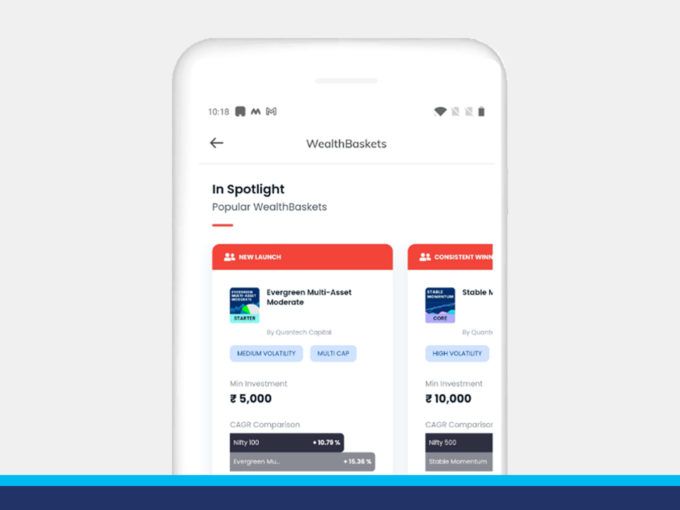

‘WealthBasket’ is a wealth and investment advisory marketplace that will offer curated advisory services and products to retail investors in the country

The users will be able to invest in multiple WealthBaskets via the free starter pack or by subscribing to premium monthly packs available, which will be available on the Paytm Money app

With the new launch, Paytm hopes to be the super app for wealth management in India, which will offer its users everything that they need to invest and grow their wealth

To democratise wealth creation in the country, IPO-bound Paytm’s wholly-owned subsidiary Paytm Money has announced a wealth and investment advisory marketplace on its platform that will offer curated advisory services and products to retail investors.

With its wealth and investment advisory offering, Paytm is entering into an already saturated market, which has over 400 investment tech startups. According to Inc42 Plus data, the current investment tech market is expected to surge at a CAGR of 22.4% and reach a valuation of $14.5 Bn by 2025.

Paytm Money has partnered with investment tech startup WealthDesk to offer investment portfolios that will be called ‘WealthBasket’.

“Paytm Money offers retail investors an opportunity to invest in ideas, themes or trading strategies they believe in with low-cost wealth creation strategies, while also removing unnecessary risks,” said Paytm Money’s CEO, Varun Sridhar.

The new offering will be available on the Paytm Money app and offer a custom portfolio of stocks/ETFs created by SEBI Registered Investment Professionals. The startup posits the themes are something users can relate to and is backed by years of research and backtesting.

For instance, one of the themes is pertinent to investors who believe in the long-term prospects of promoting manufacturing in India. In it, the investors can invest in the ‘Make in India’ WealthBasket, which includes stocks that are well placed to benefit from that theme.

The users will be able to invest in multiple WealthBaskets via the free starter pack or by subscribing to premium monthly packs available.

Paytm said that the WealthBaskets will offer high transparency, liquidity, and control, given that investors will hold the portfolio stocks/ETFs in their respective demat accounts. It would supposedly be cost-effective as there would be no variable charges associated with incremental investments.

Founded in 2010 by Vijay Shekhar Sharma, the IPO-bound Paytm has scaled it’s business into different segments of fintech over the years, including Paytm Payments Bank, Paytm General Insurance, Paytm Life Insurance, Paytm E-Commerce, Paytm Entertainment, among other entities.

Since the onset of the pandemic, India’s stocks have seen nearly a 70% surge in the creation of demat accounts, 80% of which were created by millennials (people under the age of 35). With WealthBasket, Paytm aims to entice the young and millennial investors, who constitute more than 70% of Paytm Money’s user base.

“We have seen a surge in investment activity by Gen-Z and millennial investors on our platform over the last two years. WealthDesk is our first major partner in this journey, and we are excited to offer WealthBaskets, curated investment portfolios created by subject matter experts,” Sridhar said.

The new offering hopes to become the super app for wealth management in India, which will offer its users everything that they need to invest and grow their wealth.