This marks Razorpay’s third acquisition and comes following its foray into the B2B SME lending space with the launch of Razorpay Capital in 2019

After this deal, TERA will provide its entire technology stack, risk management capabilities, and onboarding solutions to create and enable a credit line for Razorpay’s merchant network

According to a BCG report, India will create a $1 Tn digital lending opportunity between 2019 and 2023

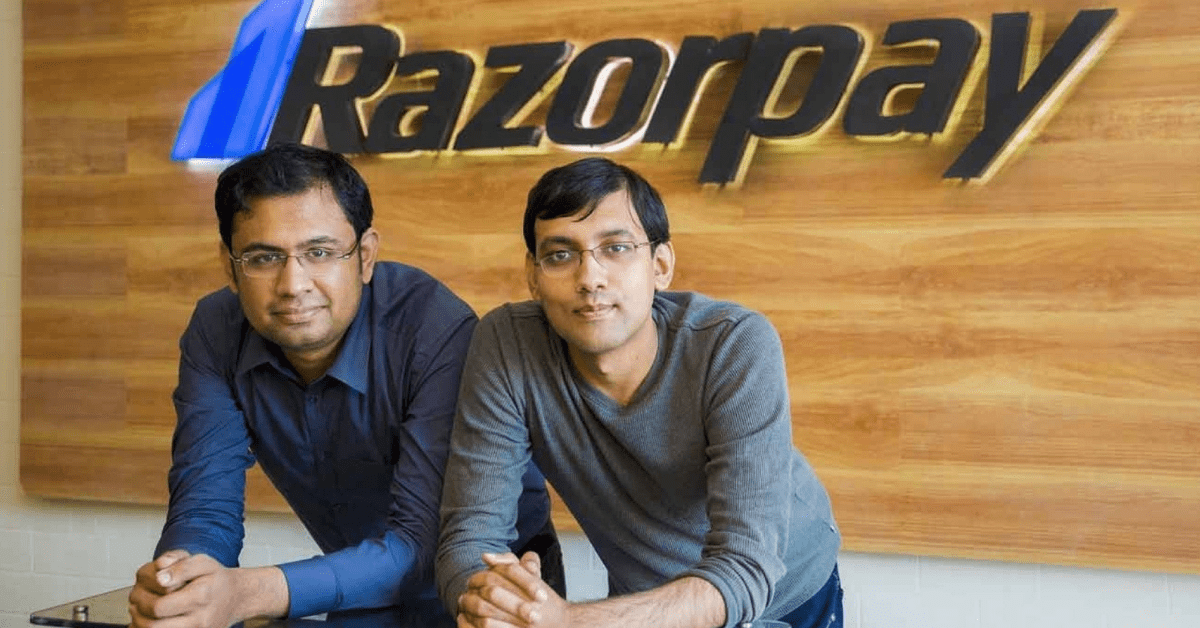

Financial solutions company Razorpay today announced its acquisition of TERA Finlabs, an AI-based risk tech SaaS Platform, for an undisclosed amount. TERA Finlabs is a Bengaluru-based startup that provides technology, risk and capital solutions to enable innovative embedded financing solutions for businesses. TERA Finlabs is an Indian subsidiary of Gain Credit, a UK-based digital lender, which was launched in 2018 to expand their global footprint in digital lending.

This marks Razorpay’s third acquisition and comes following its foray into the B2B SME lending space with the launch of Razorpay Capital in 2019. Razorpay Capital has been solving for liquidity and cash-flow challenges of SMEs, by offering instant settlements and business loans.

Prior to this, Razorpay acquired Thirdwatch (an Artificial Intelligence-driven company that helps reduce Return-to-Origin (RTO) fraud losses in e-commerce) in 2018 and Opfin (a payroll management software company) in 2019.

After this deal, TERA will provide its entire technology stack, risk management capabilities, and onboarding solutions to create and enable a credit line for Razorpay’s merchant network.

Speaking about their third acquisition in less than three years, Harshil Mathur, CEO and cofounder, Razorpay said, “In India, banks are wary of providing business loans to startups and new SMEs due to the risks attached to new revenue models of startups. Through our lending platform, Razorpay Capital, we have been striving to solve these cash flow challenges, making it easier for businesses to get finance and grow. And progressing in that journey, an acquisition such as this fits perfectly with our vision of developing tailor-made affordable credit solutions for the underbanked small businesses across industries so that they can digitally transform and disrupt. The team at TERA FinLabs comes with exceptional domain knowledge in credit underwriting & risk management and we see immense value in TERA Finlabs core lending infrastructure capabilities. Together, we are looking forward to addressing newer working capital issues faced by MSMEs and soon create a major dent in the credit space in the next few years.”

Pradeep Rathnam, cofounder and CEO, TERA Finlabs said, “MSMEs were an underserved market for a long time. However, in the last 16 months, they have started to show rapid growth with their adoption of digital. And this has created an opportunity for significant disruptions in the lending sector – Embedded Credit is one such innovation that I’m certain will transform this space. There couldn’t have been a better time than now for us to join hands with Razorpay and its technological capabilities to support the MSME segment.”

In 2018, Boston Consulting Group had come up with a report estimating India will create a $1 Tn digital lending opportunity between 2019 and 2023. While the total retail loan disbursement was expected to grow at 2.2x, from $330 Bn in 2018 to $730 Bn by 2023, the report estimated the digital penetration in loan disbursal from 23% in 2018 to 48% in 2023, witnessing 4.67x growth in digital lending.

While clearly there is a high growth ceiling, tapping the B2B lending market space currently has not been easy for digital lending startups and certainly not as easy as consumer lending. In stark contrast to the shockingly low credit bureau coverage in the MSME sector of under 10%, the credit bureau coverage of consumers increased from 10.8% in 2007 to over 43% in 2018.