Since the pandemic began, the percentage of American workers who have quit their jobs has reached a 20-year high. A Pew Research poll gathered their top three reasons:

- Not making enough money

- No opportunities for advancement

- Tired of unfair/disrespectful treatment

Companies no longer compete on the basis of salary and benefits. Prospective hires are explicitly looking for environments where they can expand their skills while contributing to (and participating in) the company’s success.

Last month at TC Early Stage, Glen Evans, a partner on Greylock’s core talent team, joined me to talk about how founders can optimize the recruiting and hiring process, source talent, and uncover some best practices for closing candidates.

Full TC+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

“The state of the job market is more competitive than I’ve ever seen it,” said Evans, who has two decades of experience overseeing recruiting and team-building at fast-growing companies including Slack, Facebook and Google.

“There’s a very limited supply of talent and probably the largest demand I’ve ever seen, so it’s really important for people to think about how to differentiate and build the foundations and the habits to get talent right in the early days,” he said.

Founders should always be in recruiting mode, says Evans, since small teams can move quickly to shorten time to hire and customize their outreach to meet candidates’ individual economic and emotional requirements. Also important: don’t guess if they’re considering other offers — just ask them.

“Most candidates will tell you, and some won’t,” said Evans. “But if you’re a Series A or a seed startup, and they’re also interviewing at Google and Netflix and Facebook, there’s something off there.”

Thanks very much for reading TC+ this week!

Walter Thompson

Senior Editor, TC+

@yourprotagonist

Psychedelics startups are on a long journey to consumer markets, but these 5 VCs are taking the ride

Image Credits: Leslie Lauren (opens in a new window) / Getty Images

For years, consumers have used substances like cannabis and microdoses of LSD and psilocybin mushrooms to elevate their mood and sharpen mental focus.

Now that regulators and clinicians are re-evaluating these drugs, investors are exploring what this mind-expanding market has to offer.

In the U.S, more than 400 clinics offer ketamine therapy, and MDMA, commonly known as ecstasy, is on track for FDA approval in 2023. In Oakland and Denver, “magic mushrooms” have already been decriminalized for adult use.

To learn more about the applications attracting VCs to psychedelics, reporter Anna Heim interviewed five who are active in the sector:

- Tim Schlidt, co-founder and partner, Palo Santo

- Ryan Zurrer, founder, Vine Ventures

- Dina Burkitbayeva, founder, PsyMed Ventures

- Clara Burtenshaw, partner, Neo Kuma Ventures

- Sa’ad Shah, managing partner, Noetic Fund

Budgeting and planning for your first digital product

Image Credits: Nora Carol Photography (opens in a new window) / Getty Images

If you can envision a solution that solves a customer’s problem, it helps to have technical skills if you want to bring it to market.

But that’s not a requirement.

As long as entrepreneurs “understand how design, technology and development interact,” building a digital product is an attainable goal, writes Charles Fry, CEO of CODE Exits.

In a post that includes a matrix for estimating the costs of building everything from bootstrapped slideware to a large-scale project, Fry explains how non-technical founders should approach budgeting, planning and which priorities first-timers should bear in mind while building.

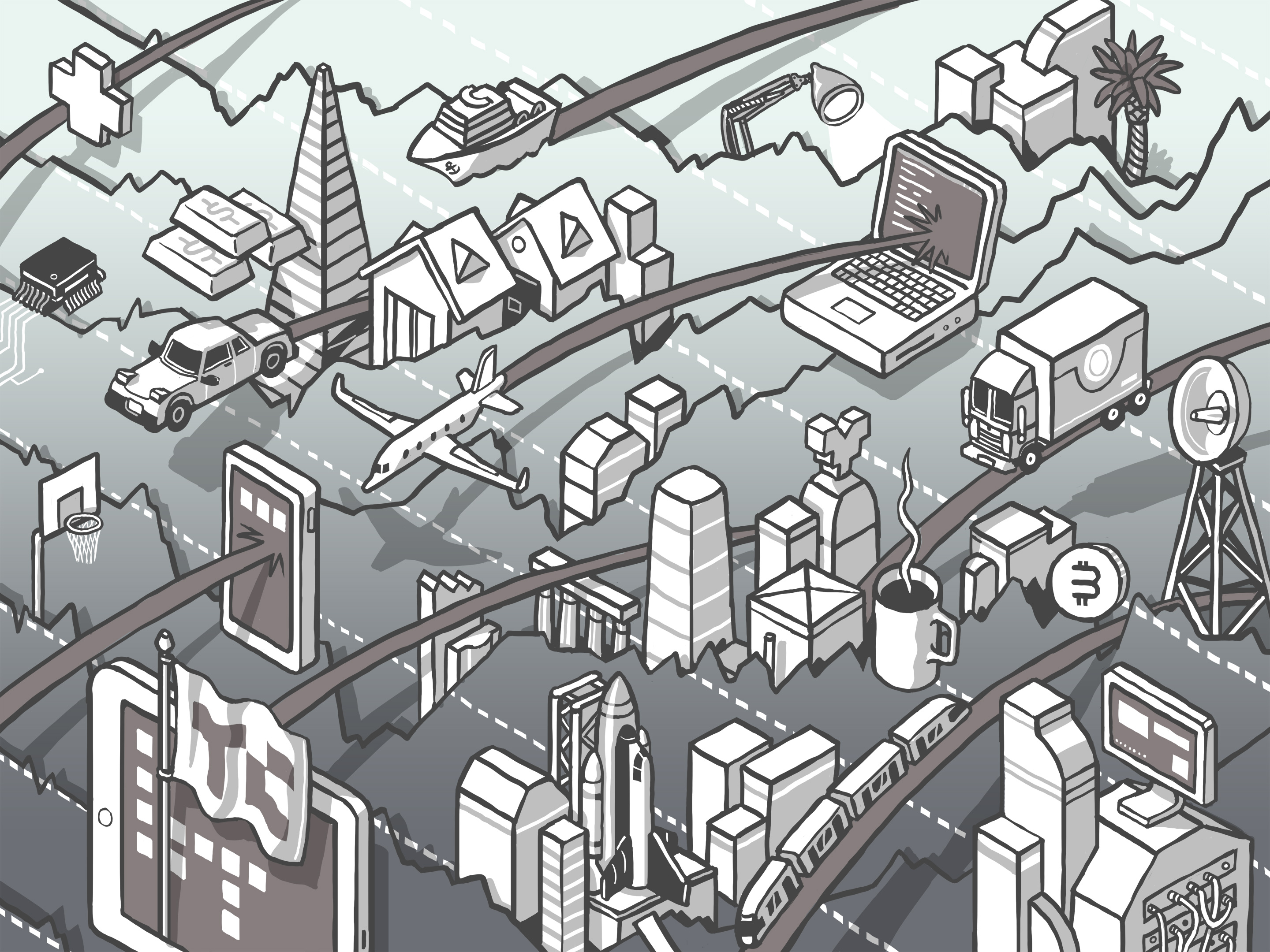

Here’s how far startup valuations fell in Q1 2022

Image Credits: Nigel Sussman (opens in a new window)

According to data from Carta, which makes software that helps startups manage their cap tables, the average valuation of seed rounds in Q1 2022 fell 5%, while Series A rounds declined 28%, Series B rounds shrank by 8%, and Series C rounds plummeted 42%, Alex Wilhelm wrote in The Exchange.

“This is the natural comedown from a multiyear period of frantic deal-making and a turn away from business fundamentals. The pendulum always swings back.”

Dear Sophie: Any USCIS updates on automatic work extensions and premium processing?

Image Credits: Bryce Durbin/TC

Dear Sophie,

My H-1B expires in late May and my employer recently filed an extension. I’m anxious about the results.

Can I add in premium processing and personally pay for it? I’m thinking about self-petitioning an EB-2 NIW green card — what’s the latest on premium processing?

— Hungry in High Tech

Will the corporate venture boom lead to an M&A frenzy?

Image Credits: Nigel Sussman (opens in a new window)

In a market where valuations are on the decline, corporate venture capital is well-positioned to pounce on opportunities. The IPO window may be closed, but investors are still nudging founders toward an exit.

As a result, Alex Wilhelm and Anna Heim speculated in The Exchange that we may see a spurt of M&A led by CVC firms in the second half of the year.

“For earlier-stage startups looking for buyers, it will only be natural to look at their own cap table and give a ring to corporate investors that show up on the list,” they wrote.

“But many times, it will also happen the other way around, with CVCs turning into lead generators for corporate M&A departments.”

Pitch Deck Teardown: Momentum’s $5M seed pitch deck

Image Credits: TC

Momentum, a B2B company that makes sales process automation software, accidentally convinced an early investor to lead its seed round before the founders had even created a pitch deck.

“We showed up on a Friday board meeting. On Monday, they were like, ‘hey, do you have five minutes? We want to sit down with you,’” said CEO and co-founder Santiago Suarez Ordoñez.

“They literally put a term sheet on the table with the exact terms we wanted.”

6 places where investors look for problems when you’re fundraising

Image Credits: Andrey Popov (opens in a new window) / Getty Images

According to Bill Petty, a partner with Tercera, these are the six questions investors are most likely to ask while conducting due diligence:

- How is your historical business performance?

- How are you thinking about and planning for growth?

- What is the ownership breakdown?

- Who are your key clients and what is the nature of the work you are completing for them?

- How are you managing the business? What is your attrition, utilization, bill rates, etc.?

- Are there any outstanding risks?

If you can’t answer these off the top of your head, you’re probably not ready to fundraise. Investors have higher expectations than the friends and family who may have helped you get this far.

“It’s the difference between inviting a friend over for dinner and preparing for an open house,” says Petty.

“With a friend, you might tidy up and shove a few things in the closet. If you have buyers coming to look around, they’re going to open that closet.”

![Read more about the article [Jobs Roundup] These openings may help you land a role at healthtech unicorn Innovaccer](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/innovaccer-founder-final-1639581661937-300x150.png)