In 2015, it took its technology bank to Toronto in Canada and began operations in the city while also setting up Paytm Labs aiming to build better data-centric products

Ostensibly, the fintech giant will continue its R&D and other operations in the North American country while only shelving the consumer application

This recent decline of the already underperforming stock came after brokerage firm Macquarie retained its ‘underperform’ rating

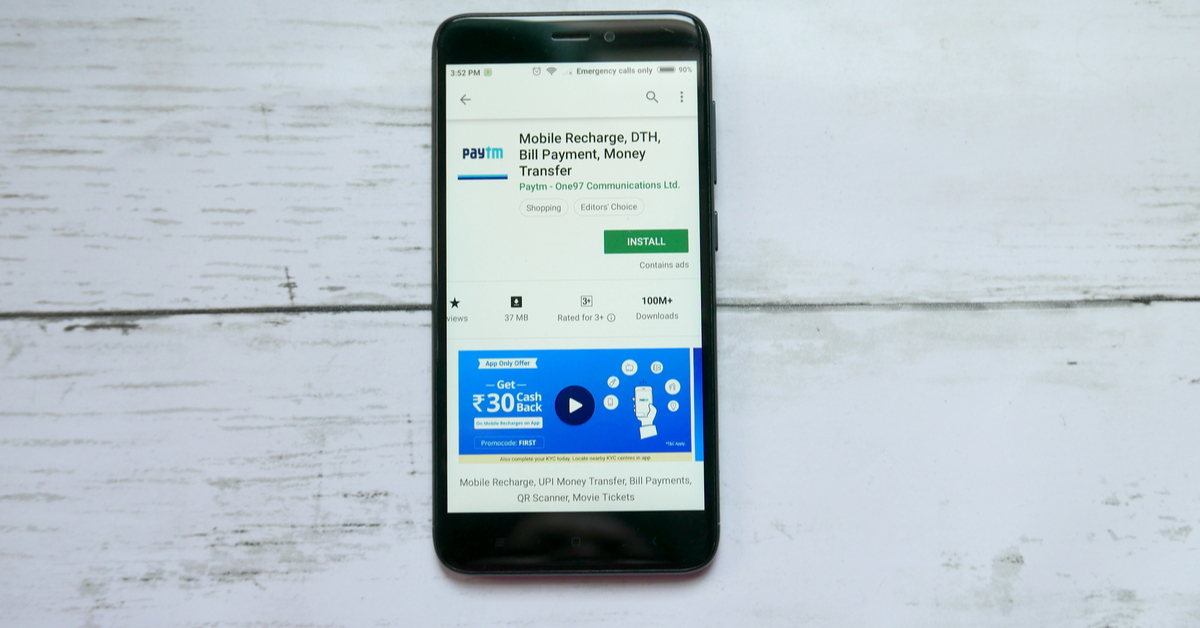

Paytm will be closing down its B2C app in Canada on 14 March, this year. As per the fintech giant, the initiative is to focus more on its India business opportunity, sloughing off the B2C app operation.

“As a part of our Canada operations, we launched a small experiment in the country with a B2C app. In order to focus all our resources on the massive India opportunity, and given the immateriality of the Canada B2C app, we have decided to sunset the Canada B2C,” said a communiqué from the publicly listed fintech startup.

Paytm began its Canada operations in Toronto in 2014. In 2015, it took its technology bank to the city and started operations in the city while also setting up Paytm Labs terethere, aiming to build better data-centric products.

The research and development centre works on Paytm’s data assets and has built products that are integrated into the fintech platform. At one point, it was reportedly working on a mechanism to determine the ‘credibility score’ of a customer.

“This has no relation or impact on the Canada-based Paytm Labs or Paytm’s India business or revenue. We continue to stay committed to our mission of driving financial inclusion in India,” confirmed a statement from the fintech startup.

Ostensibly, Paytm will continue its R&D and other operations in the North American country while only shelving the consumer application.

The development came just days after its stocks hit an all-time low of INR 1,152 on the tenth of this month before hitting rock bottom at INR 1,031.80 yesterday.

This recent decline of the already underperforming stock came after brokerage firm Macquarie retained its ‘underperform’ label on Paytm’s stock while slashing its price target by 25% from INR 1,200 to INR 900.

Since its listing on 18 November last year, Paytm’s share price has been on a roller coaster ride that saw everything from an all-time high of INR 1,961.05, and an all-time low of INR 1,031.80. But even at its record high, it failed to achieve its initial issue price of INR 2,150.