Earlier this month, Netflix senior management sat down to discuss the financial performance of the OTT video streaming giant for the fourth quarter of 2021 and, surprisingly, the management had a lot to say, especially about the Indian market.

The company has allegedly entered ‘difficult’ newer markets like Japan and Brazil, and “got the flywheel spinning,” adding to this, Netflix co-CEO and cofounder Reed Hastings said, “The thing that frustrates us is why haven’t we been successful in India. But we are definitely leaning in there.”

The statement sparked off a debate back home with many pondering over what is going wrong with the OTT player. A report by consultancy firm, Accenture, says that Indians want OTT platforms to do more to serve their entertainment needs.

The global survey has highlighted the struggles faced by viewers to find the right content on these platforms. One of the biggest takeaways of the report is that 60% of Indian users found the paid content on streaming services as being “irrelevant.”

Add to that, many users want better personalisation when it comes to recommendations. With regards to India, as many as 69% of the consumers consider the process of navigating among different media services as ‘frustrating.’

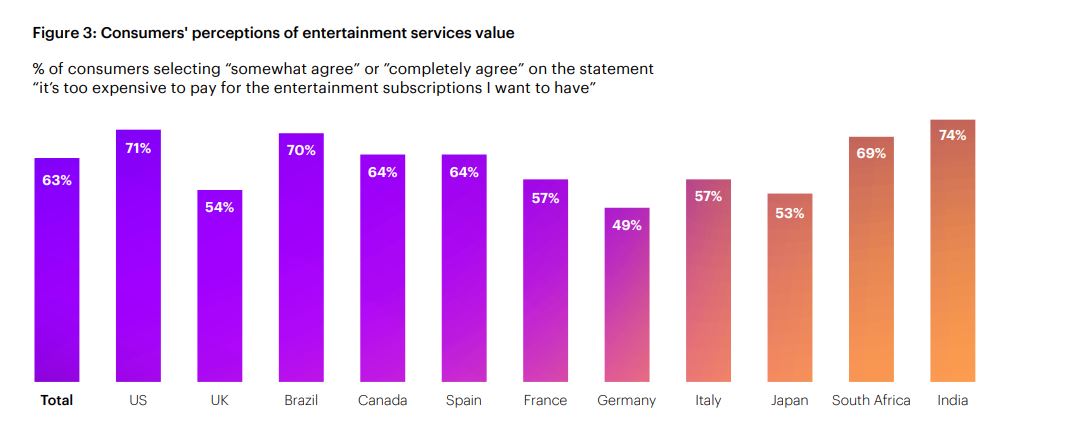

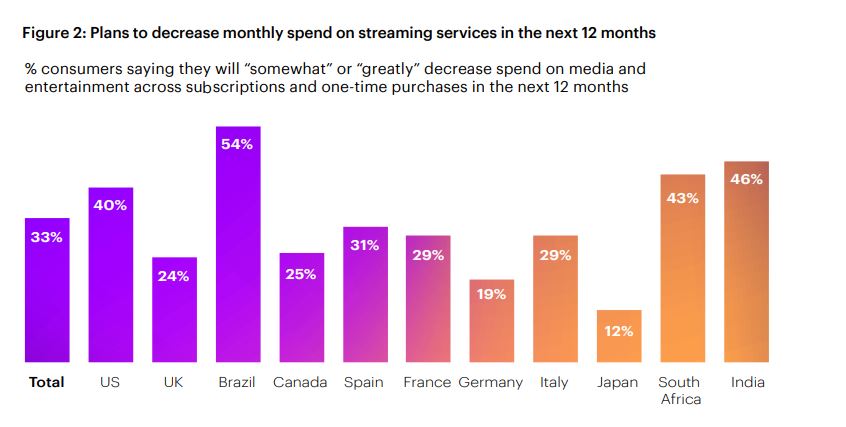

According to the report, as much as 74% of the Indian subscribers are convinced that the content they are paying for is too expensive. Add to that, 46% of the Indian consumers plan on decreasing their spending on media and entertainment over the coming 1 year.

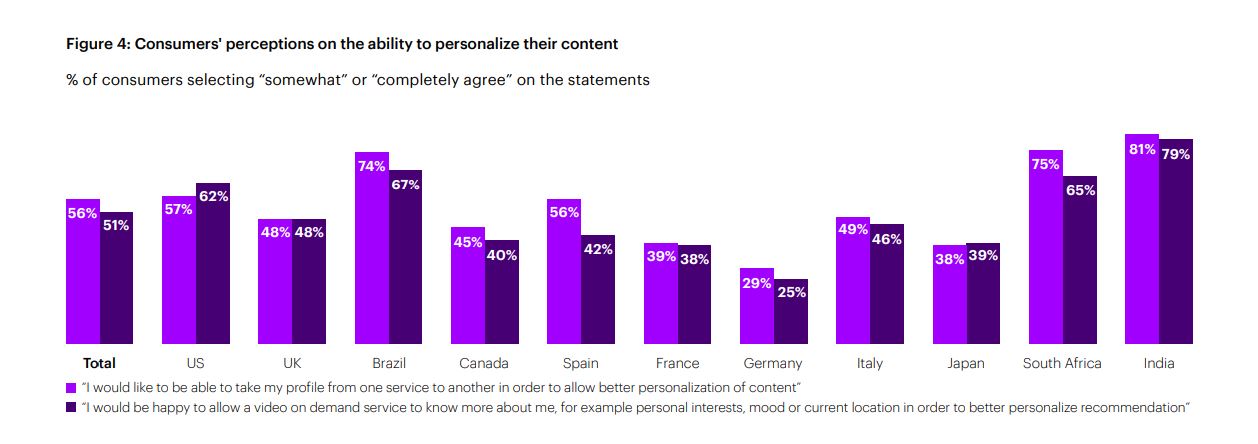

One of the biggest issues highlighted by the IT firm, in its report, pertains to algorithms that remain scattered across multiple providers. With multiple watch histories across different platforms, OTT platforms often generate incomplete recommendations. This leads to irrelevant recommendations and less personalisation of the user’s viewing habits

The report says that as many as 81% of Indian viewers were willing to change platforms to allow “better personalisation of content.” In addition to this, as much as 79% of Indian users were willing to share personal data to “better personalize their recommendations.”

The report also predicts that focusing on subscriber count was an erring strategy for OTT platforms. Rather, the report points out that streaming services need to ensure that customers are able to easily navigate across content rabbit holes. According to Accenture, OTT platforms need to unify consumer experience through APIs and data-sharing agreements to create seamless access across streaming services.

Accenture India’s Managing Director for Communications, Media and Technology practice, Saurabh Kumar Sahu said,“As the video streaming segment has matured, consumers are increasingly finding the experience to be complicated, expensive and hard to use. Evolving consumer preferences and tough economics will create challenges for video streaming platforms.”

He also added that the ecosystem needs a “major reset and the consumers will need greater control over their viewing experience.”.

The report was based on an online survey of 6,000 streaming users in 11 countries, including 500 users from India.

India’s OTT revenue hovered around $1.9 Bn in 2021 and is expected to grow to $4.5 Bn by 2026. A report by Media Partners Asia notes that advertising video-on-demand (AVOD) will continue to pull in more revenue than subscription video-on-demand (SVOD) in India. The AVOD market is expected to grow to $2.4 Bn by 2026 while the SVOD segment will rise to $2.1 Bn in revenue by 2026.

In terms of market share, Netflix leads the pack with 29% of the market followed by Disney+Hotstar which slightly lags behind with 25% of shareholding. Another contender, Prime Video also comes a close third with 22% market share.

The report is right in pointing out that focussing merely on increasing subscriber count won’t work and the streaming services need to sit down and re-evaluate the strategy. The OTT players need to find a common ground and provide better services to their users, otherwise it may eventually hurt their bottom-line in the coming days.

The post Majority Of Indian Viewers Find Content on OTT Platforms Irrelevant: Report appeared first on Inc42 Media.