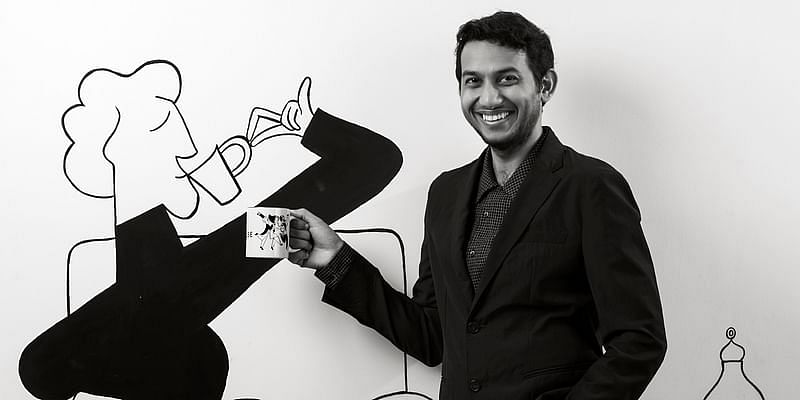

Hospitality and travel tech firm estimates its revenue in 2022-23 to be $751 million on the back of which it expects to post its first operating profit in a full year, company Founder and Group CEO Ritesh Agarwal told its employees.

At an employees townhall held this week, Ritesh is understood to have shared how the company has been able to gradually strengthen its financials after overcoming the challenges of the pandemic.

The company expects its revenue in FY23 to be $751 million, up 19% from $629 million in FY22, he told the employees through a presentation during the townhall.

In the first half of the fiscal year, OYO posted an adjusted EBITDA of $8.3 million. It registered an adjusted EBITDA loss of $37 million in the same period of FY22.

For the second half of the fiscal, continued momentum on the topline coupled with margin expansion and healthy operating leverage are expected to result in $24 million adjusted EBITDA, he added.

On the back of improving financials, Agarwal said OYO is progressing towards its “first-ever full fiscal year of EBITDA profitability”.

When contacted for comments, an OYO spokesperson declined to comment.

Agarwal had recently tweeted that OYO had witnessed a record 4.5 lakh-plus bookings on New Year’s Eve, its highest bookings per hotel per day for India in the last five years.

He told the townhall that the company’s hotel business has been witnessing a strong growth in monthly revenue per hotel, also known as Gross Booking Value (GBV).

Last week, Oravel Stays Ltd, which operates travel tech firm and brand OYO, said it will refile its draft public listing applications by the middle of next month. Earlier this month, capital markets regulator Sebi had asked the company to refile the draft IPO papers with certain updates.

In September 2021, OYO filed preliminary documents with the Securities and Exchange Board of India (Sebi) for an Rs 8,430 crore IPO.

The launching of the IPO was delayed due to the then volatile market conditions making the company prepare to settle for a lower valuation at around $7-8 billion instead of the $ 11 billion it was targeting initially.