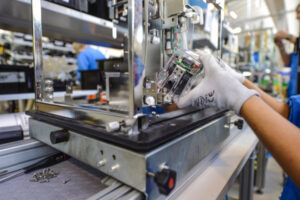

Image Source: Capagro

Paris-based Capagro, an AgriTech and FoodTech company, announced on Thursday that it has launched its second fund, the Capagro Agri-Food Innovation Fund II (Capagro II), at €200M. This launch comes five years after closing the first European venture capital fund focused on AgTech and FoodTech, Capagro I.

Capagro says that it will support AgTech and FoodTech startups for sustainable agriculture and healthy food with the second fund. The fund will act as a lead or co-lead with an initial investment of between €3M and €10M in about 15 European companies.

The fund has already made its first investment with €10M as a lead investor in Paris-based Cuure, a personalised nutrition, and food supplements startup.

Capagro II’s backers and investors

Capagro says that the new fund has the backing of investors and sectoral experts such as Avril Group, LSDH, Terrena, Bel Group, Crédit Agricole Group (IDIA), and Bpifrance.Agricultural cooperative group Euralis and other institutional investors are also participating in the fundraising round.

Much like the previous fund, the new fund will also focus on the entire agri-food value chain — from farm to fork — using an “ecosystemic” strategy that considers interconnected aspects of the ecosystem, its inhabitants, and the food chain as a whole. It will also focus on emerging industries such as “carbon farming,” and more traditional ones such as bio-intrants, robotics, specialty ingredients, novel packaging, alternative proteins, personalised nutrition, and new distribution methods.

Tom Espiard-Cignaco, President & Managing Director of Capagro, says, “The current context reminds us of the urgency of meeting the climate, food, health, social and economic challenges impacting agriculture and food. Innovation in European AgriFoodTech is already providing practical answers to these challenges but also needs financial support at a level proportionate to its potential.”

“Supplying a flow of capital into these dynamic companies is not only a means of meeting these challenges but also an opportunity to nurture new European champions in AgriFoodTech. By supporting these companies as they scale up and accelerate their growth, this new fund is addressing promising young companies that generate sustainable innovations able to bring deep-rooted transformations to the agriculture and food sectors,” he adds.

The company says that global AgriFoodTech investment increased by 85 per cent in 2021 compared to 2020, reaching approximately $52B. At the same time period, AgriFoodTech investment in Europe totalled $9.2B, or about 20 per cent of the worldwide market. There are 55 AgriFoodTech unicorns worldwide, with 25 located in Europe.

Capagro II’s first investment

Caprago II has already made an investment of €10M in Cuure.

Founded in 2019 by Hugo Facchin and Jules Marcilhacy, Cuure’s goal is to improve everyone’s health by combining science and technology in a way that is new, all-encompassing, and personalised.

Hugo Facchin, co-founder and CEO of Cuure, says, “This new investment will allow us to share our vision of health with as many people as possible – easy to access, holistic, and tailored to everyone’s needs. We are also actively working on the internationalisation of the Cuure experience, which is already available in several European countries, including Italy, Germany and Spain. Our ambition is to make Cuure an internationally recognised health and well-being reflex, the European leader in personalised health.”

About Capagro

Capagro SAS is an independent management firm (AMF) recognised by the French Financial Markets Authority. Its first fund, Capagro I, was launched in April 2014 and was the first European venture capital fund focused on agricultural and food technologies.

From 2014 to 2022, Capagro I raised a total of €124M from 13 major industrial groups and financial institutions, and invested it in a portfolio of 13 French and European startups working in areas such as agricultural robotics and equipment (Naïo Technologies, Ecorobotix, BoMill), agricultural e-procurement (Agriconomie), bio-sourced materials (CelluComp), personalised nutrition (Yooji, Nick’s), alternative proteins (La Vie), e-commerce (Japhy, La Belle Vie, Colvin), indoor farming (CleanGreens) and food traceability (eProvenance).

Capagro is a signatory of the “Principles for Responsible Investment” of the United Nations, and uses an ESG and impact approach in its investment work and in its relationships with partners.

Catch our interview with Paul Down, Head of Sales at Intigriti.

![Read more about the article [Funding alert] Xpresslane raises Rs 3 Cr in pre-seed round](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Imageid9w-1596617303202-1623047843998-300x150.jpg)