As the centre of economic growth shifts towards Asia with more disposable income and greater technological innovation, India is in the spotlight with global players looking to gain a stake in various sectors like infrastructure, manufacturing, and healthcare. But away from the mainstream, offbeat opportunities for innovation and investment have also been getting attention.

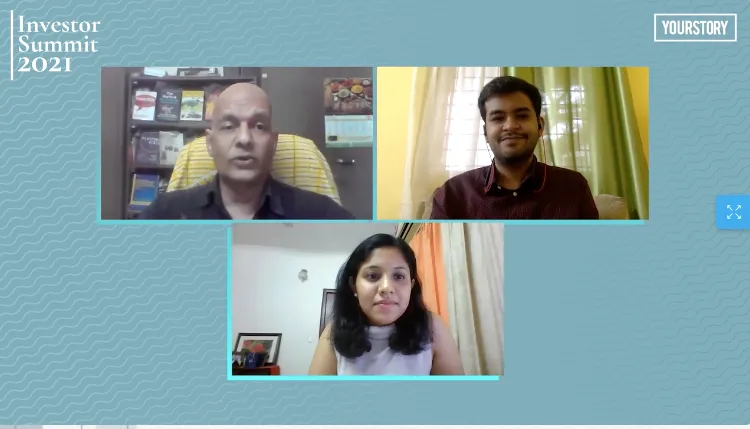

As part of YourStory’s Investor Summit 2021, Shreyansh Singhal, Investment Professional, Ankur Capital, and Radhika Agarwal, Investment Team, Blume Ventures, offered their insights on Offbeat yet high value sectors for investment in a panel discussion with Dr Madanmohan Rao, Research Director, YourStory.

Speaking about the relevance of high-value offbeat sectors, Shreyansh gave the example of agritech in the early days of ecommerce and new-age business models.

“Back in 2014, a lot of sectors were being impacted by these new business models. One of the sectors that seemed not to be impacted significantly was agritech. It was new and nascent at that point, but we collectively decided to make an investment in a company called Cropin Technology Solutions.”

Today, Cropin has grown to about 14 million acres of farmland, impacting about 3.5 million farmers and more than 50-plus countries. “The sector got a huge tailwind, because at the end of the day, everybody has to eat,” Shreyansh said.

Shreyansh Singhal, Investment Professional, Ankur Capital, and Radhika Agarwal, Investment Team, Blume Ventures in conversation with Dr. Madanmohan Rao, Research Director, YourStory.

Ankur Capital recently also invested in a company that is not just digitising, but also creating a first-of-its-kind network of farmers and others in the agri ecosystem to come together and communicate.

Blume Ventures has also been investing in several niche areas with a sector-agnostic approach. “We have invested in everything from astrology for millennials and saving platforms for rural women to fashion rental,” said Radhika, adding that here had been some interesting market shifts in recent times.

“Whether it was COVID or the launch of Jio or UPI a couple years back, it has really changed how demand forces operated,” she said, explaining that ecommerce had benefited significantly with more things going online. This was buoyed with the launch of Jio, which meant that Tier II and III cities suddenly had better access to mobile internet and making for interesting new use cases.

“Looking at how these market forces have continuously been changing over the last couple of years, we now have an interesting breakdown with investment team members willing to spend 40 percent of their time studying new sectors looking at what’s out there,” she added.

Innovate and adapt

For companies to succeed, the panel felt it was important to understand the core of what would drive business, identify the core of the technology, and build value additions and innovations on top of what is existing today.

“I think over the last year we saw about a total of 30 to 40 companies that got formed in that area,” said Shreyansh, giving the example of Dozee, which has built a Contactless Remote Patient Monitoring (RPM) and AI-based triaging system. Initially focused on the wellness segment, it today functions as a health monitoring system alerting healthcare professionals about respiratory distress and other symptoms associated with COVID-19.

The pandemic has also resulted in a change in how the education sector operates. “Most schools and colleges have adopted technology, more out of force, but we’re hoping that’s going to leave digital traces in terms of technology being used for admissions, campus placements, or evaluations,” said Radhika, highlighting that Indian companies were also scaling in global markets.

She added that a lot of premium stack offerings were on the cusp of gamification, creating a lot of opportunity not only in the pre-K and under-10 age groups but also for adult education.

Challenges and opportunities

When asked about advice for founders, Radhika said “read anything”. She said it was important to speak to people beyond one’s own circles. “Have a very high learning quotient. Speak to your Uber drivers, your friends, their co-workers, your family’s co-workers. There’s so much data being churned out by various platforms. Learn to identify new opportunities that are being created,” she said.

In terms of how to approach investors, Shreyansh said, “Today, though the market is flooded with capital, you have to innovate and have innovative ways in terms of actually raising capital as well.” He added that there were different types of VCs, angel investors, and even founders, who were investing.

“We’re always looking to tie up with such investors because they bring in not just value in terms of ‘green’ but a lot of operational understanding.”

The discussion concluded that success in identifying opportunities rested on three factors – traction, team, and timing.

It was important to pick the right sector where one could get traction with the product, to have the right team in place to handle the complex tasks of business models and educating the market, and to understand the timing to get into the market and of when to approach the investors.

![You are currently viewing [Investor Summit 2021] What successful founders must focus on: traction, team, and timing](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Image4l5t-1617276775246.jpg)

![Read more about the article [Funding alert] Solar energy startup Freyr Energy raises Rs 18Cr in a fresh equity round](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Eajz3g3UMAAI0aX-1608619243276-300x150.jpg)