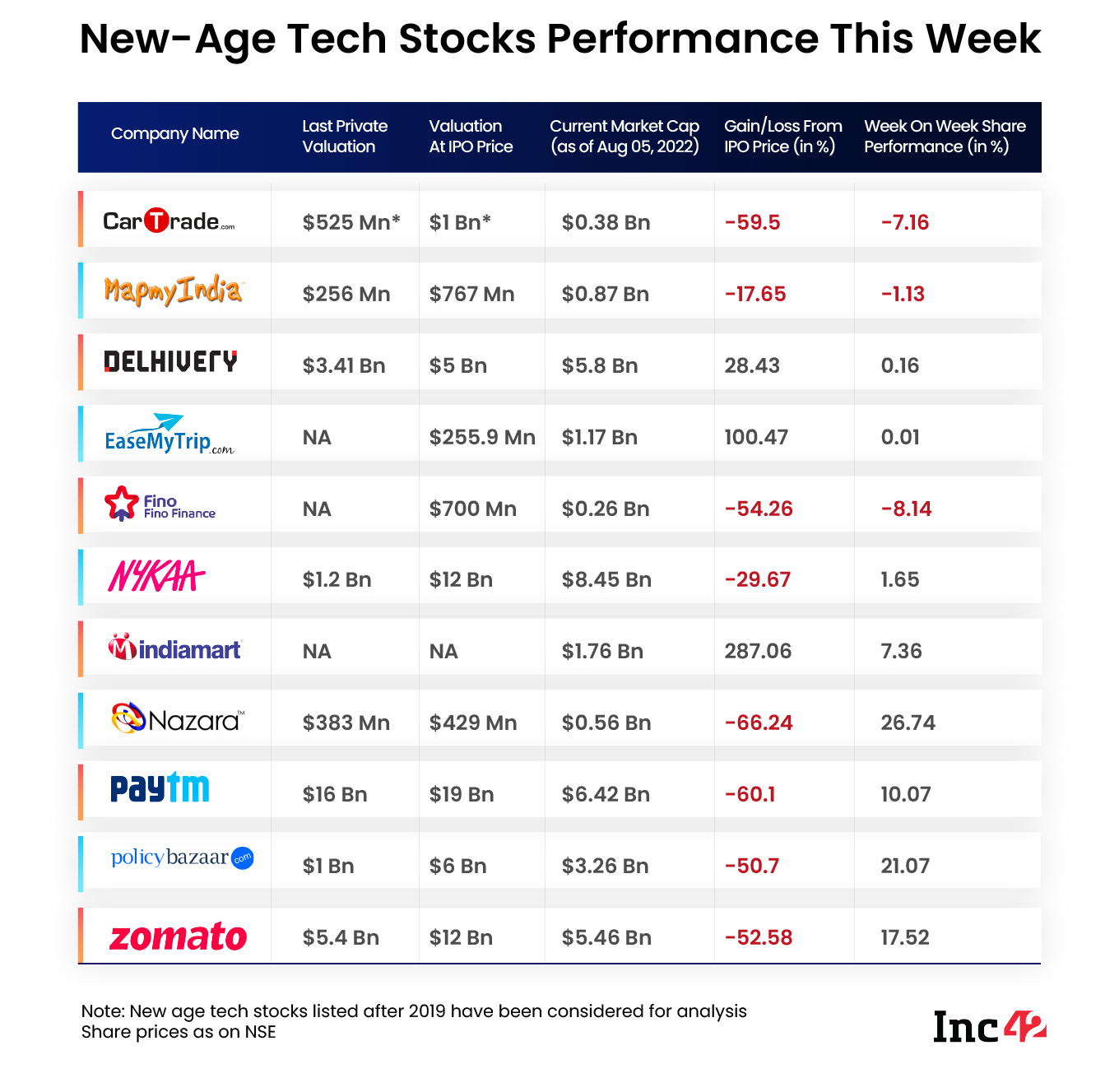

Zomato, Nazara Technologies and Paytm were among the best performing new-age tech stocks this week

Fino Payments and CarTrade were two of the biggest losers among the new-age tech stocks, both ending nearly 7% lower this week

The benchmark indices NSE Nifty50 and BSE Sensex ended the week about 1.4% higher from the previous week

After a rally of two weeks, the Indian stock market saw a relatively subdued performance this week, but still managed to close in positive territory.

From the release of financial results of companies to the Reserve Bank of India’s (RBI’s) repo rate hike and the beginning of a geopolitical conflict between China and Taiwan, a large number of factors seemed to have kept the investors a bit cautious during the week.

Despite this, the benchmark indices NSE Nifty50 and BSE Sensex ended the week about 1.4% higher at 17,397.50 and 58,387.93, respectively. The indices closed 0.9% and 0.1% higher on Friday from Thursday’s close.

Some of the major names among the Indian new-age tech startups – Zomato, Paytm, and Nykaa – reported their Q1 FY23 results this week.

Among the new-age internet tech stocks, Zomato, Nazara Technologies and Paytm parent One 97 Communications were among the best-performing stocks, ending the week 16.3%, 27.2%, and 16.1% higher, respectively, on the BSE.

Both Zomato and Nazara touched their upper circuits during the week after reporting strong Q1 FY23 results.

Meanwhile, Fino Payments and CarTrade were two of the biggest losers among the new-age tech stocks, both ending nearly 7% lower this week.

Let’s take a look at the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem and their key trends:

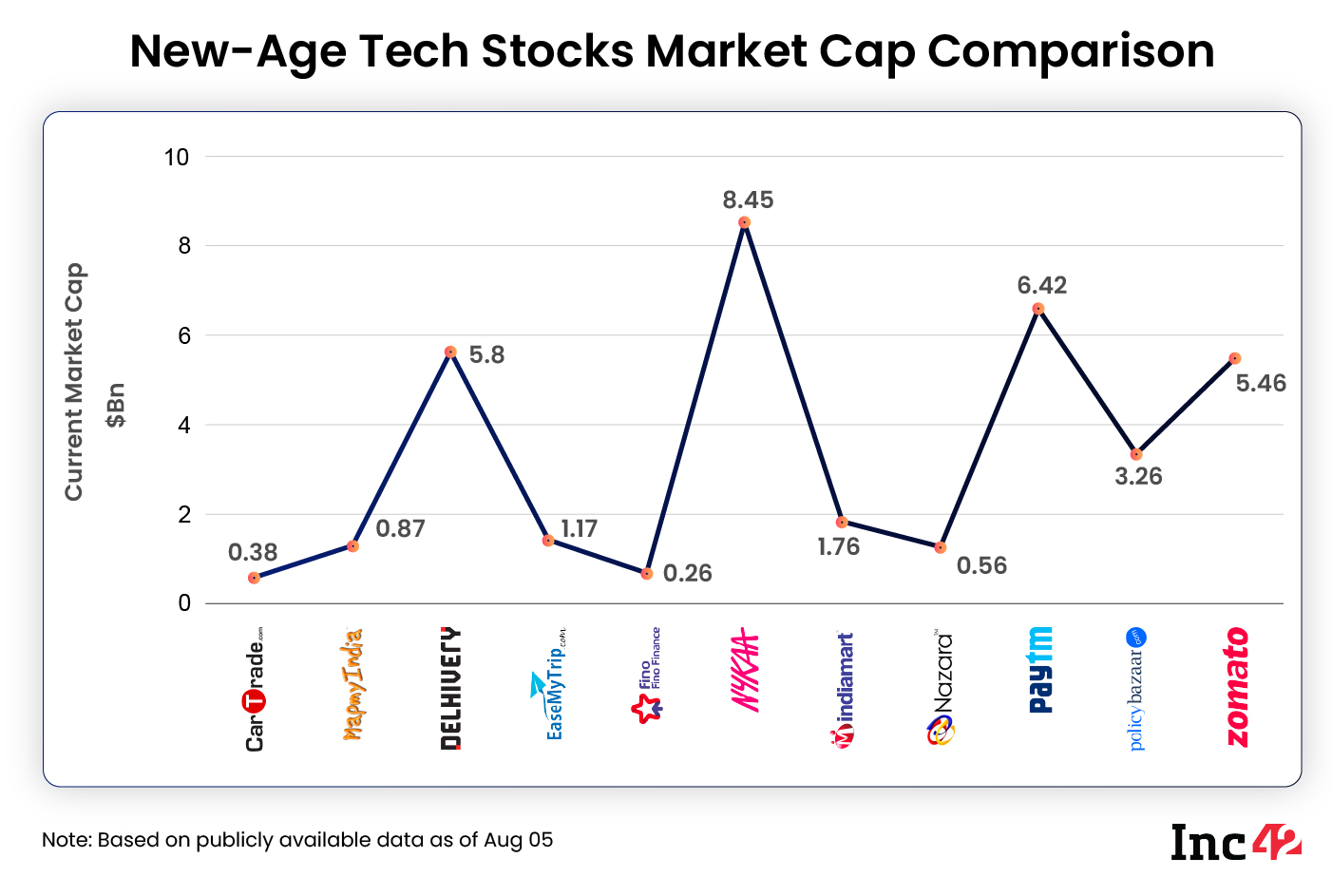

The 11 new-age tech stocks ended the week with a combined market cap of around $34.39 Bn, up from $31.89 Bn last week.

Zomato Bounces Back

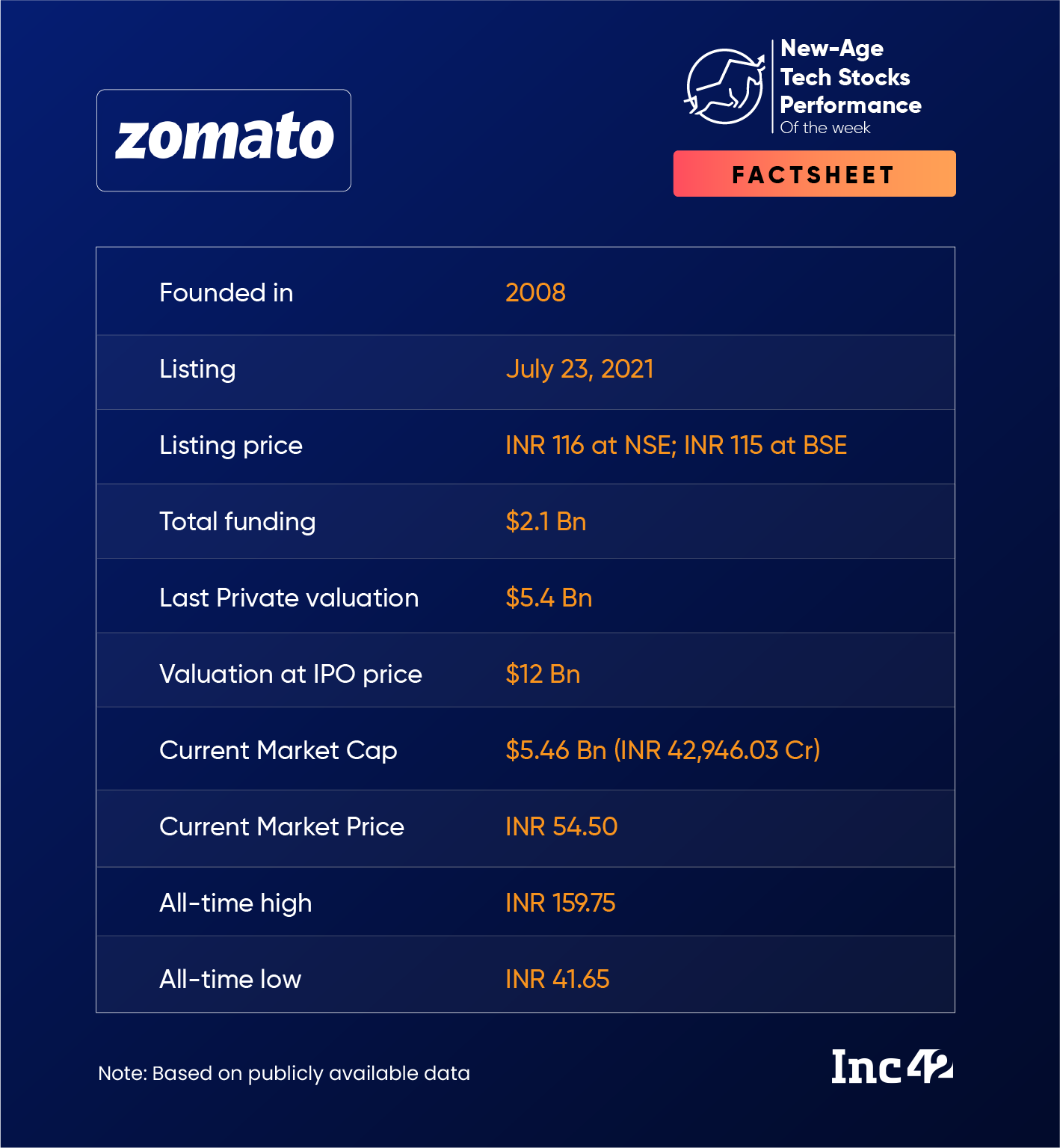

After hitting its all-time low of INR 41.65 last week, Zomato saw a good response from the investors in the stock market this week followed by its June quarter results for FY23.

The foodtech startup not only reported narrowing of its loss in the quarter, but also said that its food delivery business achieved a break-even at an adjusted EBITDA level in Q1.

Despite the negative response Zomato had received following its Blinkit acquisition announcement in June, the results seem to have re-energised investors as its shares hit the upper circuit of 20% of INR 55.6 on the day after the announcement of the financial results.

However, Zomato shares shed some of their gains later in the week to close Friday’s session 5.6% lower from Thursday’s close at INR 54.5 on the BSE.

It is also pertinent to note that the startup is under a lot of scrutiny, with questions being asked about its disclosures and conflict of interest in some of the acquisition deals. Reports about a possible new name for its parent brand and move to have multiple-CEO structure have led the startup to issue clarification on the exchanges, with markets regulators Securities and Exchange Board of India (SEBI) also reportedly asking the startup to respond to the reports.

Meanwhile, some large investors including Uber and Tiger Global sold their stake in Zomato this week.

“The stock will remain in limelight for the coming week or so but the upside will be limited because the overall structure is bearish,” said Mehul Kothari, AVP of technical research at Anand Rathi.

Rathi said he doesn’t expect the stock to go beyond INR 62 or INR 65-odd levels in the coming week. On the downside, support is seen at INR 45, he said.

Paytm Up Over 16% This Week

Paytm has been one of the major laggards in the Indian stock market among the new-age tech stocks since its IPO in November last year. However, Paytm shares have been on an upward trend since June-end.

Partly driven by the positive commentary about its business performance, Paytm shares witnessed a steep northward journey despite a few low sessions in between.

The shares closed the week 16% higher on the BSE, settling at INR 783.65 on the BSE.

There is a technical breakout in Paytm and there is a possibility of further upside in the stock from its current level, said Kothari.

Paytm reported its Q1 results after market hours on Friday. While its loss widened 69% to INR 645.4 Cr on a year-on-year (YoY) basis, it declined over 15% on a quarter-on-quarter (QoQ) basis.

Besides, on EBIDTA level (before ESOP cost), Paytm’s loss narrowed 17% YoY to INR 275 Cr during the quarter. Its operating revenue also jumped 89% YoY to INR 1,680 Cr in Q1.

The results were largely in line with the expectations of several brokerages. Goldman Sachs had earlier estimated that this would be Paytm’s third consecutive quarter of reporting 90% growth in YOY operating revenue, with adjusted EBITDA loss narrowing 13% QoQ. The international brokerage also maintained its ‘buy’ rating.

Domestic brokerage Dolat Capital had also shown confidence in Paytm’s path to profitability with a ‘buy’ rating on the stock.

“One can go long in this stock may be somewhere near 760-odd levels. On the upside, there is a possibility of 850 to 860 levels,” added Kothari.

Founded by Vijay Shekhar Sharma in 2010, Paytm went for an IPO in November last year. Its shares listed at INR 1,950 on the NSE and INR 1,955 on the BSE, at a discount of about 10% on the issue price. Currently, the shares are trading about 60% lower than their debut price.

Nykaa’s Meek Performance

Shares of FSN E-commerce, the parent of Nykaa, remained ranged-bound this week. Its shares ended 1.14% higher on a weekly basis on the BSE at INR 1,412.60 on Friday.

The beauty ecommerce platform reported strong numbers for Q1 FY23 after market hours on Friday. Nykaa’s consolidated net profit jumped 42% YoY to INR 5 Cr, while operating revenue also increased 41% YoY to INR 1,148.4 Cr.

Nykaa said its beauty vertical, both online and offline, continues to witness growth momentum despite the inflationary pressures.

Falguni Nayar-led Nykaa made a stellar debut on the exchanges in November last year. The shares got listed at INR 2,018 on the NSE, a premium of 80% over the issue price of INR 1,125. On the BSE, the shares listed at INR 2,001 apiece.

Currently, the shares are trading over 29% lower on the BSE in comparison to their debut orice with a significant drop witnessed in May.

As per Kothari, Nykaa shares are in a consolidation phase in the INR 1,350-INR 1,500 range. There will be limited upside and downside to the stock unless there is a major breakout or breakdown, he added.