Navi General Insurance is a wholly owned subsidiary of Sachin Bansal-led Navi Technologies

Navi had acquired Mumbai-based insurance company DHFL General Insurance for INR 100 Cr ($14 Mn) in January 2020

Overhauling traditional insurers to adopt more digital channels and data-driven approaches is essential in a country where insurance penetration is abysmally low at 3.7%, according to the latest Economic Survey

Bengaluru-based Navi General Insurance has introduced a monthly subscription (EMI) based insurance product instead of paying the annual premium upfront to make health insurance affordable.

Navi General Insurance is a wholly owned subsidiary of Sachin Bansal-led Navi Technologies. The insurance policies can be purchased at EMIs starting as low as INR 240 per month, said the company. Navi offers health insurance cover ranging from INR 2 Lakh to INR 1 Cr for individuals and families. The company claims that it has a claim settlement ratio of 97.3% and a network of 10,000+ cashless hospitals across 400+ locations in India.

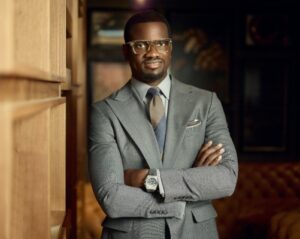

“Health insurance coverage in India is extremely low, as many people believe buying health insurance is not just complex and cumbersome, but also unaffordable. With ever-rising medical and healthcare costs, Navi’s subscription-based option for buying health insurance will help to make this important insurance cover more affordable and more accessible to many more customers,” said Ramchandra Pandit, MD and CEO, Navi General Insurance.

The Indian Insurance Opportunity

Navi had acquired Mumbai-based insurance company DHFL General Insurance for INR 100 Cr ($14 Mn) in January 2020. The company was owned by Kapil Wadhawan-led Wadhawan Group Capital (WGC) until last year, but it decided to exit the group, selling the stake to employees. The unit was then renamed as Validus Wealth after the transaction.

It was reported in December 2020 that the Sachin Bansal-led financial service company Navi Technologies is reportedly looking to acquire Aviva Life Insurance Company, a joint venture between UK-based insurer Aviva and Indian consumer goods company’s investment arm Dabur Invest Corp.

According to S&P Global market intelligence data, at least 335 private insurtechs are operating in the Asia-Pacific region. China and India are collectively home to nearly half of the private insurtech companies in the APAC region. According to figures compiled by the General Insurance Council and the Insurance Regulatory and Development Authority of India (IRDAI), the health insurance portfolio grew 11% year on year in FY21 to INR 58,584 Cr, due to the pandemic. However, two waves of the pandemic in 2020 and 2021 have also created a massive claims payout burden for the insurance industry.

Overhauling traditional insurers to adopt more digital channels and data-driven approaches is essential in a country where insurance penetration is abysmally low at 3.7%, according to the latest Economic Survey. While traditional insurers have depended on a network of agents to push products and drive sales, pandemic-induced lockdowns and social distancing norms have been the perfect trigger for digital insurance channels.

This has also prompted everyone from leading fintech unicorns and recent startups to experiment with different insurance delivery models to tap into the post-Covid demand for this product. In fact, the Insurance Regulatory and Development Authority of India (IRDAI) has also, in recent times, introduced measures to improve delivery of digital insurance products. However, analysts believe that unlike auto and travel insurance products, insurers will have a harder time digitally pushing life and health insurance products as these require a higher level of in-person due-diligence.

Join 1,000+ Attendees & A Star-Studded Lineup Of 50+ Expert Speakers At India’s Largest D2C Conference! Claim 50% + 30% OFF Today!