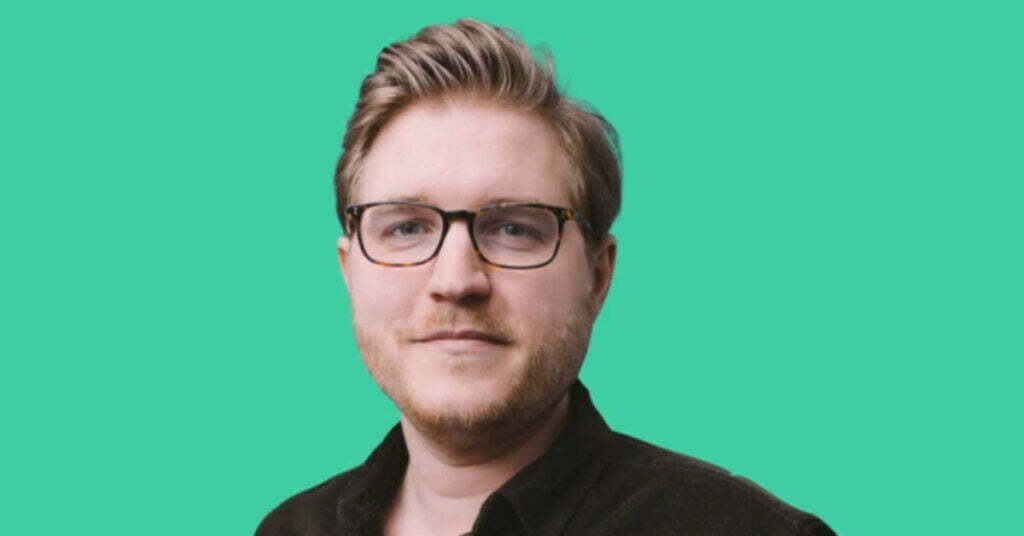

Peter Carlsson, CEO & co-founder | Image credit: Northvolt

2021 has been a great year for European tech. As the year comes to an end, it has become evident that a new record has been set in the amount raised by startups founded in Europe. Atomico’s annual State of European Tech 2021 report suggests that European tech is on track to reach $100B (approx €88.41B) invested in a single year.

Tom Wehmeier, Partner at Atomico and co-author of the report, says, “Europe is undergoing a technological revolution with profound effects across economies, societies, and the environment, driven by two irreversible trends: one, which is not unique to Europe, is the relentless march of technology.”

Get to know the amazing finalists here

“The other is what we call the European tech flywheel – a set of incredibly strong foundations including a deep talent pipeline, exceptionally strong founding teams, and a healthy pool of investors at all levels — that spins out unicorns and creates value at ever-increasing frequency and magnitude,” adds Wehmeier.

To look closer at European startups with massive amounts of funding this year, we’ve compiled a list of 21 startups that have raised the largest rounds. Certain details of these startups such as founders’ names, founding year, and the total funding raised, have been sourced from Dealroom.

Northvolt

Founder(s): Paolo Cerruti, Peter Carlsson

Founded in: 2016

Largest funding: $2.75B (approx €2.27B)

Sweden-based Northvolt is a supplier of sustainable, high-quality battery cells and systems. It offers lithium-ion cells based around proprietary Lingonberry NMC chemistry available in cylindrical and prismatic formats. Its product is an environment-friendly battery manufactured with minimal carbon footprint and with recycling technology, enabling the auto industry to replace fossil fuels with electricity in an efficient manner.

In June 2021, Northvolt announced the signing of a $2.75B (approx €2.27B) private placement to finance. A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. The round was co-led by new investors AP funds 1-4, via the co-owned company, 4 to 1 Investments; and OMERS, Ontario Municipal Employees Retirement System is a Canadian pension fund.

Check out their vacancies here.

Cinch

Founder(s): –

Founded in: 2020

Largest funding: £1B (approx €1.16B)

Cinch is an online B2C marketplace for used cars in the UK. The company, with a customer base of 30 million visitors a year, helps its users to part exchange their car and buy or finance quality-checked used cars online as well as delivers them to their home. Besides, the platform not only sells cars it owns but also provides a fully integrated digital marketplace for its partners such as dealers, car manufacturers, or leasing companies to reach new consumers and sell their cars directly to them online.

In May 2021, Constellation Automotive Group, the owner of Cinch raised a whopping £1B (approx €1.16B) in private capital. The company raised the funds from a group of global institutional investors, including a wholly-owned subsidiary of the Abu Dhabi Investment Authority (ADIA), GIC, Neuberger Berman client funds, and funds advised by Soros Fund Management.

Cinch is currently hiring. Click here to apply.

Just Eat Takeaway

Founder(s): Jitse Groen

Founded in: 2000

Largest funding: €1.1B

Amsterdam, Netherlands-based Just Eat Takeaway claims to be one of the largest online food delivery marketplaces outside China. It is focused on connecting consumers and restaurants through its platforms. The company mainly collaborates with delivery restaurants. Additionally, it also provides its proprietary ‘restaurant delivery services’ to restaurants that do not deliver themselves.

In February 2021, Just Eat Takeaway raised €1.1B through an offering of convertible bonds. According to the company, it has placed €1.1B of convertible bonds, consisting of two tranches (“Tranche A” and “Tranche B”). With an aggregate principal amount of €600M, Tranche A – upsized from €500M – is due August 2025. Whereas, Tranche B, with an aggregate principal amount of €500 M, is due February 2028.

The company is currently hiring for various roles, check them out here.

Grover

Founder(s): Michael Cassau

Founded in: 2015

Largest funding: $1B+

Germany-based Grover aims to create an innovative way for everyone – both private customers and businesses – to get the tech they want. In order to provide that, the company enables people and businesses to rent technology on a monthly basis. Grover claims its rental model is sustainable and circulates tech products so that they’re used for a longer period instead of being stored away in drawers.

In July 2021, the company secured over $1B (approx €846.34M) in equity and asset-backed funding to democratise access to tech. The round was made up of a $1B asset-backed facility from London-based Fasanara Capital, and an extension of its Series B funding round from $71M to $100M.

The company is looking to increase its workforce and has various job openings. Check them out here.

Sinch

Founder(s): Henrik Sandell, Johan Hedberg, Kjell Arvidsson, Kristian Männik, Robert Gerstmann

Founded in: 2008

Largest funding: $1.1B

Sweden-based Sinch offers a cloud communications platform that lets businesses reach every mobile phone on the planet, in seconds or less, through mobile messaging, voice, and video.

Earlier in May 2021, the platform raised SEK 9.4B (approx €929M/$1.1B) from investors including Temasek and SoftBank Management. The Swedish company directed the issue of 7,232,077 new shares at SEK 1,300 per share. Currently, Sinch is looking to increase its workforce, check out their openings here.

Gorillas

Founder(s): Kağan Sümer

Founded in: 2020

Largest funding: $1B (approx €858.4M)

Germany-based Gorillas is a grocery delivery startup that claims to deliver goods to its customers’ doorstep in just 10 minutes. The platform has access to more than 2000 essential items at retail prices for a delivery fee of just over €1.80. Within the last year, Gorillas has developed a strong international footprint, operating in nine countries, 55 cities, and employing more than 11,000 people.

The company provides all riders with fixed employment contracts, health insurance, employer-financed accident insurance, and paid vacation. Currently, their app is available in Germany, France, Italy, the US, Spain, the Netherlands, Belgium, the UK, and Denmark.

In October 2021, the grocery delivery startup secured close to $1B (approx €858.4M) in its Series C round of funding. The round was led by Delivery Hero. Existing investors Coatue Management, DST Global, Tencent, Atlantic Food Labs, Fifth Wall, Greenoaks, and A also invested in the round. Currently, Gorillas is hiring. You can check open positions here.

Celonis

Founder(s): Alexander Rinke, Bastian Nominacher, Martin Klenk

Founded in: 2011

Largest funding: $1B (approx €882.8M)

Germany-based Celonis believes that every company can unlock its full execution capacity. And to achieve that, Celonis offers an Execution Management System (EMS) that can help companies in running their business processes entirely on data and intelligence. It offers services from analytics to strategy and planning, management, actions and automation. Some of its clients include AstraZeneca, Bosch, Coca-Cola, Citibank, Dell, GSK, L’Oreal, Uber, Vodafone, and Whirlpool, among others.

In June 2021, Celonis announced $1B in its Series D round. In addition, Carlos Kirjner, a technology industry veteran and former top-ranked Wall Street analyst, joined as Chief Financial Officer from Google, where he led finance for its flagship advertising business and key product areas.

Currently, the company is hiring for different roles, check out the vacancies here.

Klarna

Founder(s): Sebastian Siemiatkowski, Niklas Adalberth, Victor Jacobsson

Founded in: 2005

Largest funding: $639M (approx €524.4M)

Sweden-based Klarna is an e-commerce payment solutions platform for merchants and shoppers. It gives customers the freedom to choose how and when to pay. The company has over 250,000 global retail partners, including H&M, Saks, Sephora, Macys, IKEA, Expedia Group, Samsung, ASOS, Peloton, Ralph Lauren, Abercrombie & Fitch, Nike, and Shein. It operates in 17 countries and has over 4,000 employees. According to the company’s website, Klarna has a total of 90 million active consumers who transact around $2 million per day.

In June 2021, the Swedish fintech giant confirmed an equity funding of $639M (approx €524.4M) led by SoftBank’s Vision Fund 2, with additional participation from existing investors Adit Ventures, Honeycomb Asset Management and WestCap Group. Currently, the company is hiring for different positions. Check the vacancies here.

N26 Group

Founder(s): Valentin Stalf, Maximilian Tayenthal

Founded in: 2013 (launched initially in early 2015)

Largest funding: €775M+

Germany-based N26 Group is a digital bank for consumers and businesses. Its services include deposit accounts, money transfers, bill payments, NFC-enabled debit cards for online/offline purchases, and cash withdrawal, among others. The platform also offers tools for transaction monitoring. Currently, N26 has more than 7 million customers in 25 markets.

In October 2021, N26 announced funding of $900+M (approx €775.57+M) in its Series E round. The round was led by New York-based tech investors Third Point Ventures and Coatue Management, along with Dragoneer Investment Group. N26’s existing investors also participated in the round. Check out the open positions here.

Mollie

Founder(s): Adrian Mol

Founded in: 2004

Largest funding: $800M (approx €672M)

Amsterdam, Netherlands-based Mollie is a payments platform that offers an easy-to-implement process for integrating payments into a site or app. With a payments-API, the company offers multiple payment methods uniformly. It claims that its mission is to make online payment simple for merchants by taking away the complexity from payment methods and offering a simple, but powerful API.

Currently, the platform processes payments for more than 125,000 clients with local payment methods such as Mastercard, VISA, Amex, PayPal, iDEAL, Bancontact, Bitcoin, SEPA Direct Debit, Cartes Bancaires, ESP, Giropay, SOFORT Banking, and more.

In June 2021, Mollie secured $800M (approx €672M) in a Series C funding led by Blackstone Growth (BXG), Blackstone’s growth equity investing business. Other investors including, EQT Growth, General Atlantic, HMI Capital, TCV, and Alkeon Capital, also participated.

The company is looking for ‘inquisitive minds’ with good ideas and a passion for helping Mollie grow.

Revolut

Founder(s): Nikolay Storonsky, Vladyslav Yatsenko

Founded in: 2015

Largest funding: $800M (approx €677M)

London-based fintech company Revolut specialises in mobile banking, card payments, money remittance, and foreign exchange. It includes a prepaid debit card, currency exchange, and peer-to-peer payments.

Revolut helps customers show how much they are spending each month on things like restaurants and groceries, and can set monthly spending budgets for these categories and manage fees for subscription services, send and request money from friends instantly, and round-up their card payments and build-up their spare change.

One of Revolut’s key features includes conversion from one currency to another based on interbank rates with no fee. Customers can hold foreign currencies in their accounts or send money to another Revolut user or a bank account outside of their country.

In July 2021, the fintech company raised a massive $800M (approx €677M) in its Series E round of funding. The investment saw participation from two new investors, SoftBank Vision Fund 2 and Tiger Global Management.

Revolut is currently hiring, you can check the vacancies here.

MessageBird

Founder(s): Adriaan Mol and Robert Vis

Founded in: 2011

Largest funding: $1B (approx €828.3M)

Amsterdam, Netherlands-based MessageBird powers communications between enterprises and their global customers – across any channel like SMS, voice, WhatsApp, WeChat, Messenger, e-mail and more.

The company’s product line also includes a Chat Widget and Flow Builder. The Chat Widget helps convert static pages into dynamic conversations. The Flow Builder is an RPA (Robotic Process Automation) platform that enables auto-replies creation and message routing. These services are also available via an API or an Application Programming Interface for easier integration with different platforms.

Earlier this year, MessageBird launched Inbox.ai, which enables customers to communicate with businesses practically through any channel of their choosing. Check out the open positions here.

In April, the company extended its Series C and raised $1B (approx €828.3M). This capital was raised by Eurazeo, Tiger Global, Owl Rock, and funds and accounts managed by BlackRock. In addition, all existing investors also participated in this round.

SumUp

Founder(s): Daniel Klein, Jan Deepen, Marc-Alexander Christ, Petter Made, Stefan Jeschonnek

Founded in: 2011

Largest funding: €750M

UK-based SumUp is a fintech company that allows businesses of all sizes to receive payments quickly and simply, both in-store and online. The London-based company supports over 3M merchants globally and operates in 34 markets across Europe, the US, Brazil, and Chile.

In March 2021, the company raised a €750m facility from Goldman Sachs, Temasek, Bain Capital Credit, Crestline, and funds managed by Oaktree Capital Management, LP. SumUp looks to accelerate its growth and continue to acquire and support its existing merchants in 33 markets across the world. Currently, SumUp is looking to hire fresh talents. You can apply here.

Trade Republic

Founder(s): Christian Hecker, Marco Cancellieri, Thomas Pischke

Founded in: 2015

Largest funding: $900M (approx €736.8M)

Germany-based Trade Republic is a mobile-only and commission-free broker that brings the opportunity to invest easily. It offers an ETF or fractional stock savings plan, which allows people to invest free of charge on a regular basis. With a team of over 400 employees, the company claims that it is Germany’s largest provider for these long-term investment strategies.

Earlier in April 2021, Trade Republic launched commission-free trading in cryptocurrencies so that people can adjust their portfolio to reflect inflation and negative interest rates.

In May 2021, the company raised $900M (approx €736.8M) in its Series C round of funding led by Sequoia Capital. The round also saw investment from new investors including TCV, as well as by Thrive Capital. In addition, existing investors Accel, Peter Thiel’s Founders Fund, Creandum, and Project A also invested in this round.

Trade Republic is hiring right now! Check out the vacancies here.

IONITY

Founder(s): –

Founded in: 2017

Largest funding: €700M

Germany-based IONITY is a joint venture between BMW Group, Ford Motor Company, Hyundai Motor Group with KIA, Mercedes-Benz AG, and Volkswagen Group with Audi and Porsche. The company builds and operates a High Power Charging (HPC) network along Europe’s highways with a charging capacity of up to 350 kW. Every IONITY charging station consists of an average of four charging points.

In November 2021, IONITY raised €700M in a fresh round of funding from new investor BlackRock Global Renewable Power and other existing investors. The company is looking to hire fresh talents right now, you can apply here.

Flink

Founder(s): Oliver Merkel, Julian Dames, Christoph Cordes

Founded in: 2020

Largest funding: $750M (approx €664M)

Germany-based Flink is an online startup that offers grocery deliveries in under ten minutes. It offers around 2400 items such as fresh herbs, fruits, bread, essentials, and home supplies to customers through Flink riders. The company supports local products, uses sustainable packaging, and delivers on e-bikes. Currently, Flink has more than 140 hubs in 60 cities across four countries, covering up to 10M customers. Germany and the Netherlands are its largest markets. The company is currently hiring for different positions. You can apply here.

In December 2021, Flink raised $750M (approx €664M) in Series B round of funding at a valuation of $2.85B (approx €2.52B). The round was led by DoorDash with participation from Mubadala Capital.

Sorare

Founder(s): Nicolas Julia, Adrien Montfort

Founded in: 2018

Largest funding: $680M (approx €579.5M)

France-based Sorare has been created by football fans for football fans. Through blockchain digital collectibles and its global fantasy football, the company is on a mission to become ‘the game within the game’. Since Sorare cards are NFTs, each card is unique, scarce, and its ownership is publicly verifiable via the Ethereum blockchain. It is a secure and transparent model of digital ownership.

Sorare has over 600,000 registered users on the platform and has licensed players from over 180 football organisations, including Real Madrid, Liverpool, Juventus, and the French and German Football Federation.

In September 2021, the Paris-based company raised $680M (approx €579.5M) in its Series B round of funding. The round was led by Softbank, with participation from Atomico, Bessemer Ventures, D1 Capital, Eurazeo, IVP, and Liontree. Existing investors Benchmark, Accel, and Headline also participated in this round. The round also saw investments from football players Gerard Piqué, Antoine Griezmann, Rio Ferdinand, and César Azpilicueta.

Picnic

Founder(s): Michiel Muller, Frederik Nieuwenhuys, Joris Beckers, Bas Verheijen

Founded in: 2015

Largest funding: €600M

Amsterdam-based Picnic became a household name in the Netherlands and their small electric vans a familiar sight. The company has developed the modern-day milkman, a mass-market home delivery system for fast-moving consumer goods. It offers the same products at the same price as regular supermarkets, but delivers them right at the door of their customers. The products are fresher and cheaper as the company does not own any stores.

Picnic controls the entire supply chain itself and works closely with local suppliers. It also develops its own products with the ‘best’ suppliers in the world. Besides, the company also delivers everything free of charge in 100 per cent electric cars – which have covered more than 1.4 million kilometres to date. The company is currently in hiring process, you can check out their vacancies here.

In September 2021, Picnic raised €600M in its Series D round of funding to accelerate its growth and become the ‘most’ sustainable grocery delivery service in Europe. The round was led by the Bill & Melinda Gates Foundation Trust which holds investments that support the Bill & Melinda Gates Foundation. Existing investors also participated in the round.

Bolt

Founder(s): Markus Villig, Martin Villig, Oliver Leisalu

Founded in: 2013

Largest funding: €600M

Estonia-based Bolt, previously known as Taxify, is a transportation platform providing ride-hailing, micromobility, and food delivery services. The company claims to build the future of logistics – one platform that connects with cars, motorcycles, scooter sharing, or food delivery from restaurants.

The company has more than 75 million users in more than 45+ countries across Europe and Africa. It claims that all Bolt rides in Europe are 100 per cent carbon-neutral as part of its Green Plan, a long-term commitment to reduce the ecological footprint of the company.

In August 2021, Bolt raised €600M in a fresh round of funding, at a valuation of more than €4B. The round saw participation from a range of investors including Sequoia and fund managers Tekne and Ghisallo. Existing investors G Squared, D1 Capital, and Naya also invested in this round.

Currently, the company has more than 900 job openings, check them out here.

Wefox

Founder(s): Julian Teicke, Fabian Wesemann, Dario Fazlic

Founded in: 2015

Largest funding: $650M (approx €531.64M)

Germany-based Wefox is a digital insurance company that claims to be driven by a single purpose: to make people safe and prevent risk by reinventing insurance at scale through technology. According to the company, it is a fully licensed digital insurance company that sells insurance through intermediaries and not directly to customers. Wefox is the parent company of Wefox Insurance – an in-house regulated insurance carrier.

In June 2021, the company raised $650M (approx €531.64M) in its Series C round of funding, at a post-money valuation of $3B (approx €2.45B). The round was led by Target Global. In addition, existing and new investors also participated in this round.

With more than 1200 employees, Wefox currently has over 100 open positions. You can apply here.

Mirakl

Founder(s): Adrien Nussenbaum Philippe Corrot

Founded in: 2011

Largest funding: €473.39M

France-based Mirakl claims to offer the industry’s first and advanced enterprise marketplace SaaS platform, helping organisations across B2B and B2C sectors launch marketplaces faster, grow bigger, and operate with confidence.

In September 2021, the company raised $555M (approx €473.39M) in its Series E round of funding at a valuation of more than $3.5B (approx €2.98B). The round was led by Silver Lake, along with long-term investors 83North, Elaia Partners, Felix Capital, and Permira.

How partnering up with Salesforce helped him succeed!

![Read more about the article [Product Roadmap] UrbanClap to Urban Company](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/PRM-1616488895708-300x150.png)