In June of 2019, I got a cold e-mail with a single link:

“My name is Braeden Kelekona and I’m the founder of Kelekona, a drone service for passengers and cargo. Below is a link to the pitch video. I look forward to hearing back from you and hopefully scheduling a meeting here in the city.”

I don’t have the original video, but from what I remember it was just an animation of what looked like a flying bus. There wasn’t any context around it—not exactly something I’d call a “pitch”.

I have a pretty direct communication style, so I replied with exactly what I was thinking—without any kind of judgement. I explained that this wasn’t really a pitch because it lacked all sorts of context. Who was the team? How many people would you need to build such a thing? What would be the timelines? Goals? Not to mention what actually went into the costs.

I had, as they say, “All the questions.”

Braeden answered them in a big block of a paragraph about who he was working with—a bunch of consulting shops I’d never heard of, with specific down to the dollar costs for materials like carbon fiber, specific battery types, etc.

It was a few days before my wedding, which we had rushed to plan in less than 90 days because of my mom’s brain tumor. I got overwhelmed with e-mail that week and basically declared e-mail bankruptcy, so I didn’t respond.

Honestly, I didn’t take it that seriously—mostly because I was starting with no information. It seemed unrealistic—not that all startups aren’t in some way realistic—but VCs generally communicate communication style with competency.

What’s the likelihood that some random guy who doesn’t even think to create a standard VC deck could know enough about aviation to build whatever this thing was he was trying to build? Plus, he didn’t even give me the context of why it was even a good idea? Don’t buses work pretty well on their own? Why would they need to fly?

Let’s pause for a moment there and ask a different version of this:

“What would a couple of Wharton MBAs know about the eyeglass industry?”

“What would a founder who built city guide software know about space travel?”

“What would a couple of adtech founders know about curing cancer?”

That’s the thing, too… He wasn’t just some random guy. He was a creative director who had been experimenting with drones (and crashing them) for recording video footage who then got into repairing them. That’s what gave him the idea that these machines could be scaled up.

But that’s the way investors tend to think about people who don’t run in our circles, writing newsletters, showing up on Clubhouse (RIP, yet?), replying to our tweets, etc.

Even for VCs like myself that want to be accessible and inclusive, it’s hard to evaluate someone who doesn’t communicate with the same package of information that everyone else is sending you.

Ask someone who has never seen a pitch deck, who wouldn’t imagine that there are pitch decks that people have posted online, who has never spoken to an investor to try and convince someone they have a good idea, and you’ll often get something like this:

Well, I didn’t hear from Braeden for a while. He went off to go recruit a team of aviation experts—people who had consulted on and built serious vehicles and projects. They helped him refine his idea.

He didn’t write back to me until I wrote this piece on backing disruption in the middle of the racial equity protests last June.

“As a person of color, I find this email entirely offensive and tone deaf.

You say your firm is leaving the door open and encouraging people to come through.

Not only were you rude in our conversations but you ghosted me entirely when I asked to sit down with you.”

Wow.

I took a step back and tried to consider things from his point of view. He has the idea that he believes, knows rather, can be a gamechanger in the transportation space, pitches it in a way that a Creative Director would, with imagery meant to impress and inspire, and I was like “Dude, what the heck is this?”

And then I disappeared.

To him, undoubtedly, this is exactly what the VC industry was made out to be—that even a firm that tries to be accessible doesn’t take founders of color seriously. Nevermind that I had no idea what his background was. In fact, I absolutely assumed that he was white because the only Braden I had ever known was a terrible Mets reliever from Oklahoma who was not a person of color.

I’m not particularly flowery with my responses. If something is missing, I say it. If I have questions, I just ask them. I have 1,000 unread e-mails in my inbox right now…

But founders don’t know that—especially those that aren’t part of the industry. Especially founders of color that expect to get the short end of the stick because they usually do.

Having been called out, I set up a meeting—but I didn’t do it to take a charity pitch.

I did it still feeling like there was no way I was going to invest in this crazy flying bus thing, but I wanted him to at least understand what aspects of the story were missing and the context that any investor would need to evaluate the idea properly.

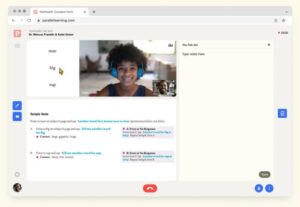

We hopped on a Zoom and I shared all of the questions I had, why I had them… and we realized that what had seemed obvious to him as someone knee-deep in the space was completely not obvious to me.

In other words, like most founders, he didn’t realize how dumb VCs are. 🙂

Every day, I get pitched everything from the next big gluten-free snacks, to vehicle insurance for fleets, to consumer electronics for menstrual pain to enterprise security platforms. No human on the face of the earth is an expert on all of these areas. In most of them, I wouldn’t even know where to begin. That’s true for most investors. We need a founder to hold our hand, walk us through a problem, help us understand the economics, the scope of the vision, and also somehow convince us they can do this thing that is unlike anything they’ve ever done in their lives, or perhaps unlike anything anyone’s ever done.

If you’re Elon Musk, you get a pass. You tweet some screwball idea for a train that goes through a tunnel with the air sucked out of it, and hundreds of millions of dollars start pouring in.

Is it possible?

Well, anything’s possible with enough cash.

Does that make Elon Musk better at building or just better at fundraising? Does he get backed because he’s an inherently better founder or does he get backed because we like to pretend he’s Tony Stark and he’s masterful at playing into that role?

Back to Braeden.

When I got off the Zoom with him, I felt like we made some progress around understanding each other and where we were coming from. I agreed to take a look at his new pitch via an actual deck. His new aim was to answer the myriad of questions I had—like where would this electric flying bus fly? What would consumers pay? How is this even possible?

We met again around an actual deck. I think I scheduled the meeting for 45 minutes, but we chatted for about twice that. My wife asked me, “Were you on the phone with the crazy flying bus guy the whole time?”

That’s when I had to admit to myself…

Maybe this isn’t so crazy.

We spent a bunch of time on the deck and the story arc of the concept. I hopped on a conference call with his team—a serious bunch of engineers across a wide range of ages and backgrounds who were experts on everything from aerodynamic design to electrical system design.

I was impressed. These people had built real things before—and they didn’t think this was so crazy.

Am I seriously going to fund this?

Ok, let’s be clear. I have a tiny fund—$15mm. This company is going to need far more capital than I’m able to shell out. Plus, the idea is so complex, that it would really be helpful if someone else with a bigger team could help out on this.

But the initial goal—to spend $3-4mm to just get something off the ground to test propulsion? Then to spend maybe about $30-40mm getting a single vehicle to fly?

When you consider what it costs NYC to dig one subway station and what went into Hyperloop, it’s not so crazy.

And what I slowly started to love about the idea was how New York it was.

If you’re a Silicon Valley billionaire, you want a flying car—because it’s cool. You’ve earned enough in life to be able to avoid having to travel with other people. The unfortunate thing about flying cars or personal jets is that they’re completely impractical, especially electric ones.

You see, the thing about electric anything isn’t producing enough power from batteries to get the vehicle moving, it’s that you’ve got to get the battery itself moving. That’s the challenge. The battery is the heaviest thing on the vehicle. You’re not trying to fly the plane, you’re trying to fly the battery.

That’s what Telsa’s designers understood from the beginning—not to let the weight of the batteries be a limiting factor. Telsa is able to have the performance that it does because they didn’t try to shove a half-hearted battery and powertrain design into an existing car. They designed the best car they could around the most powerful battery they could get moving.

Once you understand that, you realize that flying someone in a small jet or car isn’t as practical as trying to sit people on top of a much much bigger battery system.

Do you know what else happens when you get more people riding on it?

The per person cost comes down.

It’s something any public transportation rider in New York City intuitively understands—buses are more efficient and cheaper means of moving people by all measurements such as cost and energy.

However, it’s unlikely that the venture capital machine that funds out-there ideas, like the type that would pour hundreds of millions into Elon Musk’s fever dream ideas, would find anything bus-like to be cool.

But I think it’s cool—and it’s a very big idea.

The company, Kelekona, aims to make regional travel as easy as an $85, 30 minute flight from NYC to the Hamptons, or to take people to DC or Boston in 45 for less than the cost of a train—not to mention with a fraction of the infrastructure. You don’t need to use eminent domain to lay tracks or bore tunnels. As a vertical take off and landing vehicle (VTOL) whose motors turn, you need little more than a helipad or an empty lot.

It can be run as a single route or a network of regional hops with swappable batteries. It can carry cargo in and around (and above the traffic of) big cities—unless you’d rather wait around for that freight tunnel to get built under NYC.

The first thing we need to do is fundraise. I’ve given the company a small amount of capital to buy some of that Elon Musk coolness—to build the kind of website that shows off the ambitiousness and coolness of the concept that I didn’t understand in that very first pitch.

After that, we need risk-seeking investors that want to collaborate on something that just might be a very big thing after all, who are willing to open up to an idea without the social proof of a Musk tweet and top-tier Silicon Valley insiders behind it.

Check out www.kelekona.com. Reach out to Braeden and/or myself if you’d like to talk more about it. We’re seeking out bold investors for a “hazardous journey. Low wages, bitter cold, long hours of complete darkness. Safe return doubtful. Honour and recognition in event of success.”

.gif?format=1000w)