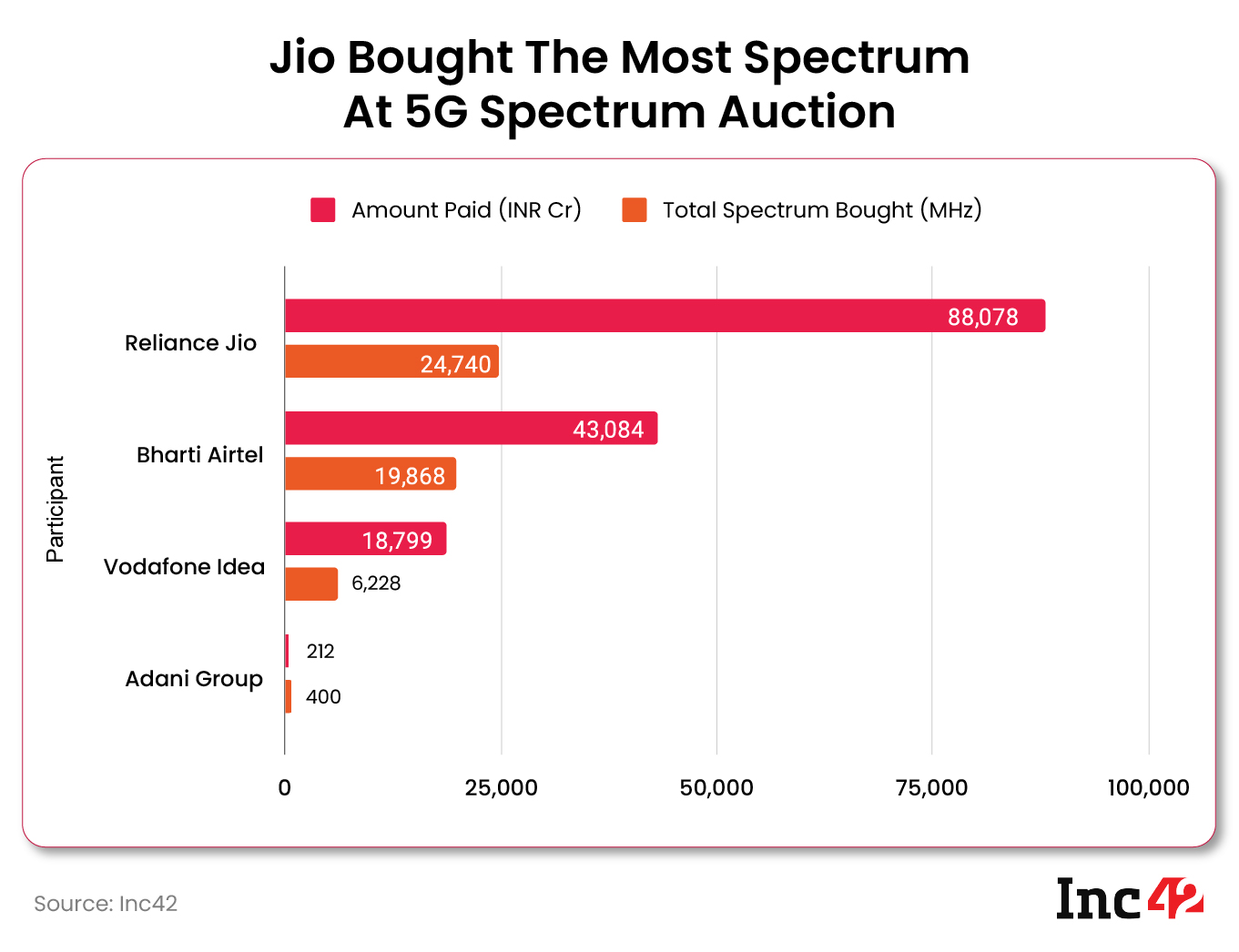

Reliance Jio (INR 88,078 Cr) was the biggest spender at the spectrum auction, followed by Bharti Airtel (INR 43,084 Cr) and Vodafone Idea (INR 18,799 Cr)

This is the highest revenue collected by the government from a spectrum sale, breaking the previous record of INR 1 Lakh Cr held by the 4G spectrum auction of 2015

We expect to allocate spectrum by August 10; hope telcos will start putting the equipment so that we will have 5G services from October: Ashwini Vaishnaw

India’s first-ever 5G spectrum auction ended on Monday (August 1), with 40 rounds of bidding across seven days. Reliance Jio, Bharti Airtel, Vodafone Idea (Vi) and spectrum auction debutant Adani Data Networks, a subsidiary of the Adani Group, bid for spectrum worth INR 1,50,173 Lakh Cr.

This is the highest revenue collected by the government from a spectrum auction since the beginning of spectrum auctions with 3G airwaves in 2010, breaking the previous record of INR 1 Lakh Cr held by the 4G spectrum auction of 2015.

Among the participants, Jio was the most aggressive from the beginning, having submitted an earnest money deposit (EMD) of INR 14,000 Cr. For the uninitiated, a participant in the 5G spectrum auction could bid for a spectrum worth nine times the EMD it submitted. Therefore, Jio had the biggest war chest at INR 1.26 Lakh Cr.

Over the 40 rounds of bidding, Jio bid for the maximum spectrum and was the biggest spender consequently. The Akash Ambani-led telco bought the rights to use 24,740 MHz of spectrum for 20 years for a total price of INR 88,078 Cr.

The Sunil Mittal-led Airtel was a distant second, while Vodafone Idea finished third.

It is prudent to mention here that the total amount is calculated based on the total bids made, dividing the same by 20 equated annual instalments and adding interest of 7.2% per annum.

The next step for the telcos will be to submit the first instalment within a few days. Communications Minister Ashwini Vaishnaw said that the telcos will be paying INR 13,365 Cr as their first instalment in a few days. The government is expected to issue a demand note for the same in the coming days.

Purchasing Trends At 5G Spectrum Auction

At a glance, Jio got the maximum 5G spectrum in the auction, followed by Airtel and Vi. However, there is a story beyond this simplification.

Since Jio had the biggest war chest and arguably is the best-funded out of the three private telcos, it used the auction to get enough spectrum to become a leader in 5G services as well. The telco bought 700 MHz, 3.3 GHz and 26 GHz across India’s 22 telecom circles.

“We will celebrate ‘Azadi ka Amrit Mahotsav’ with a pan India 5G rollout. Jio is committed to offering world-class, affordable 5G and 5G-enabled services,” Ambani said on the spectrum sale.

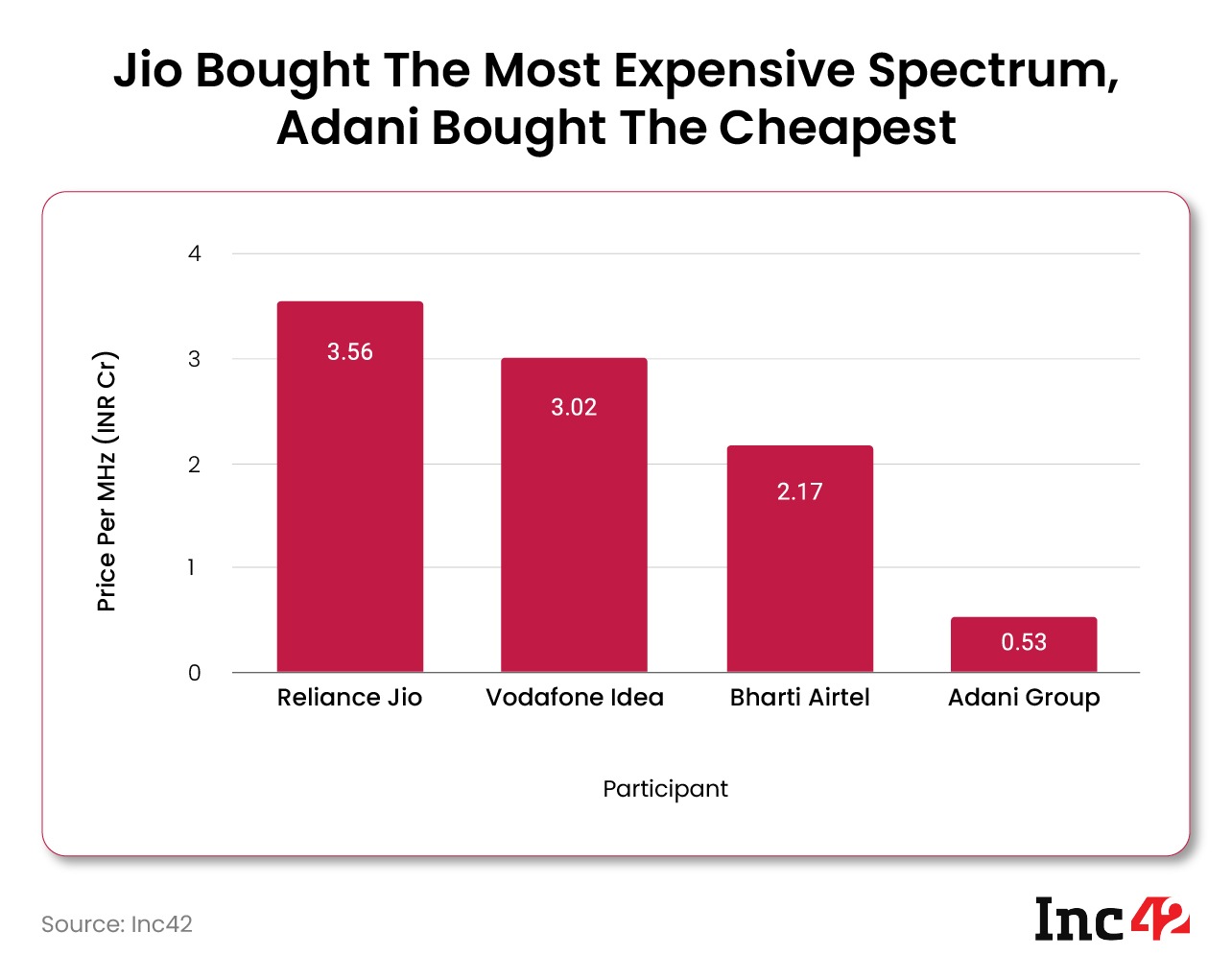

Jio was the only telco that bought the premium 700 MHz spectrum band, taking the telco’s cost for acquisition of spectrum to INR 3.56 Cr per MHz. The telco ended up spending almost 70% of its war chest, primarily because of the highly-priced 700 MHz spectrum which was unsold since 2015.

Jio also picked up spectrum in the mid-band (3300 MHz) and mmWave (26 GHz), getting spectrum across all major categories for 5G. Following the spectrum auction, Jio’s spectrum holding is now the highest in India at 26,772 MHz.

Airtel spent about 87% of the total purchasing capacity it had at the 5G spectrum auction, picking up spectrum at INR 2.17 Cr per MHz.

The Sunil Mittal-led telco did not splash out on the sub-GHz spectrum. However, it did pick up some 900 MHz spectrum across a few circles. More importantly, Airtel bought the 3300 MHz and 26 GHz spectrum across all circles, just like Jio. In fact, Airtel picked up only slightly less spectrum in these two bands than Jio.

It is also prudent to note that Airtel already owns a significant chunk of the 800 MHz spectrum, which will further help it build the foundation of its 5G network.

“This spectrum acquisition at the latest auction has been a part of a deliberate strategy to buy the best spectrum assets at a substantially lower relative cost compared to our competition. This will allow us to raise the bar on innovation and address the emerging needs of every discerning customer who demands the best experience in India,” said Gopal Vittal, MD and CEO of Bharti Airtel.

Vi, on the other hand, had a comparatively muted participation in the spectrum auction, though it spent around 95% of its total war chest. Vi picked up mid-band spectrum in 17 circles and 26 GHz spectrum in 16 circles, while also picking up 4G spectrum in three circles.

“We believe that the above spectrum acquisition will enable us to strengthen our position in our key markets and it aligns well with our long-term strategic intent. With this, we now have a solid portfolio of spectrum across all bands in all our priority circles,” Vi said in a statement.

Despite the muted participation, the telco had to spend INR 3.02 Cr per MHz, which was the second-highest cost of acquisition of spectrum during the auction.

Meanwhile, Adani Data Networks bid to acquire about 400 MHz of 26 GHz spectrum in Gujarat, Mumbai, Karnataka, Tamil Nadu, Rajasthan and Andhra Pradesh circles.

When the news first broke that the Adani Group will be participating in the spectrum auction, speculation was rife that it would mark its entry into the telecom space. However, in a statement, an Adani spokesperson denied the same, stating that the Adani Group’s intention was not to be in the consumer mobility space.

“We are participating in the 5G spectrum auction to provide private network solutions along with enhanced cyber security in the airport, ports & logistics, power generation, transmission, distribution, and various manufacturing operations.”

The same was corroborated by the muted participation from Adani Data Networks, spending only 23% of its total spending power and acquiring the cheapest spectrum of the lot at only INR 53 Lakh per MHz.

Adani Data Networks will look to supply its ports, airports and other major facilities with low-latency private networks.

Spectrum Bands Best Suited For 5G

5G networks across the world are being built on the foundations of sub-GHz and mid-band spectra as the two spectrum bands have a higher range than any other 5G spectrum band.

For instance, in the US, telcos are using a mix of 600 MHz, 700 MHz, 800 MHz and 900 MHz for long-distance network coverage, along with mid-band.

As per Vaishnaw, the 600 MHz band remained unsold in the 5G spectrum auction because of a lack of ecosystem in the country. However, he added that it will become lucrative in two to five years as 5G networks become ubiquitous in India.

As the frequency of the spectrum increases, the range decreases. Therefore, the sub-GHz spectrum has the highest range, followed by the mid-band spectrum. The mmWave has the lowest range of all.

A higher range allows telcos to save costs on installing towers. A shorter range would demand more tower deployment, driving costs of rollout higher.

The 700 MHz spectrum is the most expensive one as it has the best range and highest energy efficiency. It can also be used to operate 4G networks. During the auctions in 2015 and 2021, the spectrum remained unsold because of its premium price.

With increasing frequency comes increasing data-carrying capacity. Therefore, the mmWave band can provide the fastest 5G, with a 5G network on the sub-GHz band only slightly faster than 4G networks.

Also, mmWave can support more devices than any other 5G spectrum band, making it lucrative for highly device-dense scenarios such as metropolitan areas. 5G mmWave

is most suitable for locations like a smart factory, where there are hundreds of thousands of IoT devices connected to a network.

This is the reason behind Adani Group picking up only mmWave spectrum to enable Industry 4.0 applications across its facilities such as ports, airports and factories.

The mmWave spectrum was a subject of fierce debate last year, with satellite broadband companies, such as Starlink and OneWeb, objecting to the sale of the spectrum at the 5G auction. The companies argued that the 26 GHz band had been used by satellites for a long time and it is needed to deliver satellite-based connectivity.

Even though it seems that the two extremes of the 5G spectrum take the spotlight, the most important type of spectrum here is definitely the mid-band spectrum. Just to provide some context, the US held its mid-band or C-band auction in 2020, resulting in bids worth a staggering $81 Bn (INR 6,35,831 Cr).

The mid-band spectrum provides an ideal mix of range, speed and capacity, and hence, is used in almost all 5G networks across the world.

By When Will 5G Services Be Launched?

The government has made it clear that the spectrum will be allocated by August 10, which is just over a week from today (August 2). Therefore, India can expect to see its first 5G networks around October, with a full deployment requiring at least a few quarters.

“We expect to allocate spectrum by August 10 and then hope telcos will start putting the equipment so that we will have 5G services from October. We have been given to understand that there will be sufficient coverage of 5G in the next two to three years,” Vaishnaw said in a press conference.

The sentiment was also echoed by a report from Kotak Institutional Equities. “Allocation of 5G spectrum is likely to be concluded by August 10, 2022, and rollout is likely to commence from October 2022 from metro cities,” the report read.

Explaining how the telecom industry will shape up in the aftermath of the 5G spectrum auction, Devroop Dhar, cofounder of Primus Partners, said that while Jio may have an upper hand in terms of bundled handsets and their investments, other industry players also have an opportunity to compete in the industry.

According to studies, Indian consumers claim to be willing to pay 50% more for 5G bundled plans. Hence, companies need to find an incentive to get their customers to upgrade to 5G devices, Dhar added.

All said and done, consumers need to be convinced to jump on to the 5G bandwagon. While it is definitely the next generation of mobile networks, Indian telcos will have to convince the customers in the market, where the average revenue per user (ARPU) is less than INR 200, that 5G is worth paying more for.

![Read more about the article [Funding alert] Fashion retailer High Street Essentials raises Rs 25.50 Cr from existing investors](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Imager26e-1592803473565-300x150.jpg)