Oasis Fertility, on Thursday, announced an investment from Kedaara Capital, a private equity firm in India, for a significant minority stake in the company.

This is Kedaara’s second investment in the single specialty healthcare segment. With this $50 million transaction and a commitment to deploy further capital for strategic acquisitions, Kedaara aims to support Oasis in becoming the leading fertility chain in India and adjacent markets. The transaction will also provide an exit to InvAscent, who invested in the company in 2016.

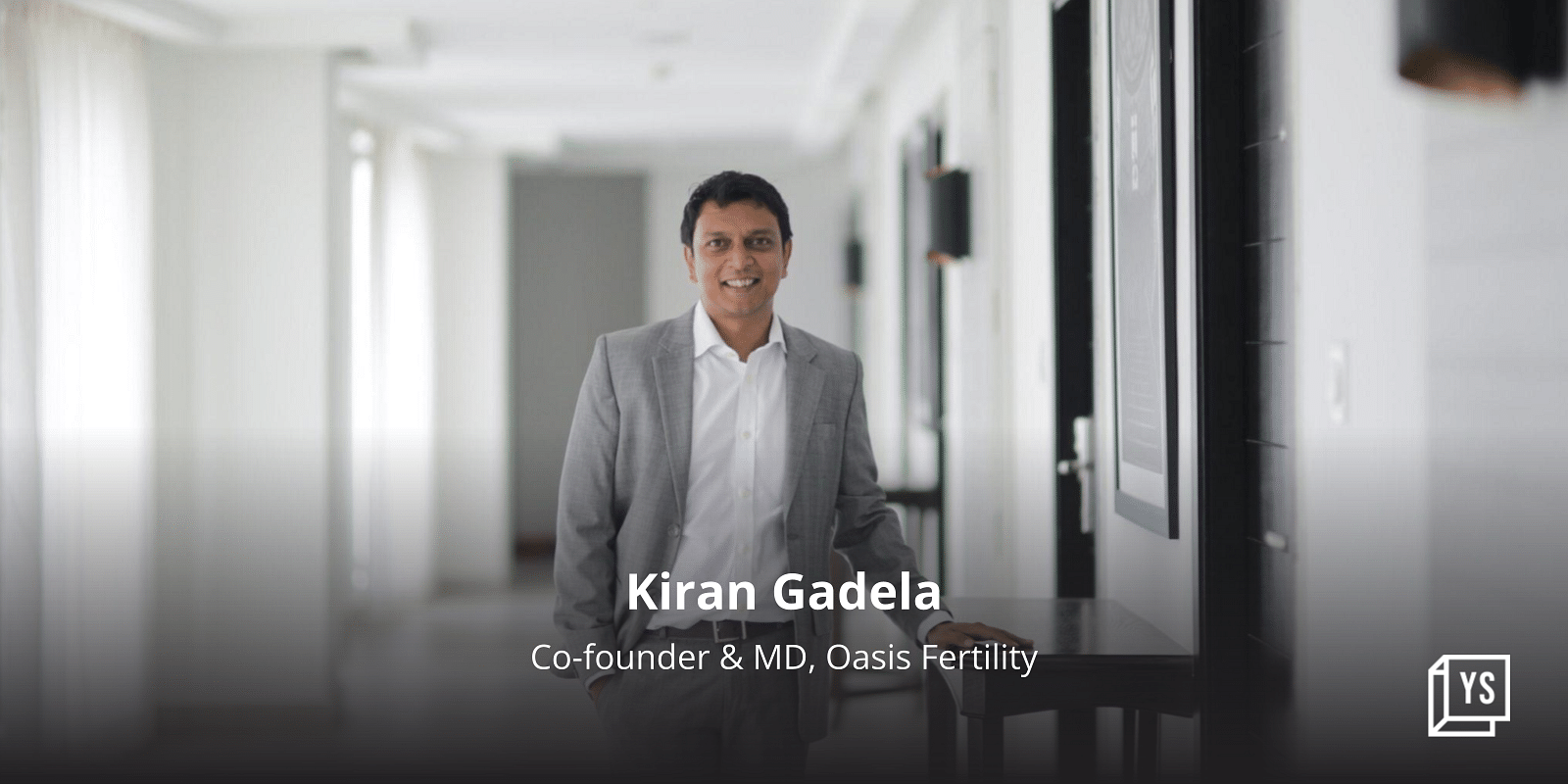

Kiran Gadela, Co-founder and Managing Director, Oasis Fertility said, “We are delighted about leveraging Kedaara’s understanding of the sector and the Indian market. We look forward to this partnership as we embark on a journey to pursue attractive synergistic acquisitions and create a leading fertility platform in India and South Asia to further our core purpose of helping couples achieve parenthood.”

Founded in 2009, Oasis says it has scaled to a network of 26 clinics across 16 cities while doubling its revenues in the last three years. The company also runs an accredited in-house training academy, Oasis School for Human Embryology and Reproductive Medicine (OSHERM), which has trained over 200 medical professionals and published over 60 research papers.

“Oasis has created a scalable, replicable model and espouses a unique culture with clinical excellence and ethics at its core,” Nishant Sharma, CIO & Managing Partner of Kedaara Capital says.

Oasis recently launched first-of-its-kind andrology (male infertility) practice called AndroLife.

O3 Capital acted as the exclusive financial advisor for the transaction and Samvad Partners was the legal counsel to Oasis Fertility. Quillon Partners acted as legal counsel to InvAscent and Veritas Legal acted as legal counsel to Kedaara Capital.