It’s a busy day in IPO-land: Olo has raised its IPO range and DigitalOcean is giving us a first look at what it may be worth when it debuts.

That Olo raised its IPO price is not a huge surprise, given the software company’s rapid growth and profits. In the case of DigitalOcean, we have a bit more work to do as its approach to growth is a bit different.

Let’s explore both companies’ pricing intervals through our usual lens of revenue multiples, market comps and general SaaS sass. And we’ll do this in alphabetical order, which puts the cloud infra company up first.

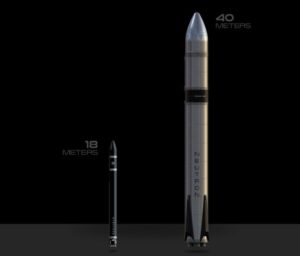

DigitalOcean’s IPO price range

According to its S-1/A filing, DigitalOcean expects its IPO to price between $44 and $47 per share. The price range is a coup for the company’s private investors, who as recently as the company’s 2020 Series C paid about $10.59 each for the company’s shares. Andreessen Horowitz is going to do very well, having led the company’s Series A at a per-share price of just more than $2. IA Ventures, which led DigitalOcean’s seed round, according to Crunchbase, paid just $0.26 per share back in the 2012-2013 time frame. That’s going to convert well.

In valuation terms, the company’s simple share count post-IPO will be 105,303,340, or 107,778,340 if its underwriters purchase their option. At $44 to $47 per share, DigitalOcean is worth $4.72 billion to $5.07 billion, including shares designated for its underwriters.

The company’s fully diluted valuation is higher. At midpoint, Renaissance Capital estimates DigitalOcean’s diluted valuation is $5.6 billion. That works out to a little under $5.8 billion at $47 per share.

Taking a look at DigitalOcean’s Q4 2020 revenue of $87.5 million, the company closed last year on a run rate of $350 million. Or a revenue multiple of 14.5x at the upper end of its non-diluted valuation, and around 16.5x at the upper bound of its diluted worth.

![Read more about the article [What The Financials] IPO-Bound Nykaa Turns Profitable](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Social-5-1-300x157.jpg)