India’s software-as-a-service (SaaS) companies are leading when it comes to growth, with many of them turning into unicorns – so much so that Indian SaaS enterprises could be unlocking a $1 trillion opportunity by 2030.

To get a better understanding of how to thrive in this ever-growing sector, the NASSCOMProduct Conclave had a panel discussion on ‘Is SaaS all the same across all ticket sizes?’ The diverse panel had Sunil Patro, Founder and CEO, ; Yamini Bhat, Co-founder and CEO, Vymo; Srividhya Srinivasan, Co-founder of Technologies; and was moderated by Prasanna Krishnamoorthy, Managing Partner, Upekkha.

Sharing their expertise and learnings from their journeys of SaaS, even though from different spectrums, the panellist shared different playbooks for growth, depending on the offering, clientele, and ticket size.

Here are the key learnings:

Go freemium and be easy

One of the key learning SignEasy’s Sunil shared is to start on a freemium model as early as possible as opposed to a free trial and paid version.

“Free or paid trial helps you because your costs can be lower. But what we realised is that users forget, time expires, and other things. We realised the future of SaaS is freemium; even enterprise companies are going down the freemium path. Freemium means you get higher word of mouth virality, you get higher mindset in terms of brand awareness, and ultimately, it will indirectly contribute to more customers coming down your path,” he said.

Team SignEasy

SignEasy is a cloud-based, mobile-first eSignature solution for businesses focused on small- and medium-sized businesses. Some of its clients included the likes of Unacademy, Curefit, AngelList, and Freshworks. “Many fast-growing startups across sectors rely on SignEasy to completely digitise their document workflows,” told Sunil.

He shared that the company’s ACV (annual contract value) is in the range of $40,000 to $50,000, which is on the higher-end side. Sunil explains that is because the company not just focuses on SMBs but also the mid-market segment, and the pricing is in such a way that the ACV is higher.

Besides this, he shared that SignEasy’s Annual Recurring Revenue (ARR) is close to $8 million. Sunil said that the company provides a business-grade product, coupled with a consumer-grade experience, and a seamless buying journey with factors like delight in terms of cross-platform usage, creating an intuitive experience, easy to discover, easy to use, easy to purchase, and easy to do business with.

Sunil suggested that as soon as a SaaS player gets a product-market fit, they should apply a top-down selling approach where their customer success team is either responsible for expansion or the outbound team works with the customer success team and does top-down selling.

He also highlighted the importance of just taking a moment, taking a step back and looking at activation and adoption among their clients and really understanding what is blocking them from not using the product. “So just focusing on those leading metrics helps you to unlock answers for your growth bottlenecks,” he said.

Expand to right and new markets

Amagi is a ten-year-old next-generation media technology company that provides end-to-end cloud-managed live and on-demand video infrastructure to content owners, broadcast and cable TV networks, and OTT platforms.

While the company is a decade old, its SaaS journey started five to six years ago when it pivoted from targeted advertising to lead cloud adoption and evangelise cloud technologies for broadcast. Sharing some key learnings in terms of what is working out for the company, its co-founder Srividhya Srinivasan said that it was the mistakes that held back the company’s growth.

The company did not expand to markets like the US and misestimated a few things. “We started Amagi with three big goals. We wanted to revolutionise the industry, we wanted to become a million-dollar business and we also wanted to do it in India for India because of our experience in India,” she said.

Srividhya Srinivasan

Srividhya added that the company initially targeted India and Europe, the Middle East and Africa (EMEA) earlier instead of the US and it misestimated the inhibition to move cloud-based solutions for traditional broadcasters.

The company’s Net Revenue Retention Rate (NRR) is as high as 170 percent and the reason according to Srividhya is because Amagi is ahead of the tech markers as there was no player to connect content producers and content platforms before Amagi’s entry. She told that the company played a key role in turning a hardware capex intensive business into a cloud-based SaaS business.

“We didn’t initially build the US market until about 2018, and only after a co-founder went to the US and saw the opportunity,” she said.

Sharing its growth trajectory, she shared its first customer came in about 2016, and the ticket price was as low as $60,000 a year, and now the company’s ARR is about $100 million. Speaking about the key contributors to business momentum, Srividhya candidly said that it is about the timing as well. “The momentum accelerated after the OTT revolution, and the pandemic has also helped, she said.

In FY21, the revenues of Amagi increased by 136 percent, with an 18 percent sequential growth in the quarter ending June 2021. The company have been doubling its revenues for the past three years and foresees the same trend going forward.

Don’t be the 151st app

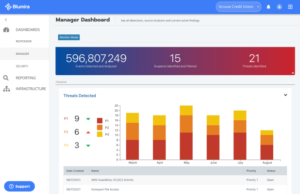

Another interesting SaaS angle that Yamini Bhat, Co-founder and CEO of Vymo, highlighted is that a new category SaaS company has to fight for its budget and a key to get that is to add value to ROI, make customer journey easy and actionable.

Vymo is one of the first enterprise SaaS companies in India with a different sales and marketing motion compared to typical horizontal SMB SaaS. It works with financial institutions as their sales acceleration platform – a new SaaS category according to Yamini. Due to this, the companies do not have a set budget allocation, and hence, a SaaS player providing solution that is a new category has to add some value.

“It’s a new category that we are creating. There are probably 10 companies like us doing this in different verticals; everyone has chosen their vertical so that they can go deeper and be intelligent. So, when it is a new category, we will not walk it with clear budgets that they (CTO) can allocate back to us. We have to fight for the creation with value story and get the budget allocated to us and we are talking of budgets of about half a million or more than $1 million,” said Yamini.

With a strong NRR between 140-180 percent and ACV of $350,000, Yamini said that the key takeaway of Vymo’s business momentum is that it a new age SaaS company has to support legacy systems that the customer has embedded within their stacks. She asserted that it is important to make the customer’s journeys easier.

“A CTO/CIO is already running 150 apps and you should not become the 151st app, rather be an app that brings down their total number to like 111,” she said. The offering, according to her, has to be about making CTO’s life easy and being able to take a big part of the stack out of the box and give it to them.

“You’re not selling a feature you’re committing to solving a problem. Identify the problem, position yourself accordingly. Close the brief, show impact and employment, and then snip off more problems across the organisation,” said Yamini.

Concluding the panel, Prasanna said that there is a huge spectrum of products that you can build for SaaS.

“Be very careful. The type of ACV that you pick the type of customer that you pick the scale of the problem that you’re solving for them will require you to do very different things across your product across Business Process Management (BPM) and you are learning to be very different,” he concluded.

![Read more about the article [Startup Bharat] This Haryana-based edtech platform wants to make test prep for competitive exams affordable](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/startlogo-1586268029937-300x150.png)