Prath Ventures, a Mumbai-based early-stage venture capital firm focused on businesses catering to the digital consumer segment in India, has raised Rs 50 crore as the first close of its maiden fund. It targets raising a total of Rs 225 crore.

The VC firm raised the amount primarily from high net-worth individuals and a few family offices. It expects to make the final close by the end of this year, with institutional investors expected to be the biggest contributors.

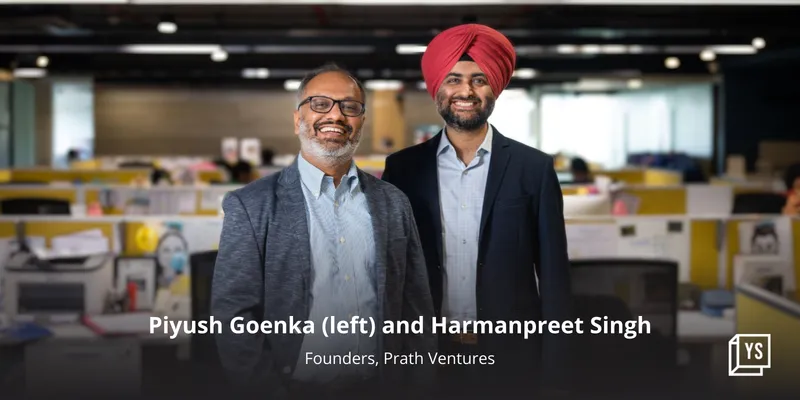

Founded in May 2022 by Piyush Goenka and Harmanpreet Singh, Prath Ventures aims to invest in about 20 startups with fresh capital, with an average cheque size of about Rs 5-6 crore and some portion reserved for follow-on funding.

Piyush earlier worked with Tano India Advisors and has nurtured consumer brands across categories—from the early stage to the growth phase. Harmanpreet has worked with multiple investment firms such as ICICI Ventures, SBI Caps, and Multiples.

“Both of us have done early-stage investments and we were very enthused by the opportunities in the early-stage consumer businesses. We strongly believe that 2023 is going to be a great vintage for VC funds,” said Piyush, Founder and Managing Partner of Prath Ventures.

Prath Ventures predicts that startup investments in the digital consumption space will cut across sectors and focus on businesses that have products or services which directly reach out to the end consumer. The founders believe this is also the right time to invest in consumer-focused startups as valuations are at reasonable levels and businesses are now looking at building sustainable ventures.

“The idea is to become over a period of time the partner of choice for consumer entrepreneurs,” said Harmanpreet.

Prath Ventures is one of a few funds dedicated to the consumer space and has onboarded Saptarishi Senare as part of team expansion. He was earlier part of Wipro Consumer Ventures and Tano Capital, and led consumer investments like MyGlamm, TAC, Power Gummies, and Soulflower.

![Read more about the article [Funding roundup] Open joins unicorn club; BarRaiser, Twixor, Frendy and others raise capital](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/V-05-1600852077699-300x150.png)