The feature will make its debut in September 2022

The upcoming in-app feature is expected to resolve 80-90% of payment failures in real time: Dilip Asbe, MD & CEO, NPCI

In April, the payment body asked banks, payment service providers, and third-party applications to introduce an online dispute resolution (ODR) system

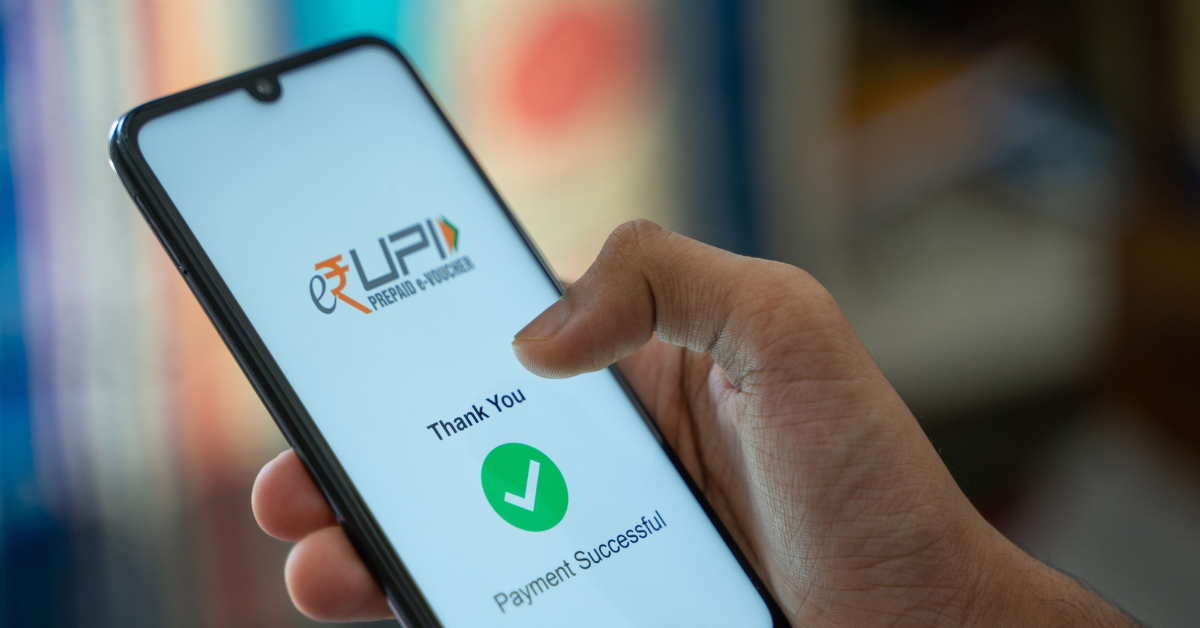

The National Payments Corporation of India (NPCI) is planning the roll out of the real-time payment dispute resolution system for the United Payment Interface (UPI) soon, which has been in the works for quite some time now.

According to NPCI MD and CEO Dilip Asbe, the upcoming in-app feature is expected to resolve 80-90% of payment failures in real time. The feature will make its debut in September 2022, Hindu Business Line reported.

“Over the next three months’ time, 80-90 per cent of disputes caused by payment issues between a variety of participants of the large supply chain of UPI ecosystem will get resolved online,” Asbe said as quoted in the report.

Since its launch, UPI has revolutionised the digital payment system in India, attracting more and more users everyday. For instance, UPI recorded 595 Cr transactions worth INR 10.4 Lakh Cr in May 2022. It registered 6% month-on-month (MoM) growth from April 2022.

As and when the new dispute redressal mechanism comes into effect, customers will no longer be required to call the bank or contact merchants for payment disputes. Rather, users will be able to get all assistance on the UPI app itself.

Considerably, the payment body asked banks, payment service providers, and third-party applications to introduce an online dispute resolution (ODR) system. In a circular dated April 11, NCPI asked the participants in the UPI ecosystem to implement the ODR system by September 30, 2022.

The circular also added that NPCI would stop onboarding new customers for participants who fail to implement the grievance redressal system, from October 1 2022 onwards.

Right now, NPCI is working on many other innovations as well such as UPI AutoPay for recurring payments, UPI Lite to enable near-offline payments for small-ticket transactions. Among others, a voice-based payments focussing on feature phones is also another focus area for NCPI.

Currently, Google Pay and PhonePe are dominating the UPI transaction ecosystem. Meta-owned WhatsApp is also trying to capture a share of the market with its WhatsApp Pay.

Further, after reigning India’s digital payment system, UPI is now looking at international expansion. It has already tied up with several institutions in Nepal, the UAE, Japan and China.