When you see Jeffrey Katzenberg’s name associated with an investment, you take a look. However, when you see his name multiple times in your inbox, for example, tied to funding rounds for Sparrow, Point.me and HUBUC, and one I personally wrote about last week, Popchew, it’s time to inquire what he has been up to.

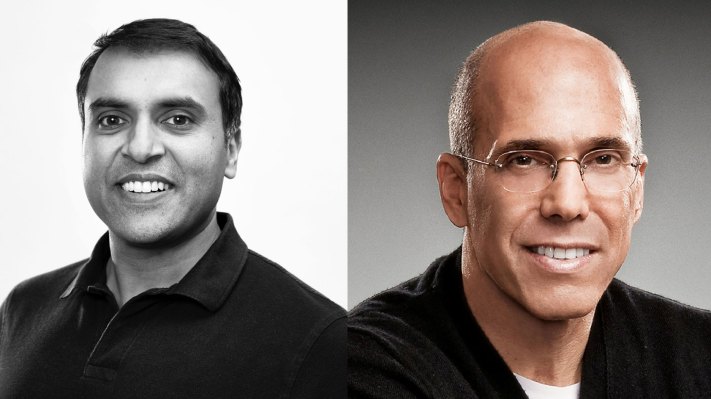

The famed DreamWorks SKG co-founder and former chairman of The Walt Disney Studios, Jeffrey Katzenberg is a founding partner, with Sujay Jaswa, at WndrCo, a holding company that acquires, operates and develops businesses at the intersection of technology and media.

Jaswa was a principal at New Enterprise Associates before joining Dropbox as one of the company’s early employees. The two met years ago when Katzenberg was looking for his next big thing, which he wanted to be “completely new and different.”

The last time I had heard his name could have been the same time you did: when Quibi’s streaming service came to a screeching halt in October 2020, mere months after it launched.

Katzenberg declined to address questions concerning how Quibi’s failure impacts his relationship with founders and how it informs his investment decisions. He offered only that he’s “very proud of my failure — I own it.” But he talked at length about some of his current bets and what drew him to them. My chat with Katzenberg and Jaswa follows, edited for length.

TC: How did you meet Sujay?

JK: I met with 300 people, and he was the most interesting, smartest and all-around great person of everyone I met. I spent nine months every day, talking to people, spending time in northern California, seeing who was doing interesting stuff. Not everyone was a potential partner or available, but it was just part of my learning process of trying to find the right partner. Sujay’s name just kept coming up in so many different places in so many different ways. When we finally did get together, he sort of exceeded expectations.

Partnerships are no different than marriages: you know who they are, you know when you find somebody you think is compatible. And, you think your goals and values and ambitions are going to be the same, and you know it’s always a bit of a roll of the dice in life. Here we are five or six years later, and it could not have been a better outcome. I’m grateful that I found somebody who’s half my age and twice as smart as me.

TC: Going back to 2017, I was reading some articles about the founding of WndrCo. Were you an angel investor before starting the firm?

JK: No, I would say the investments I had were more relationship-driven. I had a handful of these investments, but they were really driven by people that I had come to me that went out and started companies and that was my connection more than I had some investing thesis that I was doing.

TC: What ultimately sparked your curiosity for venture capital?

JK: I think the investing side of it is really the smaller part of what we’re doing. It’s a sort of the company-building part of it that has been the most interesting to me and the one where I think I am probably spending more time.

SJ: One of the things that’s very different about us is we think and act like founders every day, as opposed to just investors. We call ourselves “the founders behind the founders.” For us, it’s super fun and we know it’s going to be a lot of work. Half of our money goes into those companies and the other half of the capital goes into the traditional product-market-fit kind of investing. Then we’ve now got a separate fund that actually does venture investing. It’s seed investing and run by a cool rock star named Anthony (Saleh), who’s really one of the best seed investors.

TC: Several of your portfolio companies announced investments from you recently, including Sparrow, which manages employee leaves; Point.me, a reward travel booking company; and HUBUC, which focuses on embedded fintech. This is an eclectic batch of companies. What attracts you to certain companies over others?

SJ: The common thread across everything is that we’re really looking for founders that we think have a chance of cracking an important problem.

JK: I always looked at things that I can relate to as a consumer myself. Having been sort of in the direct-to-consumer business my whole life, I always light up at those ideas. We also look at companies that I think can make a meaningful contribution to the future of work. Sparrow is a particular pain point right now, and the importance of care and the value of how companies engage and look after their employees has literally gone through the roof.

TC: What sectors are you not interested in?

JK: We actually strategically made the decision to move away from digital media. I had interests in digital technology and used a fair amount of it in movie-making, but I wanted to do a hard pivot into a whole new world.

TC: With your kind of experiences, how have those helped inform the way you counsel founders?

JK: Every founder has their unique challenges and opportunities. Just broadly, it’s the wisdom and experience of having done this for, in my case, four-plus decades, and having seen so many different opportunities and different companies founded and built. Some of that is incredibly valuable and timeless, and some of it is less relevant. I don’t know that there’s any one sort of magic pin now.

TC: What makes you a good strategic partner for a startup? Why should they choose you?

SJ: The most important thing is that we’re founders, and we’re helping build companies every single day. Our experience isn’t from the past, it’s contemporaneous. We view it as there are four things that really matter for any company: product development, go-to-market, building and scaling the organization and capital. At this point, everyone has capital. What we try to do with the other three things is to offer a unique and distinctive value to these companies. And we’re not going to force any of it on you. Our job is just to be available for you to help you turbocharge on any of those things.

JK: We don’t take board seats. We would rather get in there and get our hands dirty and actually problem-solve. More often than not, between Anthony, Sujay and myself, there’s always some value that we have to help, as Sujay put it, turbocharge these companies. It’s also fun for us to see the result. The venture world has sort of done a pretty big pivot, and we’re just trying to find our own lane.