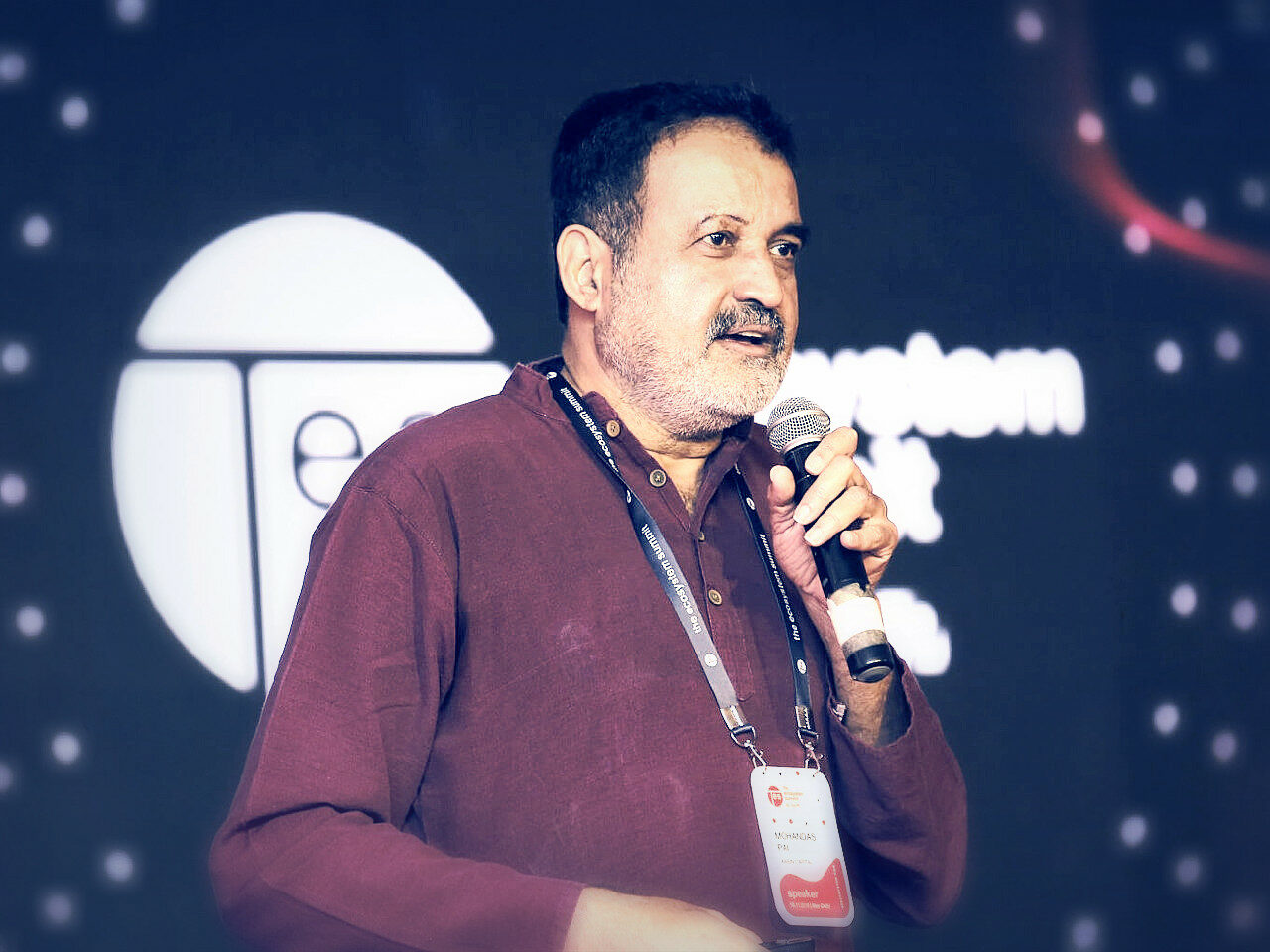

Budget 2022-23 shows some very positive signs of India’s growing economy with revenues going up, massive investment in infrastructure and social investments, said Pai

While capping surcharge on LTCG at 15%, the budget has not reduced the tax rate of 20% to 10% as it is for foreign investors; it’s a discrimination against Indian investors

The edtech plans won’t be fruitful until the government works towards bridging the digital divide, said Pai

Union Budget 2022-23 shows some very positive signs of India’s growing economy with revenues going up, massive investment in infrastructure and social investments. However, when its comes to startups, the budget is not too much except reducing the tax on unlisted stocks and a few other announcements such as a fund with blended capital to finance agritech startups etc., opines TV Mohandas Pai, partner, Aarin Capital.

Inc42: What’s the key takeaway from the Union Budget 2022?

Mohandas Pai: Budget 2022-23 shows some very positive signs of the Indian economy on upswing. This year, the GDP is up from INR 197 Lakh Cr, last year to INR 232 Lakh Cr, an increase of INR 35 Lakh Cr or $466 Bn considering INR 75 per dollar. This is a very impressive figure.

Further, the revised estimate shows revenues at INR 25.16 Lakh Cr against INR 22.17 Lakh Cr in the budget which is INR 3 Lakh Cr more than the budget. This has never happened for the last 25 years.

The budget makes some very interesting points such as increasing spends on infrastructure from INR 5.5 Lakh Cr to INR 7.5 Lakh Cr, an increase of 34.5%. In addition, there is a spending of INR 1 Lakh Cr to be given to the states for a interest-free loan for 50 years, a massive increase from INR 15,000 Cr of the last revised budget.

The focus therefore next year is clearly on building infrastructure and thus roads, railways, ports, etc. that will drive the growth for India in a tremendous way as the backward linkages for infrastructure is very high. The budget also makes sure that the increased social spending on housing, on health, on water and all social programs taken up by the Indian government to make sure every Indian had the necessities of life.

Inc42: How do you see the budget from startup perspective?

Mohandas Pai: As far as startups are concerned, the budget is not too much except reducing the tax on long term capital gains from unlisted stocks. The surcharge on long term capital gains has been capped at 15% as opposed to 37% previously.

But the budget has not reduced the tax rate of 20% to 10% as it is for foreign investors. Today, being an Indian investor, you’re discriminated by your own government very openly.

Out of the $42 Bn of investment in startups, last year, only 10% was Indian capital. To avoid from being a digital colony by 2025, we need to incentivise more Indian capital into startups.

The government has also extended the tax holiday of three out of 10 years for startups to be started by 2022 to 2023. However, that is not of much use because only around 600+ startups out of 62,000 startups have been able to get this benefit due to certain restrictions. Many startups just ignore it because it’s of no use to them.

The industry had also asked for deferment of taxes on ESOPs for unlisted companies. For listed shares, one has the flexibility to sell the stock later at their own will however, in the case of unlisted companies, one simply doesn’t have the flexibility to sell illiquid stocks in the form of ESOPs and he or she will have to be at the mercy of some of the buyers who may or may not buy it and sometimes the ESOP-holders have to borrow money to pay the taxes. This is not being considered by the government.

The government is also planning to set up a separate committee to study difficulties in venture capital and to increase the allocation to thematic funds is a step in the right direction. The government has also made sure that ease of doing business is enhanced, abolishing 25,000 more compliances and repealing over 1486 laws.

Inc42: By announcing 30% tax on income from crypto, has the govt made crypto legal?

Mohandas Pai: The government is very clear about crypto. It will never accept crypto as currency. And, that is why launching a digital currency is right decision. What has been said is that any digital asset of any kind which includes crypto will be taxed at 30%. And any sale will have to have a TDS of 1% to track the people who sell. It is the first step in making sure that crypto trading becomes legal.

Inc42: In edtech, the FM has announced plans to go digital in a big way. Does it meet the gap?

Mohandas Pai: No, the government has not taken adequate steps to tackle the digital divide. Increasing TV programmes to 200 channels from some 20 channels today is not going to make much of a difference.

Because at home, if a TV is there, it is mostly used for entertainment purpose rather than for the education. The government would have been better off by saying that all children above class six would be given a digital tablet with adequate free-loaded software. It would have helped immensely to bridge the existing digital divide across the country.

Further, the idea of the university to create content with hub and spoke model will have limited utility. Because in the higher education, the challenge is not the content but the digital divide. There is enormous amount of content available. Children studying in government schools do not have any digital device with free-loaded software which could help them learn through elearning courses.

Inc42: How Adequate Is Healthcare Allocation?

Mohandas Pai: Healthcare budget can be enhanced by the government, but the government should be able to spend the money. The large part of the healthcare Budget for 2021-22 was for the vaccination. This will be very less, next year. The government is building infrastructure for health care by increasing allocation to Ayushman Bharat, etc.

So, I think the government has done a reasonable job of making an appropriate allocation for healthcare and for water.