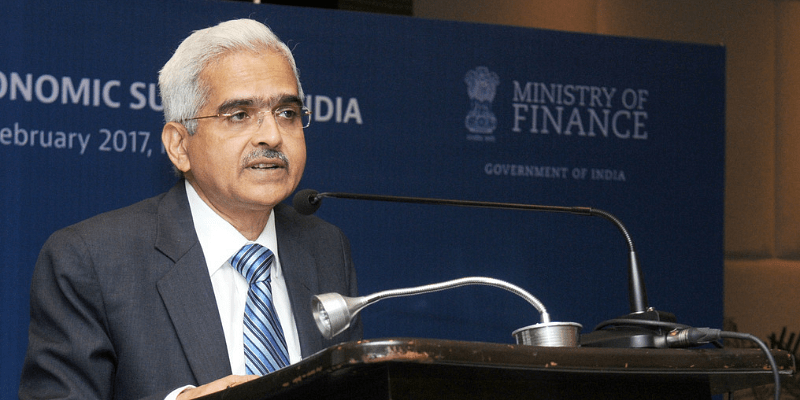

Economic activity has regained momentum from late May after the dent caused by the second wave of COVID-19, and the pandemic’s impact on the overall asset quality has been less than expected, Reserve Bank Governor Shaktikanta Das said on Thursday.

However, Das flagged rising data breaches and cyber attacks as among the risks for the recovering economy, along with others like firming global commodity prices.

The governor also said the second wave had a “grievous toll” on the country.

“The recovery that had commenced in the second half of 2020-21 was dented in April-May 2021, but with the wave of infections abating as rapidly as it had set in, economic activity has started to look up in late May and early June,” he said in the bi-annual Financial Stability Report of the RBI.

He said the “stepped-up pace and scale of vaccination” is helping communities and gradually releasing the economy from regional and localised containment measures, but there should not be any complacency by way of letting the guard down.

The governor said the dent on balance sheets and performance of financial institutions in India has been much less than what was projected earlier.

In the last FSR, the RBI had projected the GNPA (gross non-performing assets) ratio of banks rising to 13.5 percent in a year by September from 7.5 percent.

However, the latest issue of the FSR suggests that the GNPAs remained flat at 7.5 percent in March 2021 as well, and are expected to rise to only 9.8 percent as per the baseline estimate.

Das said capital and liquidity buffers at financial institutions are “reasonably resilient” to withstand any future shocks. He said while the recovery is underway, new risks have emerged on the horizon, including the still nascent and mending state of the upturn, international commodity prices and inflationary pressures, and rising incidence of data breaches and cyber-attacks.

On cyber-attacks, the FSR said we have witnessed attempts to target the payment ecosystem of the country by adopting multiple modus operandi, including the theft of payment card credentials and compromise of ATM infrastructure.

The Computer Security Incident Response Team for the Financial Sector (CSIRT-Fin) under the Indian Computer Emergency Response Team (CERTIn) issued various early warning threat intelligence alerts in near real-time to enable mitigation of attacks by the financial sector organisations, it said.

The FSR also flagged cyber attacks as a challenge for banks along with climate-related risks, increased competition from the entry of fintechs and the growing presence of big tech in financial services.

The governor emphasised that sustained policy support accompanied by further fortification of capital and liquidity buffers by financial entities remain vital to tackle the risks.

The financial system is on the front foot to aid recovery, but the priority is to maintain and preserve financial stability, he made it clear.

Das, who has in the past expressed concerns over rising markets from a financial stability perspective, said financial markets have been boosted by the strengthening signs of the pandemic’s abatement, the growing pace and breadth of the vaccination drive and renewed hopes of the economy.

The financial system can take the lead in creating the conditions for the economy to recover and thrive, he said, adding that stronger capital positions, good governance, and efficiency in financial intermediation will be the touchstones of this endeavour.