One consequence of the COVID-19 pandemic is more people had flexibility to work remotely, and that meant they also had more flexibility to live where they wanted.

As a result, more people chose to relocate — either temporarily or permanently — to other cities.

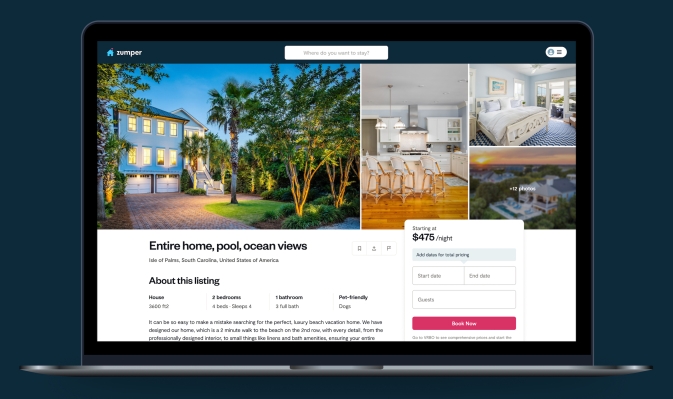

For online rental marketplace Zumper, this meant a shift in user demand. The San Francisco company historically has connected renters to landlords for long-term leases, with short-term rentals only being a very small portion of its business.

But in 2021, as more people began to explore other locales, Zumper saw “a significant subset” of its renters looking for more flexible options, such as month-to-month or hybrid leases.

For the unacquainted, a hybrid lease is typically for one to six months with no fixed contract. It also can be described as “a rolling lease,” in that tenants have short notice periods to leave.

“We saw that our users wanted more flexibility in their lives,” said CEO and co-founder Anthemos “Anth” Georgiades. “Some just want to be nomadic and some just want to try various neighborhoods before committing long-term.”

Last year, Zumper had about 1 million listings and over 70 million users. Of that 70 million, about one-third were seeking short-term rentals of apartments, hotels or condos, according to Georgiades. To better cater to that subset of users, Zumper today is announcing what the founder describes as a “rebirth.”

To that end, the company has raised $30 million in a Series D1 round of funding led by Kleiner Perkins to help it in its efforts to enhance its product to better serve people looking for short-term rental options.

The funding actually closed earlier this year, but is only being announced today. Goodwater, Greycroft and other unnamed investors also participated in the financing, which brings the company’s total raised to nearly $180 million.

Zumper had raised $60 million in a Series D round in March of 2020. Despite the latest raise being an extension of that round, Georgiades told TC that the company saw a “significant step up” in valuation. (Typically, valuations are flat when extension rounds are raised).

The executive declined to disclose the figure at which Zumper is currently valued, but sources familiar with the company’s internal operations told TC that it is now “above $500 million.”

He did say that the money has mostly gone toward funding the product development toward all the above trends. Already, Zumper has added more than half a million short-term listings to meet customer demand.

With a push into short-term rental offerings, is Zumper encroaching on Airbnb’s territory? Notably, Airbnb also shifted course during the pandemic by offering more longer-term stays on its platform.

Acknowledging that there is “some overlap,” Georgiades said Zumper is “focused on helping people find places to live versus Airbnb being focused on helping people find places to stay, often when they travel or on vacation.”

“Airbnb did a great job in the pandemic catering to flexible rentals,” he told TC. “We see a slightly different approach to flexible rentals with significantly lower fees to renters and most of our users staying for one to six months versus a stay. I wouldn’t say we’re going head to head against Airbnb, nor are we trying to kind of get into the vacation rental space against them, but we do see an opportunity as a true rental platform to deliver in this flexible world slightly differently.”

Ilya Fushman, a partner at Kleiner Perkins, notes that the venture firm has invested in each of Zumper’s funding rounds since its 2012 inception, starting with a $1 million seed round that year announced two weeks after launching into a public beta at SF Disrupt. Other backers in that early financing included Andreessen Horowitz (a16z), NEA and Greylock.

“Finding a home is a fundamental need and has to evolve with the way people live and work today,” Fushman wrote via email. “Zumper has built a modern, highly flexible, cost effective, and high quality inventory experience that allows people to find the best places to live.”

He went on to describe Zumper as “the first real estate marketplace to offer annual, monthly and nightly rental options in geographies that people desire.”

“People who are renting homes today are focused on mobility, flexibility and a high quality software experience, and Zumper delivers on all of these,” Fushman added.

Investors were drawn to what Georgiades described as a post-vaccine “explosion” of interest from renters in 2021.

That explosion has led to double-digit revenue growth year-over-year, he said.

With a self-described mission of making renting “as easy as booking a hotel,” Zumper competes with the likes of publicly traded Zillow, Apartments.com and CoStar.

The company makes money by charging multi-family and single-family landlords a subscription to its platform to get their inventory in front of Zumper’s users. For example, it works with companies like Blueground to get its furnished apartments in front of more potential tenants. While it feels like a SaaS offering in that landlords typically pay Zumper via annual contracts, Georgiades describes its long-term offering as “a classic advertising business.” In the short-term space, it’s a bit more transactional, with the company taking a fee at the point when the rental is booked at an average of 10% of the booking value generated.

But not wanting to make the same mistake as many other companies that saw pandemic-related bumps in business, Zumper is not putting all its eggs in one basket.

“Long-term rentals remain our core offering,” Georgiades said. “At the same time, we absolutely believe flexible is here to stay. I don’t think demand will return to as high as it was last year, but it’s still a massive segment that is underserved with no one who’s really built a marketplace for it, and we think that’s a big opportunity.”

The rental market is a hot one these days. Last week, storied venture firm Andreessen Horowitz wrote its largest individual check ever, at $350 million, to Flow, Adam Neumann’s new residential real estate company focused on rentals.