Given its ambitious plans, is Bhavish Aggarwal-led Ola Electric biting off more than it can chew?

When Ola incorporated Ola Electric in 2019, it was thought to be a side project, an experiment to test the electric vehicle waters. But three-plus years later, Ola Electric has become the flagship business.

Not only did it launch its first scooter last year, but now it’s ventured into battery manufacturing and has eyes on electric cars in the next two years.

Given these tall plans, we wonder whether the Bhavish Aggarwal-led company is biting off more than it can chew, especially as problems related to EV manufacturing and testing come to the fore. The answer is not yet clear if market watchers and auto analysts are to be believed.

We’ll get into that soon, but first check out the top stories this week:

Ola’s EV Ambition Grows

As Ola’s ride-hailing and mobility business capitulated during Covid, its full attention was on building up the EV business. At first Ola Electric was restricted to a few pilot projects, but the acquisition of Netherland-based Etergo in May 2020 spurred Ola’s OEM plans.

And it was quickly out of the blocks. By July 2021, it had opened up pre-orders and the first Ola S1 electric scooters were rolling out to customers by December last year after some delays and hiccups in production. With Ola’s high-profile entry, the spotlight was bright on the EV market.

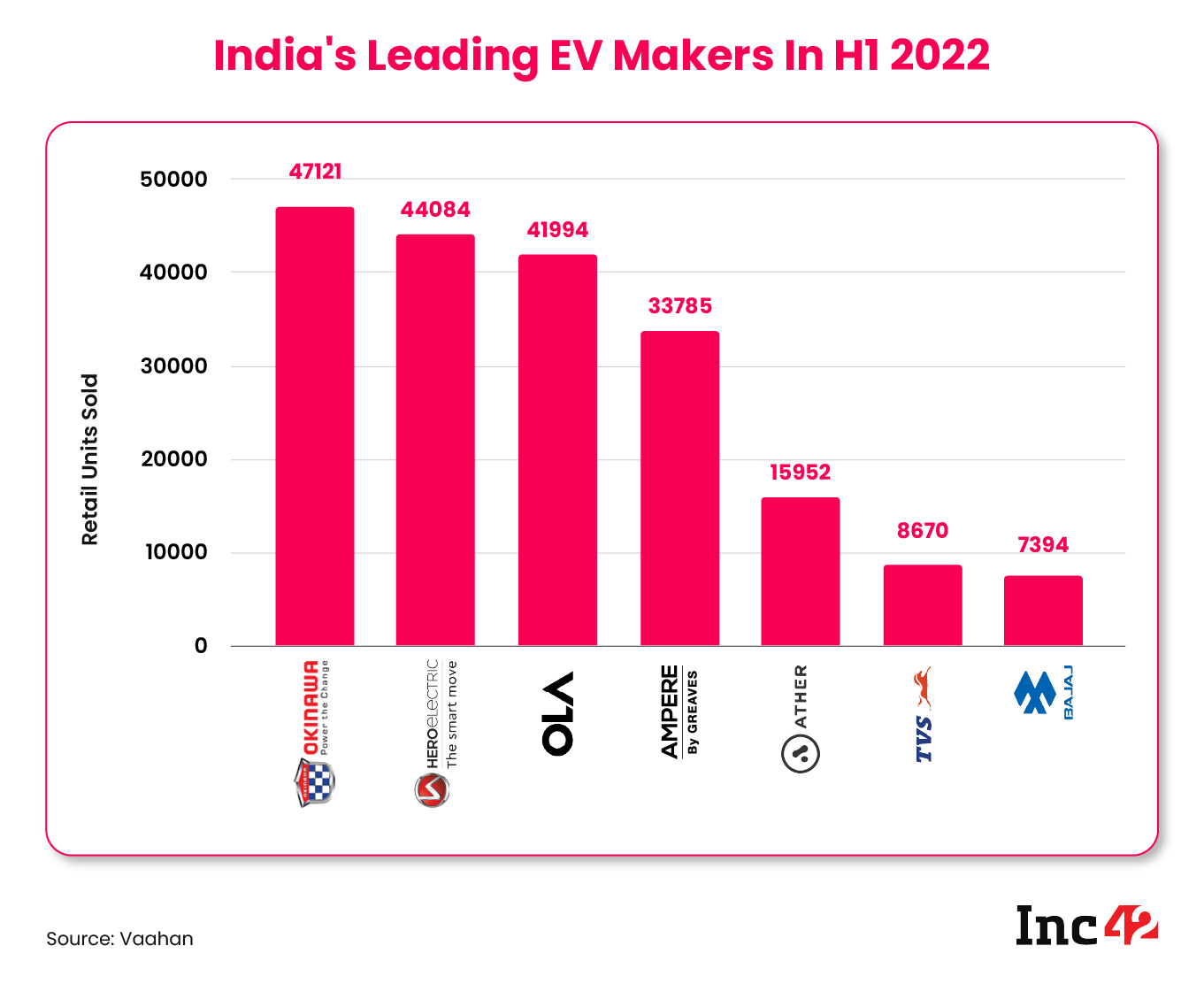

And the past year has been proven to be a huge boost in terms of acceptance. As per Vahan data, a total of 2,40,662 EV two wheelers units were sold in the first half of this year, contributing 3.6% to total two-wheeler retail sales between January and June 2022.

This is 3X the total number of EV two-wheelers sold in all of 2021, so the pace of EV adoption has skyrocketed. Further, EV two-wheeler sales in FY22 were 2,31,338 versus 41,046 in FY21, up 463.61% year-on-year (YoY).

EV Brigade Gets The Timing Right

Besides Ola, the likes of Bounce and Simple Energy have also launched their first products in this window since last year. And even Ather Energy — despite lower sales in comparison to the competition 2022 so far — has launched a fourth-generation variant of the Ather 450X bike this week and even surpassed its tally of all bikes sold last year in June.

The fact that fuel prices have risen unabated and that private public charging infrastructure has been boosted considerably in the past year have also made it easier for consumers to adopt EVs. Further, the Indian government is reportedly about to notify an EV battery swapping policy in the next 15 to 30 days after consulting with stakeholders on the direction. The battery swapping policy is likely to solve a lot of infrastructure hurdles in adoption.

This past week, Ola Electric showcased the upcoming product portfolio to investors, bankers and others at its factory in Tamil Nadu. A video of the event indicated Ola has plans to launch an affordable electric scooter, a superbike and electric cars by 2024. Given the problems in production of scooters last year and safety issues this year, is this too tall a target for the company?

“Ola and the other new OEMs are coming at the right time. Even though this does not excuse the lack of testing in many cases, the general feeling is that now it will take a more cautious approach to development because even the government is looking at it now,” according to a FADA spokesperson.

Is Ola Ready For Electric Cars?

The point about the lack of testing, improper manufacturing in the rush to get EVs to market has been blamed for the spate of fires around India this summer.

EVs made by 2022’s top-selling brand Okinawa Autotech, Pure EV, Ola Electric and others made frequent headlines for fires. About 7,000 vehicles have been recalled in the wake of these incidents.

According to Vinkesh Gulati, president of the Federation of Automobile Dealers Associations (FADA), the rush to launch EVs has resulted in inadequate testing and the R&D process has many lapses. India’s auto industry is much more tightly regulated in terms of safety testing, and recently the government has introduced new safety testing rules and standards for four wheelers.

Electric cars from Ola Electric and other new OEMs will most definitely need to meet the same standards as Tata, Mahindra or any other large auto company. With Aggarwal taking potshots on some legacy auto companies, it would be paramount for Ola to cover all bases when it comes to a four wheeler or even other two-wheelers.

“On the bikes side, there are loopholes like speed limits and battery capacity which are used to escape testing, but this will not be possible for cars. OEMs like Ola will need to plan in advance and accommodate a longer testing cycle in their development,” he added.

A recent report by the Council on Energy, Environment and Water (CEEW) claims that around 75% of India’s new passenger vehicle sales in 2050 could be electric and that half of the new two-wheelers and more than a quarter of new four-wheelers sold in 2030 in India could be electrically powered.

But that still doesn’t prove that Ola can indeed make an electric car in the next two years. From a manufacturing standpoint, making cars will need retooling and restructuring of Ola’s factory from the focus on scooters. Ola will need to procure more land or set up a new factory altogether, according to analysts.

While it may have some R&D going on in the background, the real test will come in production and meeting testing standards. Even Tesla has famously faced production issues in 2022 amid supply chain constraints, so Ola’s optimism might fade a little when it comes to actual production.

What About Mobility Business?

Amid all the EV hype, somehow the mobility business has been forgotten or left by the wayside. Last month, Ola announced that it will shut down its used car division Ola Cars and its quick commerce business Ola Dash to focus on the EV and mobility business. The shutdowns have reportedly led to layoffs of up to 500 employees.

While shutting down Ola Cars and Dash, the company claimed that the ride-hailing business is generating its highest gross merchandise value (GMV) on record along with profitability.

But pretty much all the news that comes from Ola these days is about the electric vehicle business, with the exception of its trouble with RBI over breaching KYC norms and the conflict of interest concerns around Ola acquiring fintech company Avail Finance, which has Bhavish Aggarwal’s brother Ankush Aggarwal as a cofounder.

Its recent large investments have all been for the EV segment too, including a planned $500 Mn investment in EV battery manufacturing and innovation. Ola Electric claims to have surpassed INR 500 Cr in revenue in the first two months of FY23 and is claimed to be on track to surpass $1 Bn in run rate by end of this year.

Ride-hailing saw a 57.8% drop in collections in FY21, falling to INR 884.3 Cr as compared to INR 2,096 Cr in FY20. As per its financials, Ola made a loss of INR 328 Cr on the ride-hailing business and a further INR 653.5 Cr of loss on the cab-leasing vertical.

As it shuts down many of the ancillary businesses, these losses will go down, but the question of whether the mobility business will get a major cash infusion like Ola Electric remains to be answered. VCs might not back the cashburn-reliant mobility story with the same enthusiasm as EVs, which have a larger impact.

According to analysts, Ola is likely to slow down investments in ride-hailing because its DNA as a company is changing.

“Look at Mahindra. It is an auto OEM, and Meru Cabs is a small part of its operations. Ola has to make a decision of whether to remain in both businesses with the same enthusiasm,” said the founding partner of a Chennai-based automotive advisory firm.

Clearly, Ola has set out to do a lot in the next two years — with batteries, superbikes and electric cars. And at the same time, it has to also manage growth in the mobility business and support the thousands of drivers that rely on it for livelihood. So the question is the mobility and EV giant taking on more than it can handle?

Tech Stocks & Startup IPO Tracker

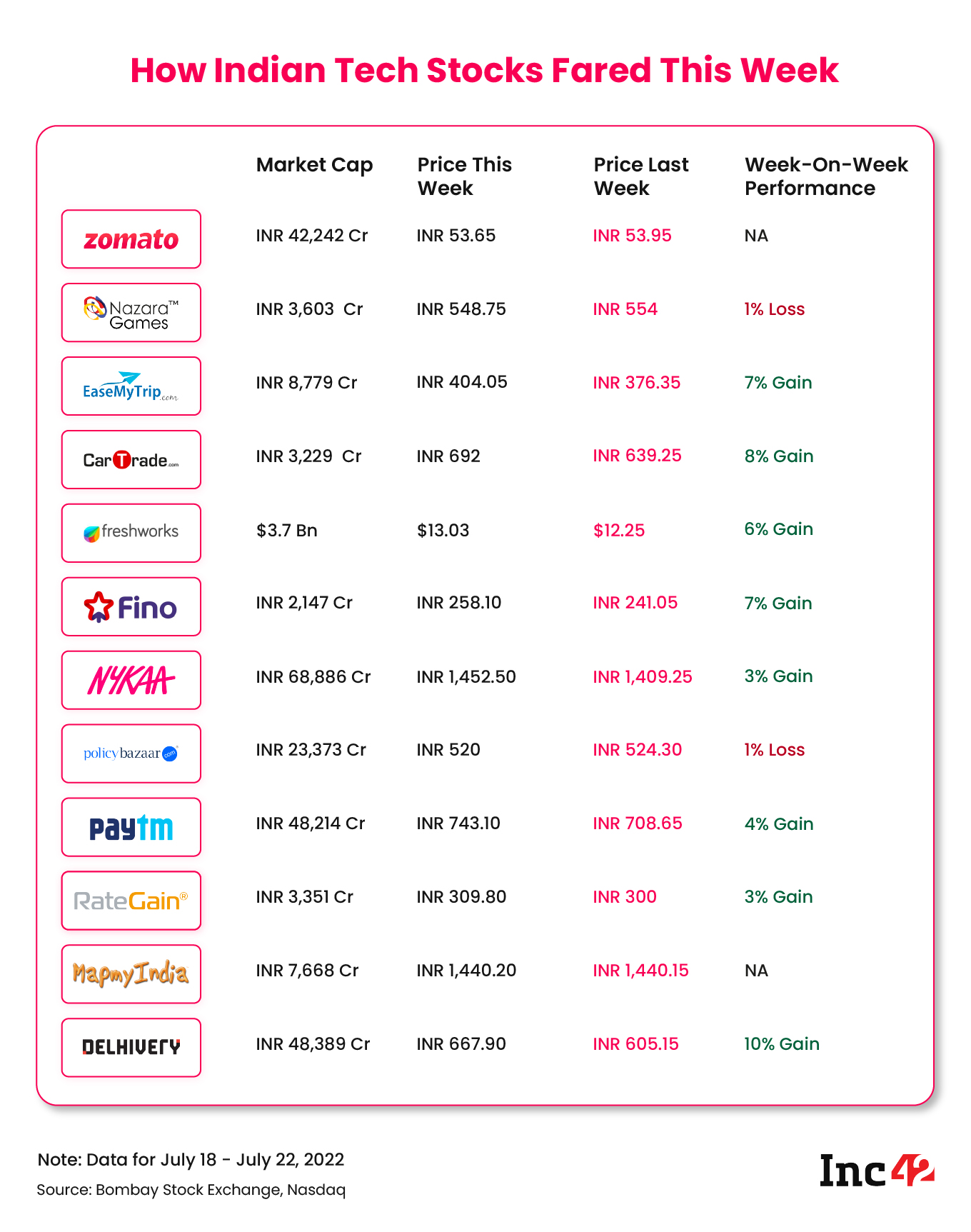

- Delhivery’s Dream Run: The logistics unicorn’s market cap crossed the INR 50,000 Cr mark after a surge in the past week; its shares ended the week at INR 667.90, rising 10% week-on-week

- EaseMyTrip’s Resurgence: After falling in May and June, online travel company EaseMyTrip’s shares saw a big upward swing, as the stock closed the week at INR 404.05, 7.4% higher than the previous week

Here’s how the past week has been for the listed tech companies we are tracking:

Startup Funding Tracker

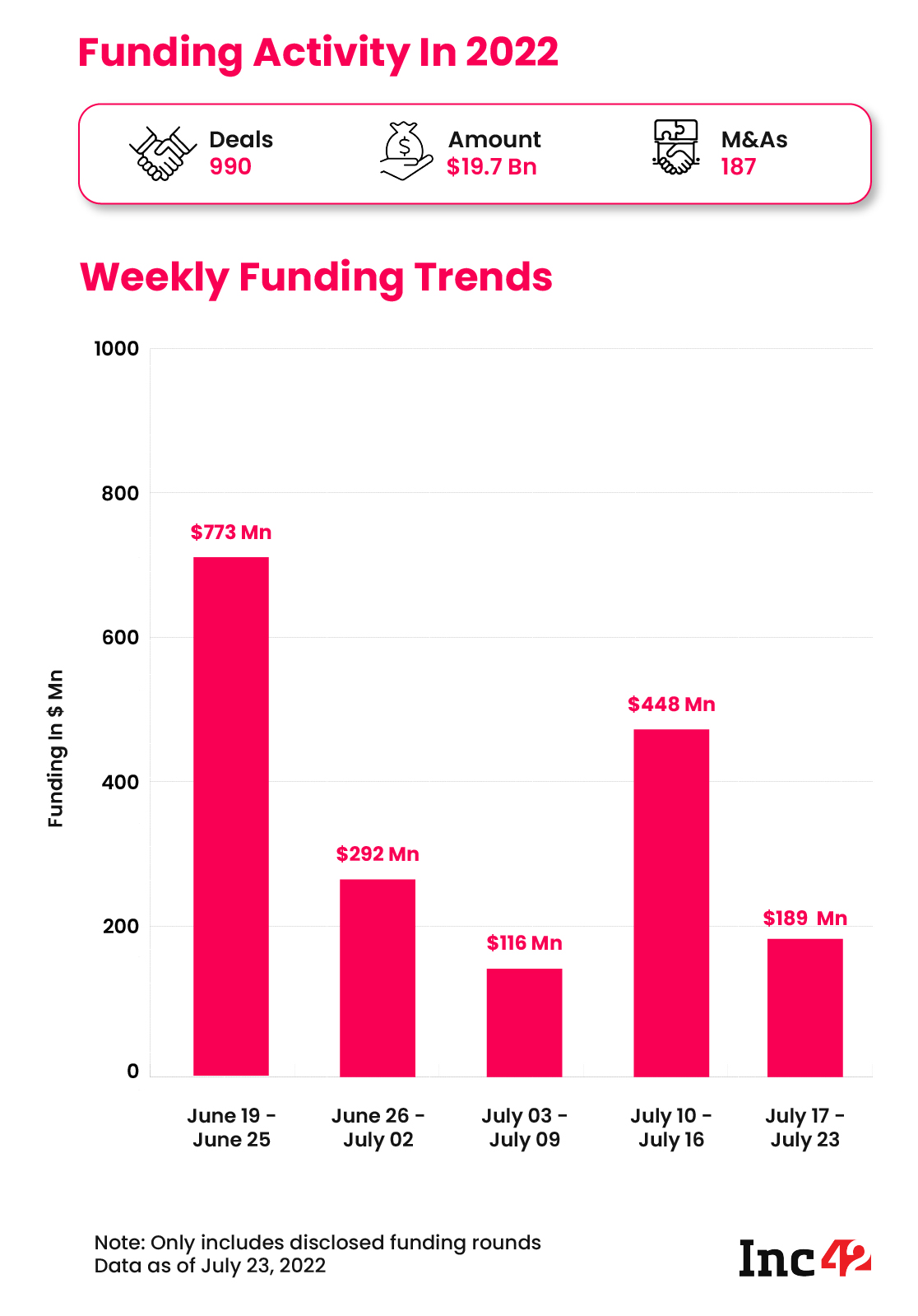

- 💰 Funding Falls Again: It is a bit of rocky period for Indian startup funding, with just $189 Mn raised across 30 deals in the past week, almost 60% lower than the previous week

BYJU’S Controversy & Other Top Stories

That’s all for this week. Look forward to seeing you next Sunday with another weekly roundup.