At 8 pm on March 24, 2020, Prime Minister Narendra Modi made a landmark announcement – a nationwide lockdown for 21 days to curb the spread of the coronavirus pandemic in the country. The lockdown continued in some form or the other for the next few months, but businesses were never the same.

For many industries, this was a transformative year. In a sink or swim situation, the entrepreneurial spirit truly came through – with many small, medium and big industries finding their own way to pivot and carve a niche.

Healthtech, edtech, fintech, OTT, and foodtech are some of the core sectors to grow at an accelerated pace in the digital startup ecosystem. Whereas travel, tourism, hospitality and related sectors took a direct hit from the chaos that was unleashed globally.

Changes aside, what we did notice was a 360-degree shift in the way entrepreneurs perceived success. From achieving greater maturity and better business models, Indian startups also streamlined revenues and innovations, and as they continue to deal with challenges, Indian startups are playing the role of a catalyst in reviving the country’s economy.

According to YourStory Research’s 2020 Funding Report, Indian startups raised $9.4 billion across 881 deals from around 1,476 active investors in the ecosystem. We have also come across many success stories under YourStory Media’s series Pivot and Persist.

As we approach the first anniversary of the unprecedented lockdown, we reached out to entrepreneurs to learn how the year unfolded for them and understand their key learnings from the days gone by for the day ahead.

Nirav Choksi, Co-founder and CEO, CredAble

What emerged clearly during the pandemic was the need for large corporate anchor buyers to enable credit for their vendor and distribution ecosystems.

The pandemic reinforced the need for large scale credit penetration to SMEs and the path forward is innovation in credit underwriting, product structuring and digitisation backed by technology to enable deep tier financing to the SME sector in India.

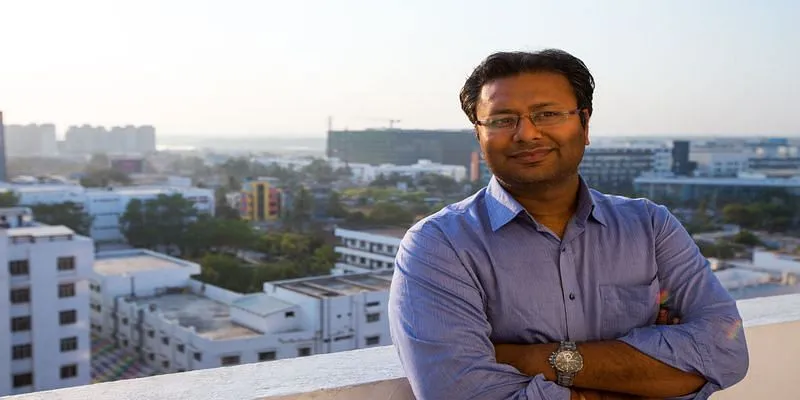

Mukesh Kalra, Founder and CEO, ETMONEY

Customers can remind you of the category basics more than you can follow them in business – this was our biggest learning from the year that went by. We had always heard that investors need advice that is human-led, in the absence of which, digital wealth platforms won’t be able to serve their investors well when markets aren’t stable or there is a period of uncertainty.

The Indian retail investors exhibited exactly the opposite behaviour of what has been traditionally their ‘so-called’ symbolic behaviour – that they exit at lows, and enter at highs. The pandemic proved this long-held belief wrong! Markets witnessed the fastest ever drop of 40 percent in a matter of weeks, and retail investors went on a buying spree.

This started lightening up the Equity Allocations once they nearly saw money doubled in a matter of six months post the March 2020 lows. The behaviour has reinforced one thing well – educate your customers well, contextualise it, and they remember the learning more than you can hope for.

Amit Nigam, COO and Executive Director of BANKIT

The pandemic taught us to align, adapt and amend businesses as well as reinforce the strategies so as to make the most of the ongoing situation. Another important point, it has taught me to believe in empathy, to trust your employees who have been a constant support for the company to bring the business forward.

Siddhant Wangdi, Founder and CEO of Meatigo

In the initial phase, people were scared to order for home delivery fearing the risk of viral contamination. However, gradually things took a turn, and people resorted to ordering online. We received numerous calls and requests from our customers to start our operations.

Keeping the gravity of the situation in mind, we took extra care in terms of the safety of our own team and our customers as well as the quality of the products that we delivered. In fact, this pushed us further to go the extra mile and as a result, we decided to deliver our meat products by renting refrigerated vans instead of bikes.

It is true that last year was a struggle but one of our biggest learnings from the pandemic is to keep delivering the best service to customers despite crises, and this pushes us to do well too.

Rohit Garg, Co-Founder and CEO, SmartCoin

The COVID-19 lockdown was a litmus test for digital lending and how we fared in this became an important benchmark. We are enabling credit to the underserved market, the segment most prone to economic shock.

During COVID-19, we noticed that the growth from the Bharat part of the market, which comprises Tier-II and III cities, has been very strong. More than demand, the real challenge is to use sustainable technology for creating the best products which make credit affordable and also build relationships.

Sourabh Gupta, CEO and Co-founder of Vernacular.ai

2020 has been truly transformational for Vernacular.ai, and our customers. As the world transitioned to remote models and digital-first approaches, we embarked on a journey to support the next billion consumers coming online, by introducing conversations in a language that they are comfortable with.

Tapping the local lingo has been both challenging and rewarding. In 2021, we will further advance our voice technology to introduce the future of business-customer engagements, focusing on hyper-personalisation to build all-inclusive digital services for Bharat.”

Saurabh Jaitly, Co-Founder, Shippigo

Amongst many other things, the pandemic taught businesses to be more frugal. The focus has shifted to becoming more tech-intensive and process-driven while doing away with the redundant time-consuming tasks which require physical intervention – be it related to client onboarding flow, customer support, or how the whole organisation is run.

In the coming years, work from home will again continue to be the new normal. The ecommerce sector will grow manifold and the opportunities will be immense.

Gaurav Chopra, Founder and CEO, IndiaLends

The lending industry went through a dramatic evolution in the last one year. While both borrowers and lenders were conservative in the initial months the demand started picking up in the latter half of the year. We, at IndiaLends, received borrowers’ loan applications for newer purposes — to start small businesses, up-skilling courses, gadgets for work-from-home, etc.

Being a marketplace for credit products, we digitised our lending process end-to-end to adhere with the social distancing norms and offered open APIs to banks and NBFCs to lend through our platform.

Saahil Goel, CEO and Co-founder, Shiprocket

The logistics industry was hit the hardest by the COVID-19 lockdown, making our business crash by about 95 percent. However, as days passed, we aligned ourselves as per what was opened for business in the market, and started focusing on the essential products’ category.

We adapted our processes and offerings to support sellers in every way we could during this tough time, like offering financial incentives, running training programs and mostly by just being there for them in their time of despair.

Nevertheless, 2021 is going to be the year for ecommerce, and Direct to Consumer space as the shift from offline to online is becoming significant among consumers and sellers.

Gaurav Kumar, Co-founder and CPO, OkCredit

Year 2020 was a mixed bag for the digital business solutions industry. On the positive front, increased awareness about the value of such tools brings to business increased receptivity of our digital bookkeeping solutions among small merchants.

Additionally, as a team, we have adapted to remote work culture and successfully shipped out new products and experiments aimed at solving the unique problems of small merchants. At OkCredit, we began work on OkShop and OkStaff after the onslaught of the pandemic and shipped them out in record time.

This year, we are focusing on scaling these products as we simultaneously work on the development of some other products.

Mandar Agashe, Founder, MD and Vice Chairman, Sarvatra Technologies

Sarvatra has seen a significant paradigm shift during the lockdown. There has been increased collaboration between banks and fintechs – we have seen a huge demand from all these banks to move from an on-site product to cloud-based implementation so that banks can give 24×7 digital products to all their customers even if branches were inaccessible due to restricted movement.

Additionally, digital payments received a boost beyond urban-centric processes like UPI, to a rise in AePS usage as well. Going forward, we hope to scale up and drive innovation on a much deeper level by introducing new features and building a seamless banking network that is accessible to all.

Anand Kumar Bajaj, Founder, MD and CEO, PayNearby

The new normal ushered in by the pandemic has accelerated digitisation in all aspects of our lives. With a majority of Bharat still technology shy and financially underserved, our focus will be to make form factor agnostic easy payments and assisted digital banking available at every corner store, so that no citizen of the country goes underserved.

Simple cash digitisation infra at local stores and distribution of digital commerce through them will be a key focus area. This will help untapped rural markets get access to essential digital services and bring a financially underserved and digitally wary population into the mainstream.”

Bhavin Patel, Co-founder and CEO, LenDenClub

After the economy opened up, since the last 6 months, we at LenDenClub sensed an upsurge in demand, and added multiple features related to easy renewals and repayments of loans. The last 12 months have pushed customers towards first-hand loan service providers like us.

With fuelling demand for credit across both retail and businesses, we have reduced our turnaround time, achieving more than 80 percent loan disbursements within just 5 hours. I think it’s time to switch from traditional banking to banking on the go.

Sudarshan Lodha, Co-Founder and CEO, Strata

The rise of the digital economy through the pandemic has transformed the manner in which investments and financial decisions are dealt with. With new tech-enabled platforms offering transparency, security, and easy traceability of investments, clients are now willing to adapt to new age mediums as they can make well-informed decisions.

More importantly, it has created a level-playing field for a diverse demographic of investors. Commercial real estate as an asset class was restricted to the institutional segment until recently but today India’s middle class and HNIs are actively investing in it.

Of the 200 crore that Strata raised in the last few months, 70 percent was raised amid the pandemic, indicative of the huge appetite in the market.

Rohan Nayak, Cofounder and CEO, PocketFM

The pandemic has created new trends in the digital realm, and audio as a content format has grown rapidly, especially via audiobooks and podcasts. People have reconnected with the listening habit, and this will pave the way for the adoption of audio as a mainstream choice for entertainment and knowledge.

PocketFM has grown 5X in the last one year, and we continue to march forward to build audio as an expansive category.

Vinay Bagri, Co-founder and CEO, Niyo

The neo-banking industry has existed in India for almost three years now, however, the industry really found its relevance the most when the COVID-19 pandemic struck. At a time when bank customers were hesitant to visit branch offices, Niyo’s offerings gave further impetus to branchless banking culture.

Niyo worked with multiple banking partners during the pandemic and is gearing up to launch a slew of new exciting products for its consumers.

Sumeet Mehta, Co-founder and CEO, LEAD

The Indian education system was caught almost unaware when COVID-19 struck, and hence the adoption of technology was brought forward by a couple of years. While most schools undertook a jugaad to set up online learning to make up for school shutdown, going forward as school reopens, there is a need to cover the learning gaps from last year and hence bridge courses are imperative.

Schools need to follow hybrid schooling, and there is an utmost need for innovation in online classroom tech like ensuring ease of practice, assessments, homework among others.

Snehil Khanor, Co-founder and CEO, TrulyMadly

COVID-19 definitely brought in a sense of isolation among young individuals, as social interactions were curtailed owing to a remote life. While we were seeing significant spikes in signups and revenues even months before COVID-19, in the first two weeks of lockdown, we saw the volume surge by nearly 30 percent, which is generally seasonal during the Christmas and New Year holiday season.

In the year ahead, we sense a higher adoption as millennials as well as Gen-Zs are shunning apprehensions associated with dating apps and are embracing it more confidently, especially if they want to find a compatible life partner and not just a hookup.

Manish Patel, Founder and CEO, Mswipe

The global pandemic fuelled tremendous and large scale adoption of digital payments and online commerce from metros to even Tier IV and V towns. The pandemic has boosted prospects for fintech players – at Mswipe, contactless payments grew from 13percent in January 2020 to 30 percent in January 2021. Businesses that were earlier offline, moved towards accepting contactless online payments enabled by Mswipe’s PayByLink.

We believe that the adoption of digital payments will continue because people have realised that digital payments methods are simple and a lot of it can be done remotely and contactless as we continue to emerge from the shadows of COVID-19.

Gaurang Sinha, Director, Go-to-Market Strategy at Flock

We have gone from working in an office, to a complete WFH mode and now a hybrid working model. Through March 2020, Flock has been incredibly successful in becoming the de-facto platform for work communication for thousands of companies around the world, and customers are easily adapting to collaboration platforms.

What we learned is that employees can work from home or anywhere for that matter, as long as the organisation provides them with an efficient working platform. Our goal ahead is to fulfil the customised needs of our clients, in order to grow and promote a safe and efficient working environment.

Aditya Malik, CEO and MD, Talentedge

With the lockdown commencing in March 2020, educational institutions were compelled to shift their classes to online learning – incorporating digital technologies, to make learning more interactive. Now in 2021, with the news of schools, colleges and universities slowly reopening, what is being heard often is the phrase “hybrid learning”.

The perfect amalgamation of interactive digital learning and traditional face-to-face learning. The new normal has empowered young minds to strike a perfect balance between learning with technology.

Siddhartha Gupta, CEO, Mercer | Mettl

We realised any crisis could be in waiting and as a business, we have to be ready. Businesses need to continuously evolve to suit the market dynamics and customer’s most pressing demands.

We have learnt from our experiences and learnt well that when you keep the conversations going with your customers, listen to their feedback and work on incorporating those, you can easily innovate your way out of any crisis and maintain business continuity”.

Shan Kadavil, Co-Founder and CEO, FreshToHome

Like everything else, even the fish and meat purchasing behaviour of consumers was affected dramatically during the pandemic. With “safety” and “hygiene” becoming topmost priorities for customers, ecommerce witnessed a habit-forming shift. As a result, FreshToHome saw its online demand rise manifolds for its products that come with a safety guarantee of “100 percent fresh and 0 percent chemicals” as well as contactless deliveries that became a routine in 2020.

Our biggest learning during the pandemic has been to maintain the ethos of the company, which is the promise of no chemicals. We have stayed true to it despite gaining a broader reach and more complex operations during these trying times.

Akshay Chaturvedi, Founder and CEO, Leverage Edu

The last year has helped us to become more innovative, more efficient, and also a company with a huge heart. It saw us flip out the model and launch UniConnect, a virtual education fair that saw over 130 universities partner to meet matched students. We also took the hard call of not letting a single teammate go, irrespective of much bigger peers in the tech ecosystem doing it. And pretty much resultantly, we ended up growing our monthly topline over 4x. Will always remember this year as one that gave us unbelievable character.

Rahul Pagidipati, CEO at ZebPay

Bitcoin was under $5000 and ETH around $100 when the lockdown started and now, since a year of the lockdown, they have gone up by 10X. When the Supreme Court lifted the ban on crypto and the lockdown accidentally forced people to be home, they had time to research and learn about new things. Both of these acted as a great boost to the crypto industry.

At ZebPay, in 2020, we saw a 270 percent increase in trading volume and registered users from quarter to quarter, a 218 percent increase in number of users trading, and 143 percent increase in app downloads—this, without accounting for the explosive growth buoyed by the Bitcoin rally in our fourth quarter.

Lalit Keshre, Co-founder and CEO, Groww

The major takeaway from the upheaval caused by 2020 was to build a resilient organisation that can thrive under chaos and uncertainties. Following the path of antifragility, we were able to create the best in class investing experience to support our investors in leveraging market opportunities.

2021 would be the year of resurgence and making up for the lost ground. It would be the year of shedding inefficiencies and making the most of one’s time and resources. Carrying along with the lessons that 2020 taught us, we remain laser-focused on our mission of democratising investing in India in 2021 as well.

Akshaya Aron, Co-Founder, Quartic.ai

The silver lining in these dark times has been the acceptance and success of remote work. I think it’s an excellent opportunity for the government to build new startup hubs in Tier-II cities of India.

This will not only ease pressure from our already overburdened metros, but also strengthen our startup ecosystem.

Rishab Mehta, CEO and Founder, GrayQuest

The pandemic and the resultant physical restrictions brought about by the lockdown has boosted the demand and public acceptance of digitisation of financial services. The financial constraints caused due to the pandemic has enabled parents to dedicate more time to streamlining their personal finance and efficiently take financial decisions.

In the year ahead, our vision is to become the default mode of fee payment for 10 million learners from different schools and universities across India. We also aim to reach all corners of the country and bring more students under the radar of education financing thereby providing accessible and affordable education to all.

Narayan ‘Naru’ Ramamoorthy, Chief Revenue Officer, Global PayEX

COVID-19 has sped the adoption of digitisation in the B2B payments and automation space by many years. At Global PayEX we achieved a 40 percent Q-o-Q growth in electronic B2B payments and saw 4X increase in adoption of FreePay among dealers and distributors who are largely MSMEs.

We see clear adoption of cloud, Artificial Intelligence and Machine Learning by CFOs to optimise working capital efficiency in the year ahead.

Dhruvil Sanghvi, CEO, LogiNext

The pandemic has reaffirmed the importance of planning and building with a long term vision. Technology is revolutionising how everything is done and logistics is an impact area for us where we’ve been working relentlessly to bring in visibility and tracking to ensure a digital and automated supply chain.

The biggest lesson has been to always factor in a variable which will not be in our control and build systems in a way that the impact can be handled.

Ruhan Naqash, Co-Founder and CMO of Mycaptain

The pandemic led schools, colleges and traditional learning institutions to collaborate with private players more proactively. The technology and methodology that private players have, has thawed the coldness schools and colleges had towards the same, and this will result in an upsurge of collaboration in the space.

Moreover, not only did K12 and test prep see a surge in online consumption, but we saw hobbies and alternate fields also take the front seat during the pandemic. This will just keep growing from here.

Monark Modi, Founder and CEO, Bitex

Inflation proofing investments has been the biggest draw for people to move towards alternate investment assets during COVID-19.

Despite continued scepticism on the regulation front, worldwide the acceptance of cryptocurrency as a hedge against uncertain economic times has been established, and in the coming months, its adoption among millennials as a SIP will only grow.

Dr Somdutta Singh, CEO and Founder, Assiduus Global

This past one year has only made my resolve and the mantra I live by stronger: Every adversity comes with an opportunity. In 2020, when the government mandate stopped sales via ecommerce platforms, I started planning for other ways in which I could deliver and how to make the most of a grim situation like this.

By smartly redirecting my resources to manage the different facets of the pandemic, I have ensured that my businesses survived.

Niraj Hutheesing, Founder and Managing Director, Cygnet Infotech

Last year was a challenging year for our business, especially the first half due to the pandemic. However, we adapted our processes and operations in the second half, and did exceptionally well in the latter part of the year. Hence last year helped create a strong foundation for further growth. We have now expanded our business operations in the UK too. We are looking to hire new talent to accelerate business growth.

The outlook for this year looks very positive and we are moving towards onboarding new clients. We are focusing on delivering Digital Transformation and Automation solutions that help our enterprise business clients scale. Cygnet Infotech is also looking at upgrading its solutions to meet the needs of its customers in the new normal.

Piyush Vishwakarma, Co-founder and CEO, Jeevam Health

During the pandemic, the use of technology has made it a blessing in disguise and just by sitting at home a patient can analyse 1000s of biomarkers, get the feedback from best expert doctors. The change in perception and mindset of people has given players like us to expand this untapped market.

Lalit Mehta, Co-founder and CEO, Decimal Technologies

We focussed our energies on crafting new solutions such as Saarathi (AI-enabled digital lending marketplace for DSAs and Lenders) and VahanaHub (API Aggregation platform for all KYC, financial data, geolocation, biometric etc APIs across various providers).

We doubled our investments in business development by doubling our team in the first six months of lockdown. We also started a Customer Success function, increased our efforts in digital marketing and inside sales. All this put together has led us to attain more than 40 percent growth in revenue, 40 percent increase in team size, launching of new products and shaping up of newer, futuristic revenue streams.

Overall, with some hiccups here and there, and learnings, we have come out stronger from the global crisis. COVID-19 pushed us to think differently. All our customers are back to their pre-COVID-19 or better numbers. They are now looking to invest and grow while being cautious, especially on digital lending. Home Loan and Gold Loan are also seeing good demand and growth since the pandemic. Digital will continue to remain the mantra of the post-COVID-19 economy.

Surya Phadke, Chairman at Doot

2020 will be remembered as a great victory for human endurance in the digital age. The adage “hold fast, stay true” has never been more relevant. 2020 taught us the importance of being agile – the scale of digital adoption not only helped us in reaching a bigger audience but also forced us to adapt our product to solve a broad spectrum of citizen grievances.

Going forward it is imperative for SMEs to go 100 percent digital and envision a frictionless future.

Suumit Shah, Co-founder, Dukaan

The one thing that I learnt is resilience along with empathy. Millions of small as well as big businesses have already started undergoing ‘digital transformation’ and those who invested more in digital technology as compared to their peers, are already seeing huge ROI. This new way of doing business ‘digitally’ is going to become a ‘new’ norm in the long term.

Aakash Anand, Founder, Bella Vita Organic

What demonetisation did for digital payments, the pandemic has done the same for D2C brands. It has severely increased the revenues for brands like us, and has also created a new trend of mass audience relying on online marketplaces for essential goods and FMCG products and the future looks very promising as the online audience is now ever-growing along with an elevating trust in new and upcoming Indie D2C brands.

Vivek Desai, Founder and Managing Director, HOSMAC

COVID in 2020 has exposed the dire state of Healthcare infrastructure not only in the third world but also in developed nations. We not only need more capital investments but also focused strategy to increase the number of skilled human resources to tackle such calamities.

India’s move to have a separate administrative cadre for healthcare is a welcome step. Private and public collaboration which was forced upon has also taught us that it works and we must learn from it.

Vikas Chaturvedi, CEO of Xanadu Realty

In my opinion, the biggest lesson that the COVID-19 outbreak has delivered is the need to remain agile and flexible. As we gradually move towards pre-pandemic normalcy, entrepreneurs must keep that agility at the core of their operations. They must evaluate every development that impacts their business in real-time and be prepared to pivot their approach at any given instant.

Another aspect that emerging entrepreneurs must focus on is building a strong data model. As an entrepreneur, you must ensure that your business is prepared to leverage this imminent data explosion to inform your decision-making processes and drive better business outcomes.

Narayan Mahadevan, Founder of BridgeLabz

The COVID-19 outbreak has wreaked financial havoc around the globe, leaving many business owners struggling in its wake. A business needs intense focus and caring. While the short-term outlook for businesses varies greatly by industry, it’s important to consider what recovery mode will look like once the economy begins to return to a state of normalcy—or establishes a new normal.

We as an organisation believe team spirit is a key factor that builds transparent communication across the organisation to ensure everyone is on board. The team should synchronise all efforts towards the same target and focus on a single-minded target.

As an entrepreneur, one must ensure that your team is able to find a gap or need that your business requires at the time of crisis.

Bharath Sastry, CEO of Vistaprint India

Here are a few mantras around building your business in the post-COVID-19 era:

- Focus: It lets you better connect with potential customers as they are integral to the success of your business. also helps businesses/brands to identify the areas where it can play a critical role in delivering a customer promise in a profitable way. Once this is arrived at, businesses need to rationalise their portfolios accordingly and ensure that the whole organisation is rallied around the strategy.

- Personalisation: It is a strong differentiator that helps your business/brand build a connection with your customers.

- Innovation: With customers’ behaviour constantly changing, they are continuously evaluating and reevaluating their choices Innovation helps you solve a real consumer issue as a marketer by offering relevant products and services.

- Adaptability – T It is imperative that businesses keep reinventing themselves to swiftly sustain through challenging times.

- Digitisation – The pandemic has ensured that digitisation is not a choice anymore but a necessity. Companies and individuals need to embrace it wholly or partly.

Shekhar Rawtani Founder and CEO of Prescrip

This is the best time to work on your business’s online presence. Because today a great number of people are spending their free time online, and businesses should take advantage of the situation. So, if a good online presence is attained any business can build its brand and get credibility to charm its way into new customers attention. Additionally, the business will be more accessible to customers who will easily get acquainted with your business and its offerings.

Amith Agarwal Co-founder and CEO, Agribazaar

The last one year taught us:

- Ability to handle ambiguity: Post-COVID-19, organisations will have to build the capacity to handle ambiguity. A new crisis or global scare may hit you tomorrow, but we have to face, navigate and overcome it.

- Building a lean and capex efficient business model: Every business has to behave in a frugal manner and build a cash conservation mindset.

- Putting employee health and safety a priority: Businesses can slow down and can be built later. However, what can’t be replaced is human life. WFH is a useful discovery that will become the new normal.

- Solving a real and genuine problem digitally: The pandemic has demonstrated that businesses solving real problems of customers through a digital business model continued or picked up quickly.

- Focusing on 4C – Collaboration, Compassion, Courage, and Commitment: The post-COVID-19 world will have the 4C’s of building a business. Everything can’t be done by itself; hence an ecosystem of collaboration and trust needs to be built. Profits alone cannot define success. Compassion and doing the right thing will be critical for businesses to succeed. Courage and commitment to stay on course even during the worst times would be vital for teams; COVID-19 demonstrated how employees acted as frontline workers for their organisations and helped generate revenues.

Raghav Sood, Co-founder, Skin Elements

Last year was full of learnings! The ecommerce industry in India has taken a leap of at least five years, in terms of penetration not only in metro cities but also in Tier-II and Tier-III towns.

Industry-wide we see a lot many brands entering the Rs 100 crore club and this trend will only continue to grow with better logistics and brands serving niche customer demands with innovative products. Our captive sales have seen a jump of 100 percent vs pre-COVID-19.

Praveen Dhabhai, CEO, Payworld

Through the right infrastructure in place, it was easy to switch to the work from home model immediately and completely, and our operations were not impacted at all. With the upgradation of our technology and using analytics tools, we switched to a virtual form of training through Zoom and Google Meet to teach our retailers and grow our retailer awareness.

Our primary learning was that business dynamics can change drastically at any moment and an organisation should be able to adapt to the changes instantly to sustain itself.

Satish Shukla, Co-founder and Director, HR and Marketing, Addverb Technology

Due to the COVID-19 scenario, as people are shifting towards more online shopping and home deliveries, we have come up with a new offering, “Micro-Fulfillment Centers” specifically dedicated to the e-grocery segment. To meet the increased demand and make the supply chain robust, automation has emerged as the levelling point and with-it various distribution concepts such as micro fulfilment centres have come into play. Also, to successfully fight the pandemic and assist the frontline warriors of COVID-19, we have designed and deployed Decimator – our disinfectant mobile robot across hospitals, and quarantine centres.

Going ahead on our journey, we have managed the tide and will continue to overcome the challenges in our way. COVID-19 will reshape our world. We don’t yet know when the crisis will end. But we can be sure that by the time it does, our world will look quite different. This gives us an opportunity to think and reorganise our work for reliable delivery to our customers, to adjust and innovate as per the new normal.”

Apoorv Jain, Co-Founder and CEO at Express Stores.

In grocery supply chain and consumption, the pandemic made consumers dependent on their neighbourhood Kiranas and gave birth to hacks like online ordering through WhatsApp from their favourite Kirana. Bharat’s kiranas, who don’t have access to an ideal supply chain, got further exposed to such challenges during the pandemic.

With such additional value propositions getting exposed through hacks during the pandemic, the need of the hour is to provide consumers with a much better shopping experience in their neighbourhood, which is exactly what Express Stores is focusing on. We are now building a modern omnichannel chain of neighbourhood grocery stores.

Amit Srivastava, CEO and Chief Catalyst, Nutrify Today

Pandemic induced the common man to hyper digitisation. In nutraceuticals, the journey ahead would be a complete deviation of what it was perceived to be in 2019. Accelerated growth in nutraceuticals will witness a convergence of technologies that deliver personalised nutrition. AI will drive the choice of nutrition and its timings through convergence portable dispensing devices. Early innovations have started entering the market.

Aayushi patwari and Ishita Das, Co-Founders of Connecting NER

The pandemic required us to take actions on which we had been pondering over for months. The stillness also made us reflect on the teams we want to build, because those that were not just vanished into thin air. Not only that, but our learning through this pandemic has made us realise the kind of leadership that is meant to last, one that harbors communication, collaboration in its most basic sense and also ensuring that humanity as a factor is kept alive across all dealings undertaken.

Anand Virmani, Co-Founder and CEO, NAO Spirits & Beverages

We learnt the value of time this last year. The value of taking time to reflect on ourselves and also taking time to understand our consumers. This was in stark contrast to the non-stop pre-pandemic life and we really hope we don’t misplace the pause button again.

Amit Agarwal, Founder and CEO, OckyPocky

The pandemic allowed all of us to learn the importance of technology and its impacts on our lives. Currently, eight out of 10 children have relied on edtech platforms for their educational needs and this development is truly going to be beneficial for the Indian education system.

Because we are made in Bharat and made for Bharat, it was truly transformational to see the huge demand upsurge that came from Tier III, IV towns, and government sectors.

Going forward, we forecast more innovative products as these hungry newbie users are demanding a huge investment in vernacular. We have already quadrupled our content, sales capabilities to meet Bharat’s kids and their needs.

Also fascinating is the cross-border opportunities, given all the attention we are getting for building the most awesome English learning product.

(Disclaimer: This is a rolling story and will be updated as and when more inputs are received from Indian startups, entrepreneurs, and industry experts.)