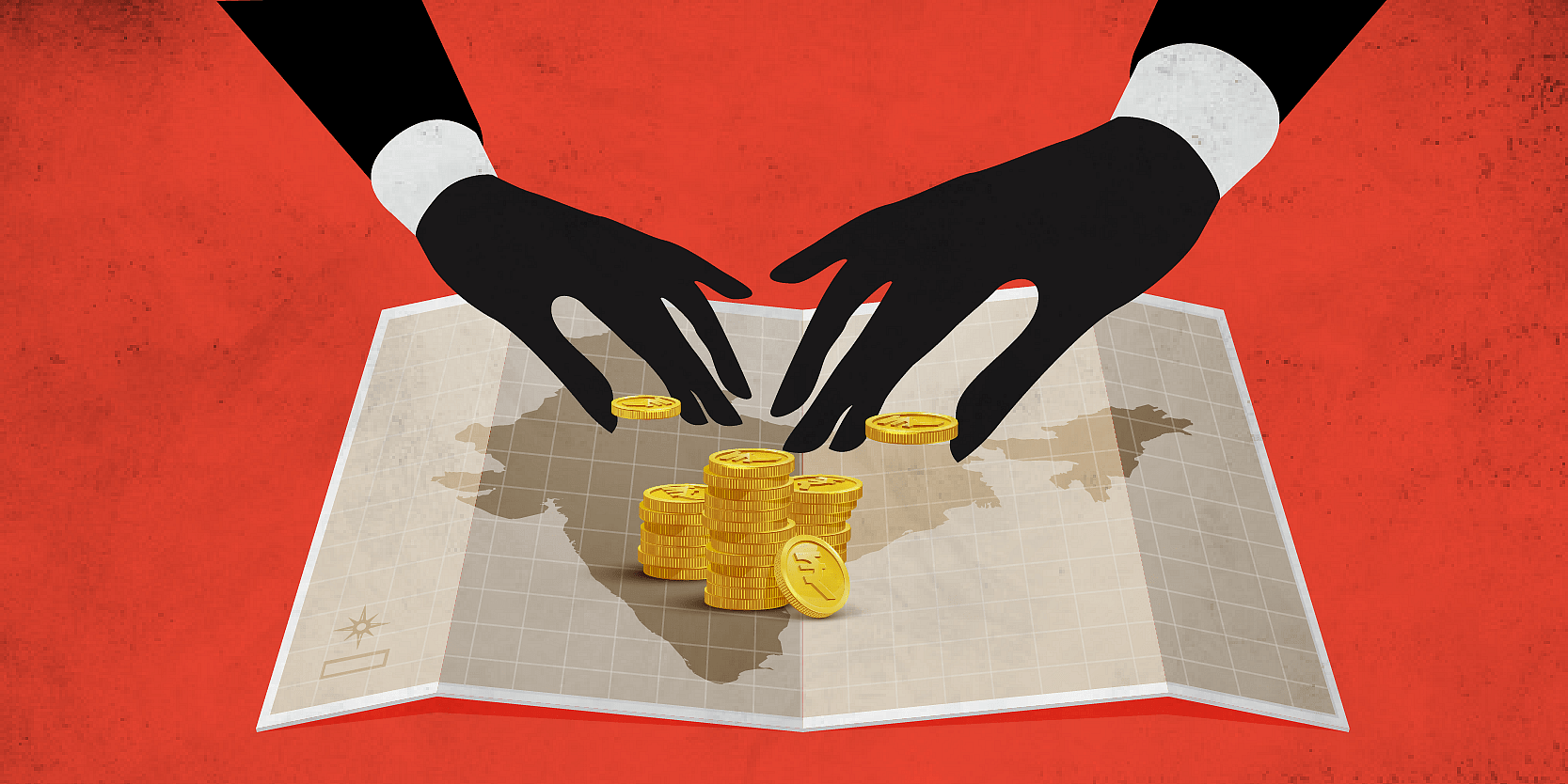

The inflow of domestic capital into the startup ecosystem in the country has got another boost as the Insurance Regulatory Development Authority (IRDA) has allowed Indian insurance companies to invest in fund of funds (FoF).

The new notification from IRDA has allowed insurance companies to make their investments in FoF, subject to the condition that these investments are not made into overseas companies.

This decision by IRDA comes close on the recent decision of the government to allow private retirement funds to park certain percentage of their capital in Alternate Investment Funds (AIFs).

On the decision of IRDA, Siddharth Pai, Founding Partner and CFO at 3one4 Capital, and Co-Chair at Regulatory Affairs Committee, IVCA, said, “This move will help accelerate the quantum of rupee capital going into Indian startups.”

He further said, “The FOF system is the perfect vehicle in terms of diversification for Indian institutional capital and the inability of insurance companies, whose annual premium flows is orders of magnitude larger than the entire Indian AIF universe.”

The participation of domestic capital into AIFs has been limited with the overwhelming dominance of overseas investment. This decision is likely to diversify the pool of domestic capital into newer areas as most of the investments are made into gold, real estate and stocks.

Ashley Menezes, Partner and COO, ChrysCapital Advisors, LLP, said, “It is a huge win for the private equity industry that insurance companies are now permitted to make investments into funds of funds as well, similar to them making a direct investment in an AIF. This allows insurance companies to de-risk their exposure.”

In the month of March, the government had issued a notification allowing private retirement funds to park five percent of their investible surplus into AIFs. It stated that non-government provident funds, superannuation funds, and gratuity funds to invest in units issued by Category I and Category II AIFs, subject to certain conditions.

Both these decision are expected to boost the inflow of domestic capital into Indian startups. According to Siddharth, the inflection point for any startup ecosystem is when domestic institutional capital is allowed to start investing into the local ecosystem.

“This move by the IRDAI and the move by PFRDA last month shows the government’s intent to accelerate institutional rupee funding to startups, which will help in economic growth and job creation,” he said.

![Read more about the article [Techie Tuesday] Meet Gaurav Srivastava, a small-town boy from Dhanbad who is now building a global SaaS company](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/TechieTuesday30-1623077105570-300x150.png)