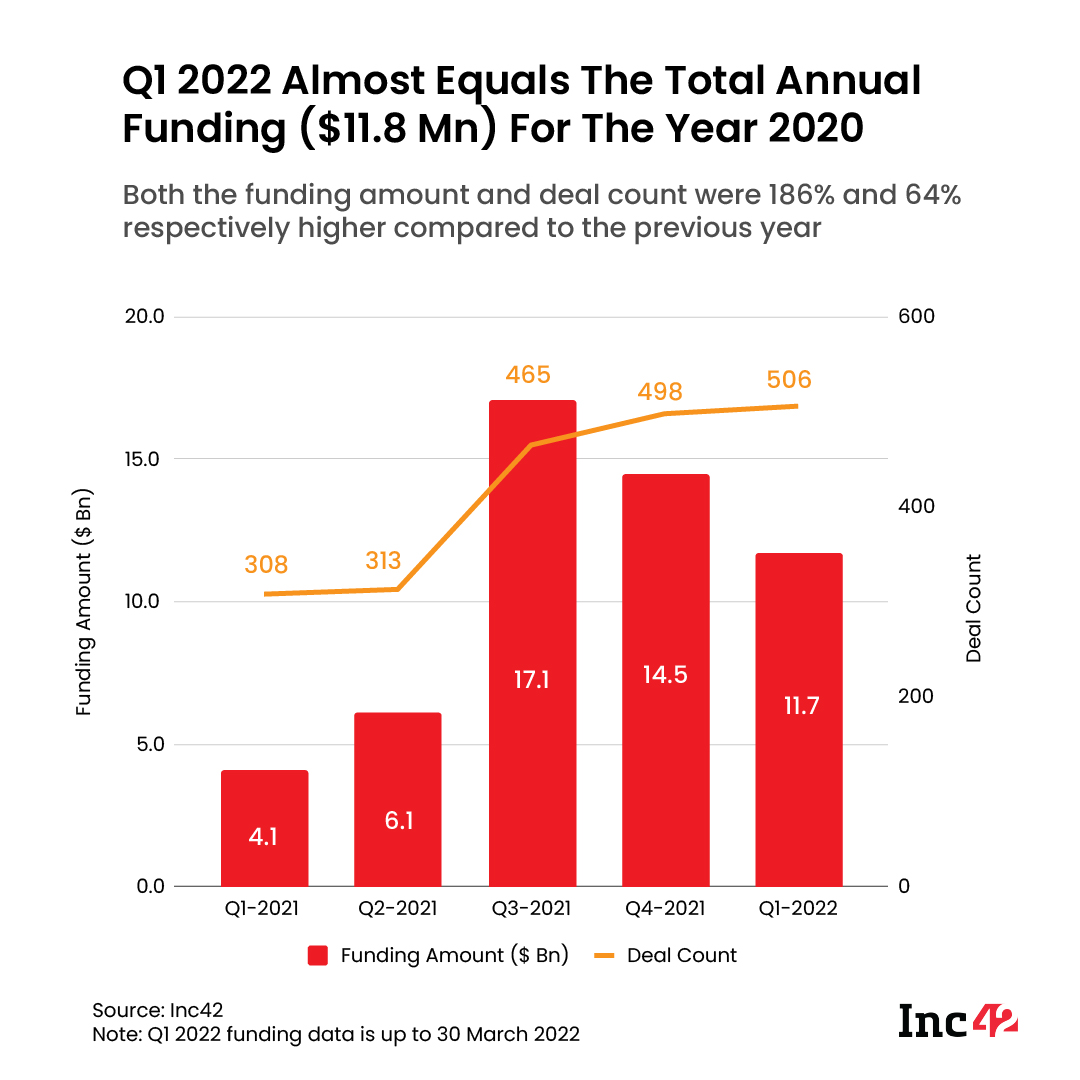

After an outstanding 2021, with $42 Bn in startup funding and 1583 deals, the growth momentum for Indian startup ecosystem has been intact so far till the first quarter of 2022.

According to an Inc42 report, 506 startup funding deals were recorded in Q1 2022 in the Indian startup ecosystem, thus, marking the highest number of funding deals in the last few years on a YoY basis. Over $11.8 Bn was raised by Indian startups in this quarter, 186% higher than the funds raised in Q1 2021.

In Q1 2022, enterprisetech startups grabbed investors’ greater attention, therefore, getting 5X higher venture capital funding as compared to Q1 2021.

Besides this, startups operating in ecommerce, fintech, edtech and consumer services, among others also have gained investors’ interest in turn, bagging $1.90 Bn, $1.80 Bn, $1.50 Bn and $1.29 Bn respectively.

Here is a list of top 20 investors that have backed these startups in the said quarter.

Note: The current list only includes the most active investors based on their deal participation in the Indian startup ecosystem in Q1 2022. The data has been collated based on deals recorded by Inc42 and the Most Active Investor Raking Survey Q1 2022. If you would like to be included in the survey mail list, write to us at [email protected]

Most Active Startup Investors In Q1 2022

AngelList India

Investment platform AngelList India has made the highest number of investment deals by investing in 82 startups in the first quarter of 2022. SuperShare, Hiver, Crib are some of the notable startups that have been backed by it.

Sequoia Capital

Venture capitalist Sequoia Capital India has made the second highest number of investment bets in Q1 2022. It participated in 31 startup funding deals in Q1 2022. Of this, OneCard, Polygon and CredAvenue are some of the notable startups that have been backed by it.

The venture capitalist primarily invests in consumer, technology, and healthcare startups in the Indian business ecosystem.

Titan Capital

Kunal Bahl, and Rohit Bansal, led VC fund Titan Capital has participated in 25 startup funding deals in Q1 2022. The fund has backed startups such as Hatica, KhelGully and ClaimBuddy.

As per the website, Titan Capital manages a portfolio of more than 200 startups that work in various segments including consumer internet, SaaS, Fintech and Web3.

Alteria Capital

Mumbai-based venture debt fund Alteria Capital has invested in 24 startups in Q1 2022. Stanza Living, Rupifi, and MediBuddy are some of the startups that were backed by it in the first quarter of 2022.

The venture debt fund essentially focuses on innovative startups that are backed by strong VC sponsors. According to its website, it has a portfolio of 42 companies as of now.

ah! Ventures

The Mumbai-based ah! Ventures participated in 20 funding deals in Q1 2022. Bibo, We360.ai and Adyaway are some of the startups that have been recently backed by it.

Better Capital

Early-stage venture company Better Capital has invested in 20 startups in Q1 2022. Some of its Indian startup investments in the quarter include Filo, Flint and M2P.

As per its website, Better Capital has a portfolio of more than 150 companies including slice, Khatabook, Teachmint, Yulu, and ShopKirana.

Accel Partners

Venture capitalist Accel Partners infused money in 19 startups in Q1 2022. Niyo, RetainIQ and Scripbox are some of the startups that the investor eyed upon in Q1 of this year.

In March 2022, Accel raised $650 Mn in its commitments towards the seventh fund, the Accel India VII, aimed at funding startups in India and Southeast Asia.

InnoVen Capital

Venture debt company InnoVen Capital has struck 18 investment deals down in Q1 2022. MediBuddy, Rupifi and Scripbox are some of the startups that have been backed by it.

Founded in 2008, InnoVen Capital primarily focuses on early and growth-stage technology businesses. As per its website, the venture capitalist has made more than $450 Mn capital investment to date.

Capier Investments

Early-stage venture capitalist Capier Investments invested in 16 Indian startups in Q1 2022. In the first quarter of this year, it backed SuperShare, Eat Better, UpSwing and others.

It essentially focuses on tech startups. Its portfolio includes a wide range of startups from fintech, agritech, SaaS, and D2C brands.

iSeed Ventures

Early-stage venture capitalist iSeed Ventures participated in 14 Indian startup funding deals in Q1 2022. GoldSetu, Hatica and threedots are some of the notable startups that have been backed by it in the quarter.

The venture capitalist focuses on companies operating in digital healthcare, consumption upgrading, IoT and enterprise services segments.

2am VC

Early-stage venture fund 2am VC has invested in 11 Indian startups in Q1 2022. Invact and SuperScholar are some of the startups that have received investments from it.

As per the website, 2am VC is a US domicile fund investing in Indian startups. It claims to be a sector agnostic fund that invests between $10k – $300K targeting 1%-9% ownership.

9Unicorns & Venture Catalysts

Accelerator VC and Venture Catalysts’ maiden fund–9Unicorns has invested in 11 startups in Q1 2022. Kenko, Memechat and Power Gummies are some of the startups that have lately received investment from it.

According to the website, 9Unicorns aims to raise INR 500 Cr and is operating uniquely as an accelerator. It further aims to fund more than 150 early-stage startups in nearly three years.

Sixth Sense

The Mumbai-based venture fund Sixth Sense made 10 investments in the Indian startup ecosystem in Q1 2022. Altigreen neEV, Dogsee Chew and FREECULTR are some of the startups backed by it.

Founded by Nikhil Vora, Sixth Sense is a consumer-centric venture capital fund. According to the website, the venture fund likes to back first-generation entrepreneurs.

Anicut Capital

Investment company Anicut Capital has infused in 10 Indian startups in Q1 2022. Burgerama, Giva and ChargeUp are some of the Indian startups that are backed by it.

According to its LinkedIn page, Anicut Capital is originally the investment manager to Grand Anicut Fund 1 and Fund 2, Category II Alternative Investment Debt Funds and Grand Anicut Angel Fund, a Category I Angel Fund. It currently has a portfolio of 40 companies.

Elevation Capital

Early-stage venture capitalist Elevation Capital has made investment in nine Indian startups in Q1 2022. Polygon, Sprinto and SuperOps.ai are some of the leading startups that have been backed by it.

The venture capitalist focuses on various segments including consumer brands, consumer tech, crypto and Web3, enterprise, SaaS and B2B, financial services and logistics.

3one4 Capital

Early-stage venture capitalist 3one4 Capital has invested in nine Indian startups in Q1 2022. Darwinbox, Kuku FM and Dozee are some of the startups that have received investment from it in the first quarter of 2022.

Trifecta Capital

Gurugram-based venture capitalist Trifecta Capital has made eight investment deals in the Indian startup ecosystem in Q1 2022. Innoviti, Kissht and Rupifi are some of the notable startups that are backed by it.

According to the website, Trifecta Capital gives several offerings including monetary support, equity and advisory services.

Kalaari Capital

Early-stage venture capitalist Kalaari Capital has made investments in eight Indian startups in Q1 2022. Baaz Bikes, Hiver and threedots are some of the startups backed by it.

According to the website, Kalaari Capital is a technology-focused venture capital firm. It invests across Seed and Series A startups. It claims to have raised more than $740 Mn and funded more than 90 startups.

Sauve.vc

Venture capital fund Sauve.vc has made eight investment deals in the Indian startup ecosystem in Q1 2022. HYPD is one of the notable startups that has been backed by it.

As per the website, the venture capitalist is a consumer-centric fund that focuses on startups operating in F&B, personal care, and apparel segments.

JITO

JITO made eight investment deals in the Indian startup ecosystem in Q2 2022. Plantvita, SuperScholar and Tablt are some of the notable startups that have been backed by it.

As per the website, JITO has a wholly-owned subsidiary–JITO Incubation and Innovation Foundation(JIIF) that provides a complete startup ecosystem with JITO Angel Network and Cello JITO Incubation Centre.

Note: The current list only includes the most active investors based on their deal participation in the Indian startup ecosystem in Q1 2022. The data has been collated based on deals recorded by Inc42 and the Most Active Investor Raking Survey Q1 2022. If you would like to be included in the survey mail list, write to us at [email protected]