In a recent survey among 1,500+ CXOs and 400+ merchants to understand their business banking experience, Razorpay learned that 64 percent of companies believe their payment service providers are best equipped to solve their payment challenges as opposed to banks. As many as 10X of companies polled believe payment service providers innovate better than banks, while 36 percent of businesses believe manual dependency and reconciliation are the biggest challenges in their current money management.

Clearly, innovations in payments and neobanking have much to offer D2C businesses who while being underserved also form an important part of the economy.

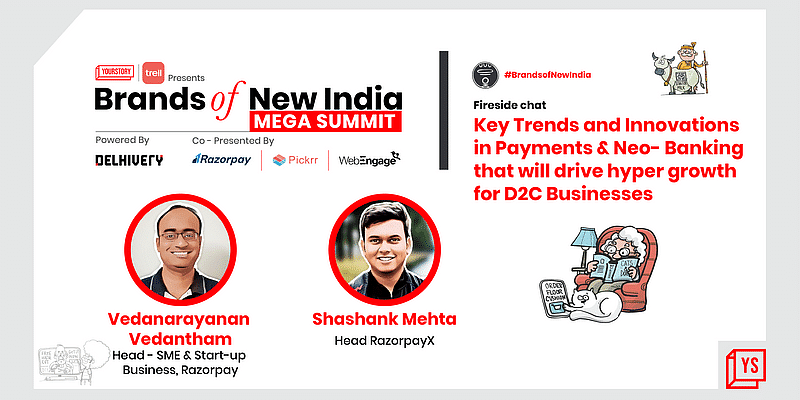

To help unpack the ‘Key Trends and Innovations in Payments & Neo Banking that will drive hyper growth for D2C Businesses’, Vedanarayanan Vedantham, Head – SME & Start-up Business, Razorpay and Shashank Mehta, Head, RazorpayX shared their first-hand perspectives on the insight-packed session at the premier edition of YourStory’s Brands of New India Mega Summit.

The two-day virtual event on January 28-29, 2022 brought together leaders, entrepreneurs, innovators, policy makers, and enablers who are leading the transformation in the D2C landscape of the country.

Here are the key takeaways from the discussion.

Hallmark of a successful payment strategy

More than 50,00,000 businesses power their payments with Razorpay, giving them an unmatched perspective on not just successful strategies but also the kind of strategy lapses that product teams and D2C players make when it comes to payments.

Vedanarayanan revealed that the most common mistake that product teams and D2C players make when it comes to payments is not choosing a payments partner that covers a wide range of payment instruments. He also advised checking if they had enough coverage when it comes to EMI, netbanking, and subscription options – marking them as critical factors for a successful payment strategy for D2C players. Finally, he recommended looking into the success rate and checking if they offered seamless user experiences, when deciding on a payments’ partner.

“At Razorpay, we’ve launched our Magic Checkout product, which brings into play the entire intelligence that we have in the ecosystem. We’ve got over 100 million Indians who’ve used the Razorpay checkout offering in the last seven years or so. And we’re able to leverage all of this information and this intelligence that resides within the raceway ecosystem,” he said.

“We are passing this benefit on to merchants and DTC brands to make sure that their user experience is maximised.Magic Checkout could help improve their checkout conversion rates by up to 20 percent – which is absolute gold,” he added.

Learnings from working closely in the D2C arena

“The last two years have been like sitting inside of a time machine. The kind of change and the accelerated adoption to digital that we might have seen over a 5-10 year horizon is what is actually seen in the last two years,” said Shashank, talking about how tech massively impacted the D2C space over the last two years.

Speaking on the tech interventions he foresees in the D2C space and the innovations that he was personally excited about, he said, “We’re going to see an increase in tech that can make tech more abstracted, i.e. any innovation that will make the entire data ecosystem more accessible to a vast majority of entrepreneurs who don’t know tech, so that they can focus on the other important parts of growing their businesses.”

“Also, most brands that are signing up with Razorpay are first-time entrants into the digital ecosystem,” he added, pointing to a growing number and variety of D2C brands in the ecosystem.

Vedanarayanan agreed with his views, saying, “Founders are looking at ‘plug and play’ tech and finance solutions, and solving for local vernacular is also going to be a key play, going forward.”

Key factors that will fuel India’s D2C ecosystem

Vedanarayanan called out three ecosystem enablers that could power DTC entrepreneurship in India – namely digital literacy, financial literacy and compliance enablement.

“Razorpay is the only payments solution in India that allows businesses to accept, process, and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets, said Shashank, talking about how Razorpay is powering India’s D2C ecosystem for the next phase of growth.

“Unlike traditional banks, we look at the payment gateway transactions. When we observe low return rates and low chargebacks, we know that the business is trustworthy,” he added.

“The essence of our success lies in making the DTC founders as efficient as possible without requiring them to become experts in areas, which doesn’t add value to the business directly. That’s where the maximum innovation will happen,” he said.

Watch Brands of New India Mega Summit – on demand

You can watch videos from all the sessions of Brands of New India Mega Summit here. Don’t forget to tag #BrandsOfNewIndia when you share your experience, learnings, and favourite moments from the event on social media.

For information on future events, collaborations, and information regarding the D2C ecosystem, please visit our website.

![Read more about the article [Jobs Roundup] Work for rural fintech startup Jai Kisan with these openings](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Imageb728-1622430597422-300x150.jpg)