Leading payments processor on Tuesday launched MandateHQ, a product to help banks comply with the Reserve Bank of India’s guidelines on recurring payments, in partnership with Mastercard.

In a bid to make recurring payments in India safer, the RBI introduced an ‘Additional Factor of Authentication’ (AFA), where it asked banks to notify their customers 24 hours in advance about any recurring payments, and only process it once they get the go-ahead. The pre-transaction notification via SMS or email will have to include the name of the merchant, the amount due, and the date and time of debit, the central banking authority said.

The new rule will be applicable to all types of recurring payments, such as phone bills, OTT subscription charges, SIPs, etc, as per the RBI.

Razorpay’s API-based plug-and-play product is expected to help make this process a lot easier for banks by helping automate the entire process, end-to-end — right from creating, viewing, and updating the recurring payment mandate, to cancelling and paying them as per the customer’s inputs.

The platform will also help banks enable a 24-hour pre-debit notification via email, SMS and WhatsApp, as well as provide end-users with a portal to manage card mandates, the company said in a press release.

The RBI’s directives come into effect from September 30, 2021, and is expected to boost recurring payments in India, especially those via debit cards.

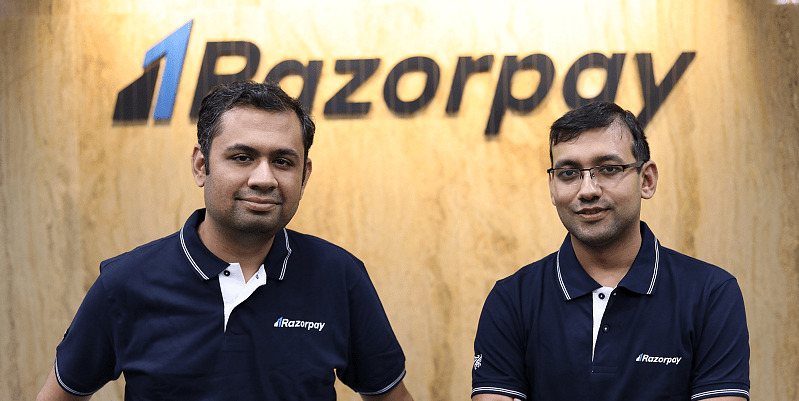

“We’ve seen great traction in recurring payments via credit cards, and UPI-Autopay already, but debit card users have lagged. Considering India has nearly 900 million debit card users, recurring payments have the potential to become the norm in the country, especially as subscription-based services increase,” Shashank Kumar, Razorpay’s Co-founder and CTO told YS in a quick conversation ahead of the public release announcing the new compliance product.

When it comes to monthly vs annual subscriptions, most Indian companies, including OTT players such as Zee5 and Hotstar, prefer payments for three, six or 12 months, cumulatively, since most people use their debit cards to carry out online transactions, and manually input a one-time password for each transaction, as per the latest digital payments mandate.

But the RBI’s new guidelines are expected to give customers better control over their recurring payments, giving them the option to halt or modify before the payment even occurs.

That is expected to help more subscription-based platforms move to monthly payments systems, where instead of paying a big, lumpsum amount upfront, customers can choose to break it up into smaller instalments, and only for as long as they need.

“While (the RBI’s guidelines) have created a certain level of challenge for the ecosystem in how they will pay monthly bills post-September, we want to make it easier and faster for banks to implement the e-mandate framework issued by RBI and also ensure that businesses and end-consumers are not inconvenienced. We’ve developed multiple products with Mastercard in the past and we are happy to launch MandateHQ with India’s leading banks, and look forward to partnering with more,” Shashank Kumar said in a press release.

The MandateHQ platform is designed to easily integrate with any bank quickly, and can be put to use within seven days, the startup said. Three leading Indians banks are already using the service, and more are in the process of hashing out final details, Razorpay added.

![Read more about the article [Funding alert] Infosys to invest $1M in ideaForge Technology](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/Narayana-Murthy-Infosys-1580279407025-300x150.png)