With a deadly second wave of Covid forcing states to curtail movement of people, mobility players are once again forced to cut back on operations in major cities

Both Ola and Uber have lost thousands of cars owing to drivers defaults as banks and NBFCs impound the vehicles leased on credit

Activists and critics allege that the multibillion-dollar companies have not done enough to help drivers meet their debt obligations during a time of crisis

Ride-hailing giants Ola and Uber have lost around 30,000-35,000 vehicles from their fleets since September last year, according to multiple people close to both companies as well as sources working in the automobile industry. The primary reason for the attrition has been the inability of drivers to repay their monthly installments for the vehicles purchased on auto loans.

Amid a steep fall in demand for mobility services, drivers have seen income fall and as a result can no longer afford to pay the EMIs on the financed vehicles.

According to one large second-hand car retailer, 30,000-35,000 cabs belonging to both Ola and Uber have been impounded by banks and NBFCs after drivers defaulted on the vehicle loans. The defaults grew in number after the RBI-imposed loan moratorium was lifted in September 2020. The source asked to remain anonymous as they aren’t allowed to publicly disclose details of impounded cars.

Two sources within cab driver unions told Inc42 that at least 30K vehicles have been seized by financiers in the past 6-7 months. Up to 30% of these cabs are understood to have worked with both Ola and Uber simultaneously, as per industry insiders.

Tanveer Pasha, president of the Ola, TaxiForSure and Uber (OTU) Drivers’ Union in Bengaluru, said that around 25,000 vehicles belonging to both Ola and Uber in Karnataka purchased via bank and NBFC financing have been impounded.

Shaik Salauddin, the national general secretary of the Indian Federation of App-Based Transport Workers (IFAT), added that more than 6,000 cabs in Telangana have been impounded by financiers in the last 6-7 months for non-repayment of monthly instalments.

The ongoing health crisis in India has taken a severe toll on the economy, particularly on the gig workers who work with Ola and Uber. While most gig workers in other sectors such as ecommerce delivery, food delivery, hyperlocal delivery have found work during the lockdown, the same cannot be said about ride-hailing. Drivers working with Uber and Ola are arguably the worst affected.

Salauddin claimed around 497 Ola and Uber drivers in India have tested positive for Covid, and that an estimated five drivers have lost their lives till date, according to IFAT’s tally.

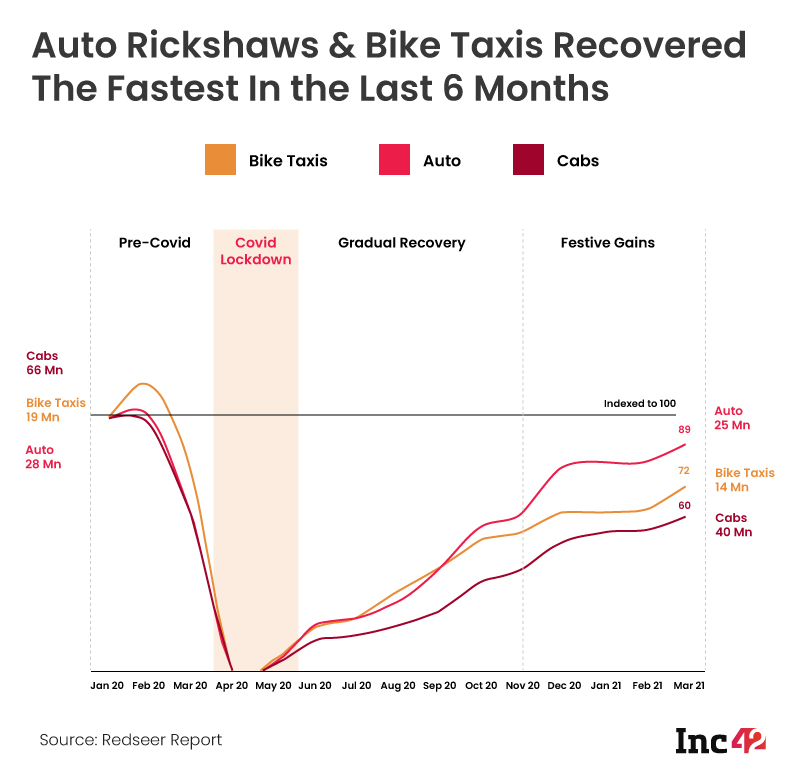

As per a recent Redseer report, although app-based cab rides fell in March 2021 soon after a minor recovery since August last year. A downward trajectory is expected in the next few months, as citizens continue to stay indoors in the worst-affected states like Mahrahstra, Delhi, UP, Karnataka, and others, where the usage of app-based cabs is the highest.

How Ola And Uber’s Cab Leasing Model Has Come Back to Bite It

Although Ola and Uber have recovered up to 60% of their business post unlocking, as per the Redseer report, cab aggregators are once again facing loss of demand and this could further complicate their revenue for yet another fiscal.

Both the leading cab aggregators in India built their supply on the back of the leasing model, which promised drivers greater control on their income and an opportunity to be ‘entrepreneurs’. Both companies massively increased the supply of cabs on the roads between 2013 and 2018, and spent heavily backed by VC dollars.

Ola claimed to have around 1 Mn drivers on the roads in the country as of 2018. It operates a standalone leasing unit which allows its drivers to borrow taxis at cheaper interest rates. To avail the facility, drivers are required to make an initial deposit as well as monthly installments for a period ranging from three to five years. Since its inception in September 2015, Ola had pumped in millions of dollars into the unit to ramp up supply of vehicles on the road.

Ola did not respond to an email seeking comments. However, a person close to Ola’s operations told Inc42 that only 2,000 cabs were taken off the roads ever since the lockdown due to “wear and tear” as taxi operators are mandated by regulators to scrap cars after six years of usage.

Uber launched its leasing unit in India in December 2015, where drivers have to pay $462-$539 (INR 30,000 – INR 35,000) to be part of the programme and are then required to make monthly lease payments with an option to own the vehicle after three years. Although Uber’s leasing unit is currently operational in India, it had earlier shut down the leasing business in its home market in the US owing to steep losses.

It’s clear that the business model required a huge cash burn. As per the company filings with the Ministry of Corporate Affairs, Ola posted a loss of INR 2592.93 Cr on a consolidated level in FY19, an 8% hike from FY18. The model was not sustainable given that Uber and Ola also had to charge more commission from drivers to achieve positive unit economics. This meant drivers had to complete more rides to make the same income but this demand was not seen in the market in 2019 after the boom of 2013-2018.

Then came the pandemic and choked off all revenue for Ola and Uber. According to a July 2020 report by The Ken, around 95% of Ola’s 33,000 leased vehicles were lying unused in various parking lots. The companies, which at one time encouraged drivers to purchase vehicles through loans, no longer have the capacity to provide the income that actually supported these repayments.

There seems to be no way out except allowing the natural market course correction and letting supply level off with the demand. But once lockdowns are over, will Ola and Uber have the financial power to rebuild their supply and also create demand?

![Read more about the article [YS Learn] How following ‘double play’ can help startups create value](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/Untitleddesign-1613121626689-300x150.png)

![Read more about the article [Funding alert] Deeptech startup Log 9 Materials raises $8.5M in Series A+ led by Amara Raja Batteries](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Imagen59z-1599818083656-300x150.jpg)