“We were not given any notice and were asked not to work from the next day. There will be a gap on our resume. Who will take the blame for it?,” a Lido employee on condition of anonymity questioned.

At a time when the Indian edtech sector is flushed with funds, Mumbai-based edtech startup, Lido Learning, is facing financial constraints to continue its day-to-day operations.

According to several employees, in a virtual town hall that took place earlier this month, Lido Learning’s founder, Sahil Sheth, informed the team that the startup is facing financial difficulties and will be unable to pay the salaries of employees for the month of January and the first week of February. The company has also laid off over 150-200 employees, a few employees confirmed to Inc42.

It’s important to note that the edtech startup had raised $10 Mn (INR 75 Cr approx) in September 2021 from Ronnie Screwvala’s Unilazer Ventures. According to an Inc42 source, the company is in talks for a new funding round or possible acquisition.

According to Lido’s employees, they have not been paid salaries for the month of January. While the company has assured that the pending salaries will be paid within “30 to 90 days”, however, according to employees, it looks unlikely, given the company’s current financial health.

Inc42 has been investigating Lido for the last seven days in regards to these recent developments. About 10 employees confirmed the current state of affairs at Lido with Inc42 on a condition of anonymity. Our messages and call to the company went unanswered last week and we are yet to receive any response from the company on the questionnaire sent earlier today to Lido founder Sahil Sheth.

A LinkedIn post by a former employee who worked at the company till November 2021 highlighted that unpaid or irregular salaries were not uncommon at Lido.

A similar post by Supreme Court lawyer Nitish Banka highlighted that besides the employees, even the teachers’ salaries have not been paid out either.

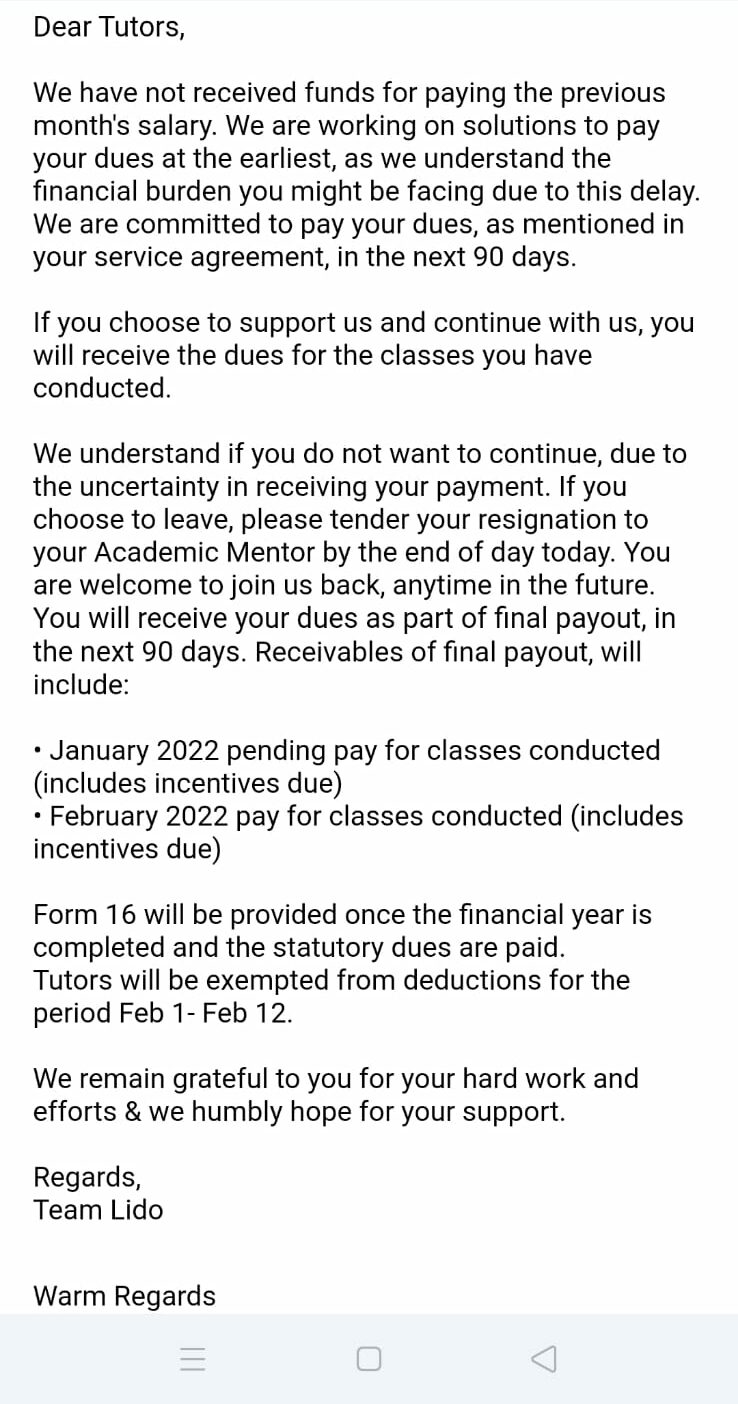

An internal e-mail was shared with teachers from Lido’s management explaining the financial difficulties the startup was going through.

Inc42 has learnt that most of Lido’s teachers who work on a contractual basis were credited 20% of their salaries last week.

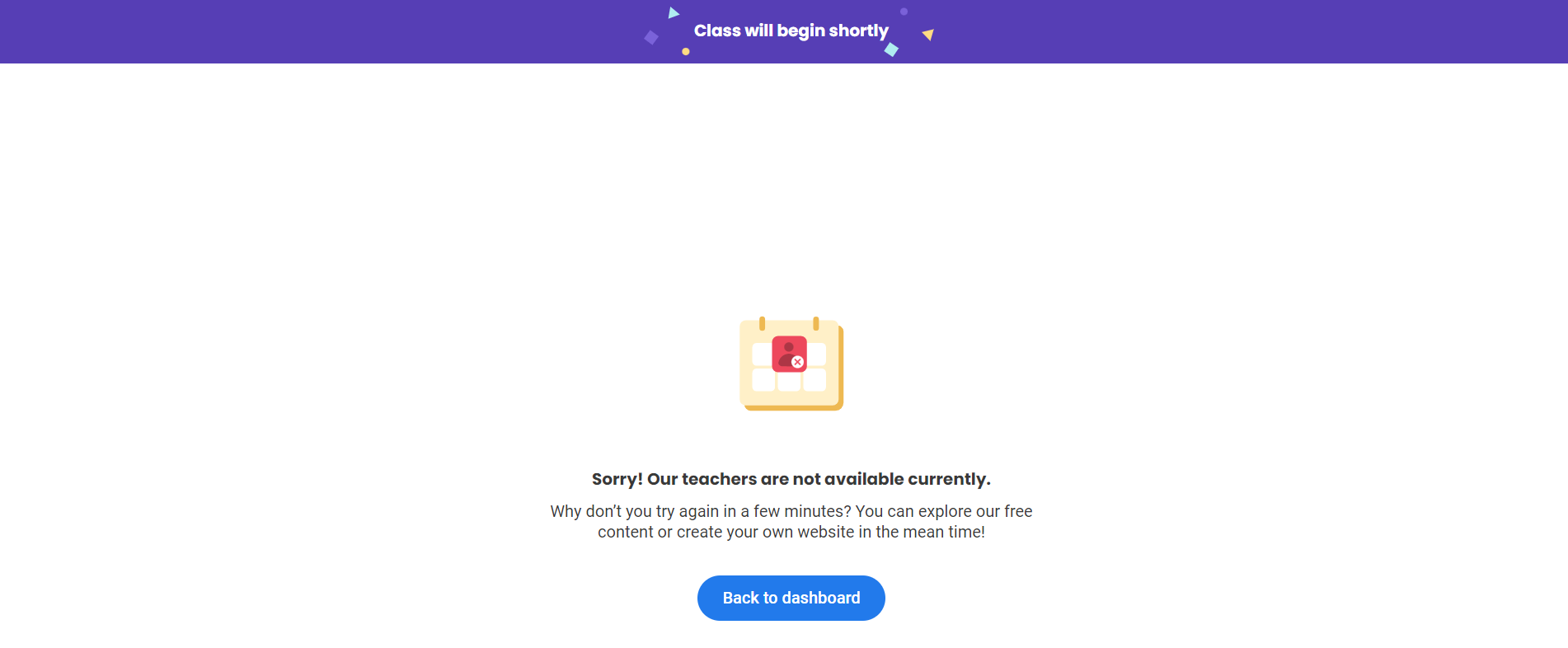

We also tried to book a free class on Lido for February 15, 2022. While the class started with a promotional video, however, no teacher was assigned throughout the session – reinforcing the claims of the company no longer being operational.

According to a few Lido employees, the company has already asked team members to look out for job opportunities.

“People who have gotten better opportunities have resigned, remaining have either put down their papers or are on a sabbatical period,” a current employee told Inc42 on the condition of anonymity.

He added that though their immediate managers are helping them get a job, no such efforts have been shown by the senior management of the company.

“It is easier for CXO level executives to get a job as they have worked so long and have so many connections and referrals. But for people like me, it is starting from scratch,” the employee said.

One of the employees further claimed that Lido was allegedly deducting PF (Provident Fund) amounts from employees’ salaries but hasn’t been depositing the same into the employees’ PF accounts. Inc42 was able to partially verify this claim – Lido had last deposited employee PF in August 2021.

Another employee claimed that Sheth had mentioned that one of the investors had backed out after committing an investment.

A tech team member said that though they had halted their operations for two days after the town hall, and then they resumed it back. The person asking not to be named said initially he was worried, but the management allayed their fears. The employee said that the startup is in talks for bigger funding or a possible merger.

Inc42 has further learnt from multiple social media posts that employees who have parted their way with Lido last year were yet to receive their salaries.

Started in 2019 by Sheth, Lido Learning offers small-group online tutoring to the K-12 segment. It coaches students in subjects including Maths, Science, Coding, and English. The startup claims that its curriculum has been designed by experts from Stanford, Harvard, and IITs. Plus, its classes have just six students in a class, and it uses a combination of AI, an immersive curriculum, and gamification to ensure success for every child.

The startup also claimed its ACE program offered improved test results within just eight months of classes. According to its website, its subscription costs between INR 50K and INR 90K.

Since its launch, Lido Learning has raised close to $24 Mn in funding. It counts BAce Capital, Picus Capital, angel investors such as Anupam Mittal, Mensa Brands’ Ananth Naryanan, and JK Tyres’ MD Vikrampati Singhania, among others, as its investors.

Another Casualty Of Tightened FDI?

It is to be noted that Lido Learning is backed by Chinese investor BAce Capital. In early 2020 the government of India made it mandatory to seek approval for investments from countries that share land borders with India to curb opportunistic takeovers of domestic firms following the COVID-19 pandemic. This means Chinese investors have to seek approval from the Indian government before placing their bet in Indian businesses.

This has led to the exit of several Chinese investors among the Indian startups. One such example is Fosun International, which has sold the majority of its stake from the IPO-bound ixigo to GIC & Invesco. As per media reports, Fosun has already diluted 1.32% of stake from 3.8% stake in IPO-bound Delhivery.

Koo, giving exit to Shunwei Capital, KreditBee giving exit to Shunwei Capital and Xiaomi are more examples. Vijay Shekhar Sharma-led Paytm which went for INR 18,600 Cr had to step down two Chinese representatives of Ant Group – major investor in Paytm – from its board.

Refund Issues Pile Up

Another reason behind the difficulty in running Lido could be attributed to its business model as well as the rising competition in the edtech sector. Nearly $4.7 Bn was raised by edtech startups in 2021, while the top 3-4 players took away the major portion of the funding, still, several growth to early stage startups building similar products or catering to similar audiences had grabbed funding leading to massive competition.

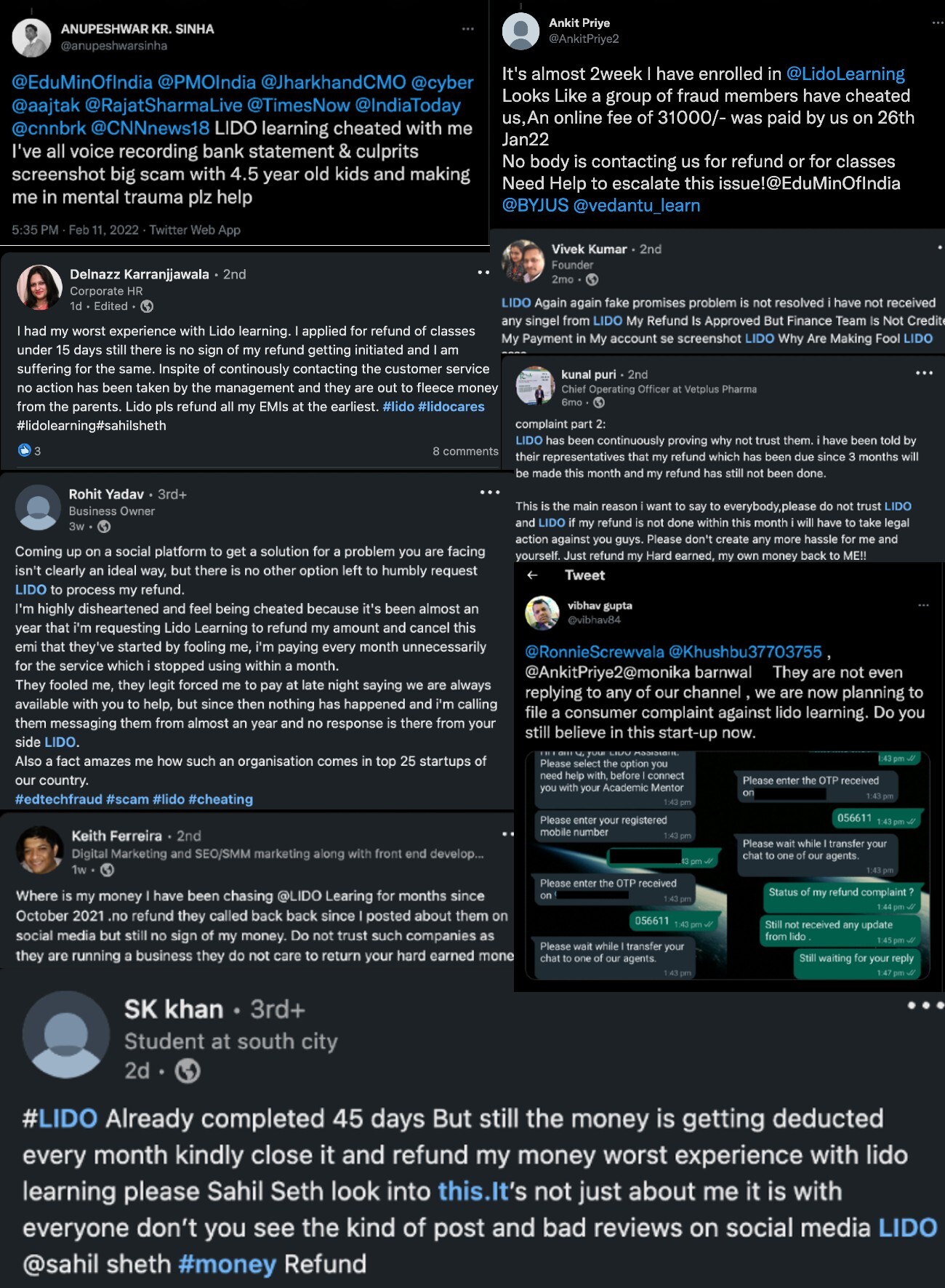

While competition is one part, the problem of refunds has been plaguing edtech startups for quite some time now. In the past too, several companies were called up for refund issues. Lido’s case is not different here. Social media platforms are piling up with grievances of Lido customers seeking refunds.

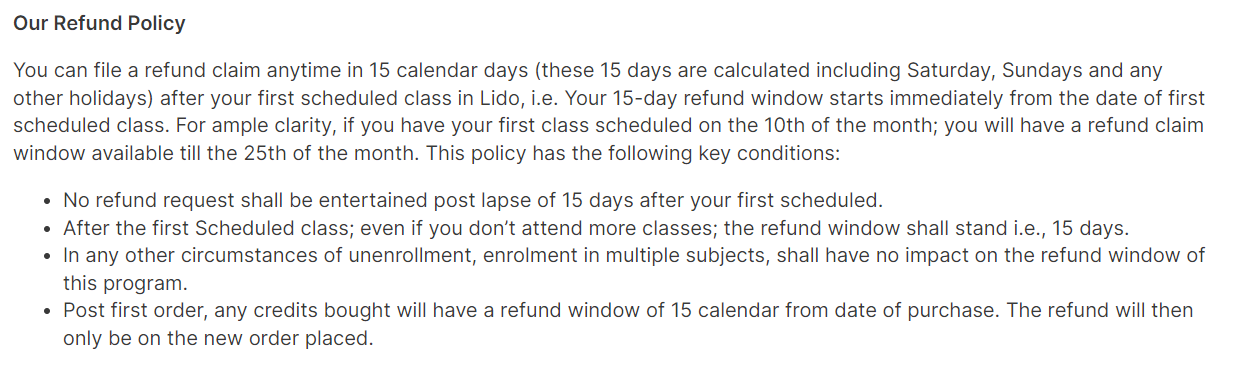

According to its website, Lido Learning claims to offer a complete refund of the course if a student cancels the subscription within 15 days.

People close to the company also informed us that many times, students who receive tablets as part of the course from Lido, fail to return these tablets after cancelling the subscription, thus causing additional expense to the startup.

As per Lido’s regulatory filing, founder Sheth owns 5,36,833 equity shares of a total 5,36,834 equity shares as on March 31, 2021. Sanjay Pankaj Gadiali held one equity share. Further, Ronnie Screwvala held 32.31% share, followed by BAce Capital which held 19.97% in Lido Learning. Paytm founder Vijay Shekhar Sharma’s VSS Investco held 4,529 preference shares, while Nikhil Vora and Mukesh Bansal held 3,397 3,397 preference shares each.

According to RoC filings, Lido Learning posted a revenue of INR 11.3 Cr in FY21, a significant increase from INR 3.7 Cr it posted in FY20. In FY21, the company widened its losses to INR 58.7 Cr, a 34.9% rise from INR 43.5 Cr it witnessed in FY20.

The startup’s expenses in FY21 almost shot by 1.4X, mostly due to the significant rise in employee expenses. It had spent INR 70 Cr, a 47.9% increase from INR 47.3 Cr it incurred in FY20.

If we look at overall numbers, over the two years (FY20 & FY21), the company spent nearly INR 102 Cr, and the total funding raised during that time stood at around INR 111 Cr. ($14.8 Mn). While, the $10 Mn funding which it raised in FY22 helped it stay afloat for some time, however, lack of investor interest in the venture and an inability to secure further funding, could have made it difficult for the company to sustain itself financially.

At the time of its last fundraise in September 2021, Lido had also announced its international expansion plans, which included the UK, Australia, New Zealand and South East Asia in early 2022, in addition to its existing Middle-Eastern, American, and Canadian operations.

Inc42 had tried to reach out to Sheth via calls and a text message. The story will be updated to include his statement.

![Read more about the article [Jobs Roundup] With Snapdeal eyeing a $400M IPO, here’s how you can land a role at the ecommerce firm](https://blog.digitalsevaa.com/wp-content/uploads/2021/09/Imagemumc1572344228547jpg-300x150.png)