underperforming the benchmarks, making it very difficult for the average Indian investor to invest cautiously. According to a study undertaken by the Dezerv team, currently 30 Mn households of working professionals are facing the same difficulty today.

Such difficulties along with increased attention given to finances amidst the pandemic has led to the surge of the Indian investment tech sector.

Currently, India is home to more than 400 investment tech startups, with companies witnessing a spike in demand due to multiple reasons. According to data from Inc42 Plus, the investment tech market is projected to reach $14.5 Bn by 2025 with an expected CAGR of 22.4%.

Additionally, Indian investment tech startups have raised a total of $379.2 Mn between 2015-2020. Recently, India got its second investment tech unicorn Groww with $83 Mn Series D funding from Tiger Global.

A rise in digital infrastructure, growing awareness regarding retail investments and finance, and the enhanced convenience offered by investment tech platforms will trigger their growth.

![Read more about the article [Funding alert] D2C startup WaterScience raises undisclosed sum from Velocity](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/feature15627598600911574830759090png1-1623828929350-300x150.png)