The Bengaluru-headquartered VC firm plans to invest in 60 startups in the next two years

ointOne has so far backed 30 startups, 20 of them in 2021 itself, with a ticket size ranging from $100K to $150K

Startups in PointOne Capital’s portfolio include CreatorStack, Tamasha, Blend and Poshn

Bengaluru headquartered pre-seed VC firm PointOne Capital has announced the final close of its $7 Mn fund. This has come a year after its first close of its maiden fund in December, 2020.

The SEBI-registered alternative investment fund (AIF), PointOne Capital, will be investing in beta or pre-launch stage startups.

Founding partner of PointOne Capital, Mihir Jha said, “Macro sentiment in India has seen a clear shift towards tech and it was very apparent from the huge participation interest we received from investors across profiles, globally.”

The fund will be used to back 60 startups in the next two years. PointOne has so far backed 30 startups, 20 of them in 2021 itself, with a ticket size ranging from $100K to $150K. The VC firm said that it aims to triple its portfolio in the next two years.

The fund so far invested has so far backed startups in sectors such as creator economy, gaming, enterprise SaaS, fintech, healthtech and edtech. Its portfolio includes startups such as CreatorStack which is an engagement tool for creators, an SMB-focused graphic design platform called Blend, B2B marketplace for non-perishable items- Poshn, among others.

The VC firm was founded in 2019 by Mihir Jha and Ravish Ratnam. The team at PointOne Capital also includes Archana Priyadarshini, who serves as a General Partner. It claims that these three team members have collectively worked with more than 1,000 startups, closing over 60 investments in their tenure.

PointOne Capital closed its maiden fund at a time when more and more cash was pumped into the early-stage startups. In 2021, Indian early-stage startups secured a total of $1 Bn in funding across 706 deals, Inc42 data shows. The average ticket size for early-stage funding or the seed funding deals also crossed $2 Mn in 2021.

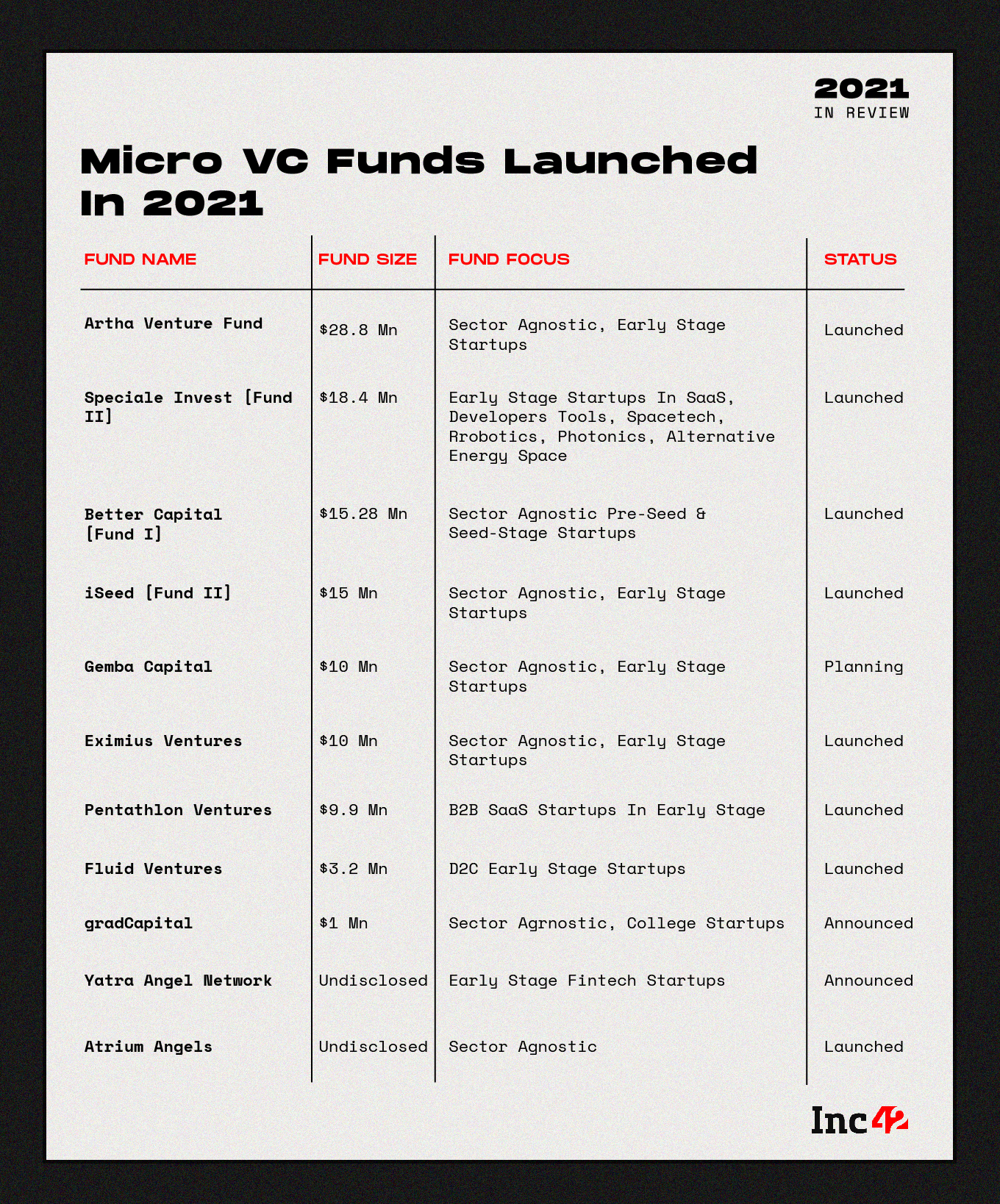

It followed strong performance by new VC funds last year when as many as 62 funds raised over $6.2 Bn across categories (VC, Debt, CVC, Micro VCs) to back the Indian startup economy. These included A91 Capital which raised over $550 Mn, Chiratae Ventures which saw investment worth $337 Mn flowing into the fund, among others.

For the last years, India has also seen the launch of several Micro VC funds that have helped fuel the early-stage funding at a massive stage. In 2021 alone, 11 micro VCs were launched.

![Read more about the article [Funding alert] Social investment startup StockGro raises $5M in pre-Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Imagevjig-1628055178521-300x150.jpg)