IRDAI approved the company’s insurance broking licence enabling PolicyBazaar to undertake insurance aggregation

The company now aims to launch 100 offline retail stores across India

The health insurance portfolio grew 11% year on year in FY 2021 to INR 58,584 Cr, due to the pandemic

Insurance plans aggregator, PolicyBazaar has entered into the insurance broking segment. The company currently has 15 outlets and is working towards scaling up to 100 locations.

Recently, the insurance regulator IRDAI approved the company’s insurance broking licence. This enables PolicyBazaar to venture into different business fields including insurance aggregation under the broking umbrella.

The Gurugram based company’s latest move after this announcement has been to set up comprehensive plans for various segments including fast-growing, small and medium-sized enterprises (SMEs) to serve customers better by having an offline presence.

Approximately three years have passed since PolicyBazaar turned into a unicorn after SoftBank led an over $200 Mn financing in the company in 2018.

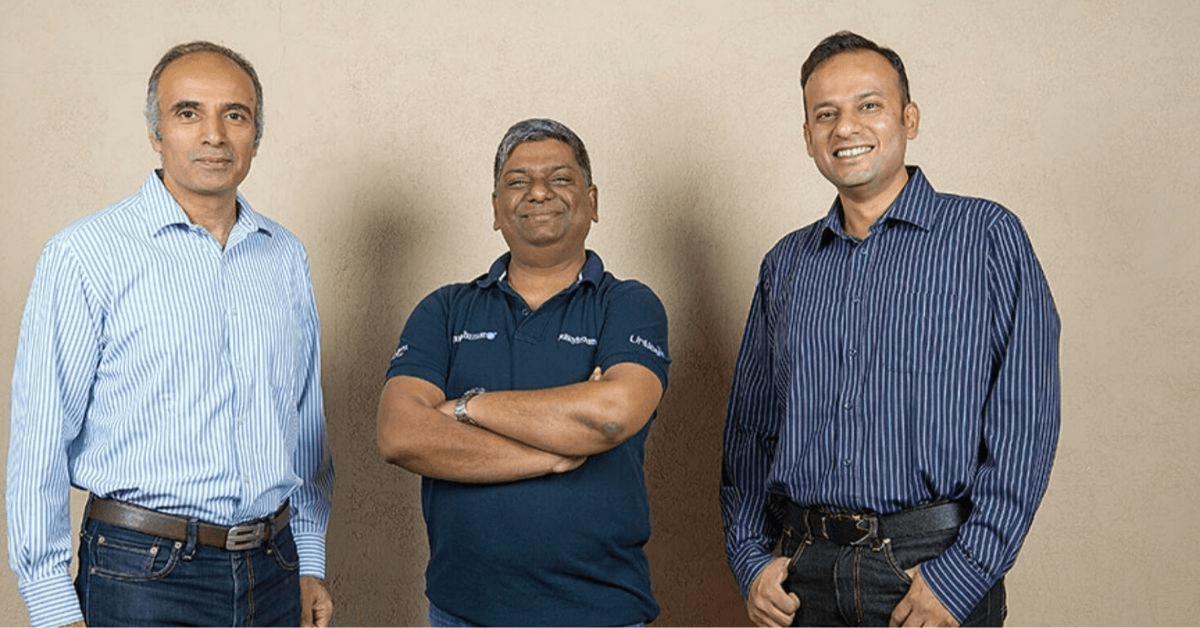

Founded in 2008 by IIT Delhi and IIM Ahmedabad alumni Yashish Dahiya, Alok Bansal and Avaneesh Nirjar, PolicyBazaar is owned by EtechAces Marketing and Consulting. The company also has two other sister companies — PaisaBazaar, which is a lending marketplace, and healthtech venture DocPrime. PaisaBazaar was launched in February 2014 as a financial advisory platform.

The company now plans on launching offline retail stores across India. Currently, the brand has set up 15 stores and it will eventually try to expand this to 100 locations. The main objective of these physical stores remains to provide face-to-face physical assistance for various requirements ranging from financials to insurance-related services.

As a part of scaling up and expanding its services in the offline sector as mentioned above, former executive director of SBI Life Insurance Rajiv Gupta joined the PolicyBazaar team.

The Indian insurance (including insurtech) space has started observing a rising demand since the past year. The onslaught of Covid-19 pandemic since 2020, especially this year’s more deadly second surge, makes insurance a top benefit and most people are likely to choose companies that provide comprehensive insurance cover for employees and their families.

According to figures compiled by the General Insurance Council and the Insurance Regulatory and Development Authority of India (IRDAI), the health insurance portfolio grew 11% year on year in FY21 to INR 58,584 Cr, due to the pandemic.

While in the pre-Covid19 world, insurance was viewed as a mere benefit, today its provision has become a basic necessity. Even in companies and startups, it is now essential to offer this powerful perquisite across the board to ensure better employee welfare, preserve employee morale and thus improve productivity.