The Honourable Finance Minister acknowledged the role Indian startups have played during the pandemic and how they will supercharge India’s roadmap over the next 25 years

The greatest reform put forth by the budget is in legitimising cryptocurrency as an asset class for investments

Allowing companies incorporated from April 1, 2016 to March 31, 2023 (as opposed to 2022) being considered as eligible startups for tax benefits

Union Budget 2022 will go down as the Digital India Budget, with the government committing to a digital path forward, with Indian startups as the primary vehicles of delivery.

The Honourable Finance Minister acknowledged the role Indian startups have played during the pandemic and how they will supercharge India’s roadmap over the next 25 years. The term digital was mentioned no less than 35 times in the budget speech.

The greatest reform put forth by the budget is in legitimising cryptocurrency as an asset class for investments. By creating a framework of taxation of crypto, no matter nor pernicious, the government has acknowledged the widespread use of crypto as an investment class by Indians and seek to take their fair share of all those gains.

A flat 30% tax, no leeway for setting off crypto gains against other losses, no way to set off crypto losses against income and no deductions makes this amongst the harshest taxation regime for any asset class. But it ends the ambiguity of crypto as an asset class and will pave the way for regulating this emerging field. In addition to this, it allows for a framework for Web3 companies to stay Indian as opposed to moving their headquarters to geography that permits crypto applications. The lack of any regulation on crypto, outside of the 2018 ban, has set back Web3 innovation in India by years.

For startups especially, the key tangible takeaways were:

- Allowing companies incorporated from April 1, 2016 to March 31, 2023 (as opposed to 2022) being considered as eligible startups for tax benefits

- Fund of Fund mechanism for funding innovation in agritech, pharma, deeptech, climate action

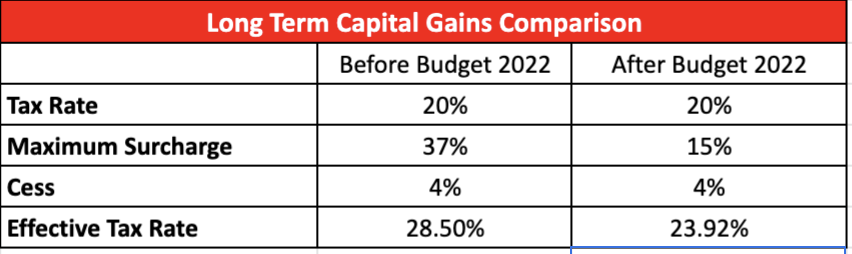

- Capping the surcharge on long term capital gains at 15% as opposed to 37% previously.

But these wins must be contextualised in terms of the asks of the startup ecosystem, which were:

- Complete tax parity between listed and unlisted securities

Unlisted securities pay Long Term Capital Gains at 2.4 times the rate of their listed counterparts. Parity was long expected in this budget. The 2022 Budget created parity in the surcharges applicable, but the fact that the tax rate for unlisted securities is still twice the rate of listed securities is a large, unmet ask.

- Reform the IMB framework for tax benefits to startups

In order to avail of Income Tax benefits, a startup must be certified as eligible by the IMB (Inter-Ministerial Board). Out of 62,000 DPIIT registered straps in India, only 450 of them are IMB certified. The reform is this system was an oft-requested ask in order to broadbase the Income Tax benefits of being a startup

- Clarity on foreign direct listing

Ever since the 2020 Atmanirbhar package announced the intention to allow for a foreign direct listing, the rules for the same have been widely expected to be announced in this budget. The lack of clarity for close to 2 years is causing uncertainty in the boards of startups in terms of exploring listing options

Union Budget 2022 shows the commitment of the Government to Indian startups and must be lauded for supporting innovation in setting the tone for the next 25 years of India.

![Read more about the article [Startup Bharat] Meet five startups from Jaipur that are making a mark](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Jaipurinside1-1597409191980-1614863675913-300x150.jpg)