Though the Indian equity markets have digested several macro-economic negatives and showcased resilience (given the global outlook), increasing volatility continues to remain an omnipresent threat to an investor’s portfolio, at least in the near future. This has caused justifiable worry amongst investors who are increasingly getting swayed by the market noise and overwhelming figures around. While investors are aware of the importance of portfolio diversification to be able to prevent any direct threats to their investments, the sheer number of options available under each asset class can become confusing to understand and balance. In such cases, a Balanced Advantage Fund can prove to be beneficial in an investor’s portfolio.

The cyclical nature of the market has historically demonstrated that no two asset classes perform in a similar manner. Ideally, the lesser the co-relation between two asset classes, the more improved are an investor’s chances of creating a balanced portfolio. Since the Equity to Debt ratio is determined in a dynamic manner, these funds tend to have the flexibility to manoeuvre volatile market conditions better and thereby, classify for a core allocation in an investors’ portfolio.

To tell us more about this investment category and why it is emerging as a popular choice today, YourStory caught up with Anupam Tiwari, Fund Manager, Axis Mutual Fund.

Balanced Advantage Funds – A potential hedge against volatility

As the name suggests, a Balanced Advantage Fund would balance the asset allocation between Equity and Fixed Income in a particular scheme based on the prevailing market scenario. The asset allocation in a Balanced Advantage Fund ranges from 0% to 100% towards equity or fixed income, giving the fund manager the ability to move allocation in case of swings in the market. For instance, if the equity markets witness a sudden sharp fall, a Balanced Advantage Fund will increase allocation to equity and at times when markets become overheated and valuations reach beyond comfort, the fund will reduce allocation towards equity.

Explaining how the dynamic balancing of the fund contrasted it with other market cap funds, Anupam said, “In a regular mutual fund product – a large cap, mid cap fund or the small cap fund, the equity allocation remains fixed or it moves minimally. For instance, in a large cap fund, the equity allocation will move between 90 to 100 percent depending on how the situation is, and so you always remain invested. Hence, you have a slightly higher volatility in your portfolio.”

“However, in a balanced advantage fund, the equity component of the portfolio moves in a large quantum”, he mentioned, talking about how the dynamic factor of the fund that targets to provide a cushion to the investors to battle the volatilities of the market.

Algorithms and models for optimal asset allocation

Most fund houses have their in-house mathematical models which decide the equity and debt allocations. The counter-cyclical allocation model, for instance, increases equity allocation by reducing debt allocation in falling markets and reduces equity allocations in rising markets. These models endeavour to buy low and sell high. The pro-cyclical model, on the other hand, tries to follow market trends and thereby, increases equity allocation in rising markets while reducing it in falling markets.

Talking about how the Axis Balanced Advantage Fund, Anupam mentioned, “The portfolio is structured in a manner to generate capital appreciation opportunities via equity exposure and generate income by investing in Fixed Income securities. We determine the equity percentage on the basis of three key factors, namely valuation, volatility and momentum.”

“Our belief is that in a high volatile environment, one needs to be conservative and in a low volatile environment, we need to be slightly aggressive. We try to relate fundamentals with market sentiment. And accordingly, we have designed an algorithm, which gives us an equity location in the portfolio,” he said.

Anupam also spoke about how the fund was predominantly a large cap portfolio to be able to hedge risks. “Our belief is that people who are coming to this category in particular, are those who want less volatility. And hence, the large cap allocation makes sense, ideally,” he said. “The Fixed Income Allocation & Duration is determined by a Top Down Approach. Post analysing the comfort on Domestic & Global Macros, Asset Allocation is decided. Our Fixed Income allocation showcases bias towards high quality instruments, which is why our portfolio is heavily concentrated into High Grade Liquid assets (GSECS / SDLs / AAA PSUs) with a relatively smaller allocation into Credits. The investments are also heavily concentrated in the 2-5yr Duration, in line with the fund strategy of lower volatility” he added.

An attractive investment tool for all seasons and majority investor profiles

Often called an ‘all-season fund’ because of the dynamic allocation strategies, Balanced Advantage Funds have the potential to be attractive to both new and seasoned investors looking to balance their portfolios with lower volatility. Even those who are on the lookout for an aggressive alternative to pure Debt Funds, or those keen on leaving their asset allocation to an expert can invest in these funds.

“I believe every investor who has a conservative risk appetite and is therefore, wanting lower volatility in their portfolios, may consider this product. Balanced Advantage Funds aim to offer a cushion to the drawdowns and hence anybody, from new investors to seasoned investors, or even those closer to retirement could certainly leverage the fund’s advantage,” said Anupam.

How to invest in the Axis Balanced Advantage Fund

The Axis Balanced Advantage Fund follows the same process as any other mutual fund and is available across all platforms including the Axis Mutual Fund App. The minimum application amount is INR 500 and in multiples of INR 1/- thereafter for lumpsum investments. Investors can also invest via the SIP route wherein the minimum application amount is INR 100 and in multiples of INR 1/- thereafter, with a minimum number of six instalments.

“We are available online – you can simply log into a website and start your investment process. We also have the Axis Mutual Fund App where you can invest. You could also connect with any advisor at our branch offices,” said Anupam, talking about the ease of access to the fund.

You can visit Axis Mutual Fund’s website www.axismf.com or download mobile app ‘Axis Mutual Fund’ (Android/IOS) and start your investment journey now.

Source: Axis MF Research

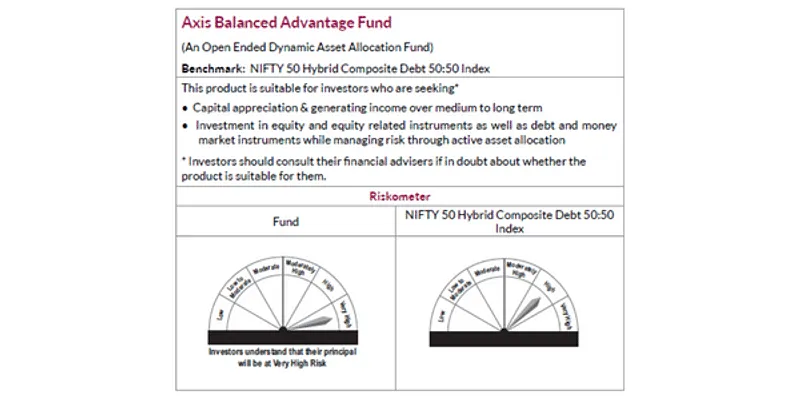

Product Labelling & Riskometer:

*Please refer the asset allocation and investment strategy from the SID

**Investors should consult their financial advisors if in doubt whether the product is suitable for them

Note: Market caps are defined as per SEBI regulations as below: a. Large Cap: 1st -100th company in terms of full market capitalization. b. Mid Cap: 101st -250th company in terms of full market capitalization. c. Small Cap: 251st company onwards in terms of full market capitalization.

Note: The views expressed by the fund manager are individual in nature and meant purely to information sharing. The sector(s)/stock(s)/issuer(s) mentioned in this presentation are for the purpose of illustration only and should not be construed as any research report/recommendation to buy / sell / hold. The Fund manager may or may not choose to have any future position in these sector(s)/stock(s)/issuer(s). Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Sectors mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

![Read more about the article [Startup Bharat] Dawaa Dost aims to address healthcare problems and reduce expenditure on medicines by 50-80 pc](https://blog.digitalsevaa.com/wp-content/uploads/2022/04/CopyofImageTaggingNewBrandingEditorialTeamMaster9-1650544822507-300x150.jpg)