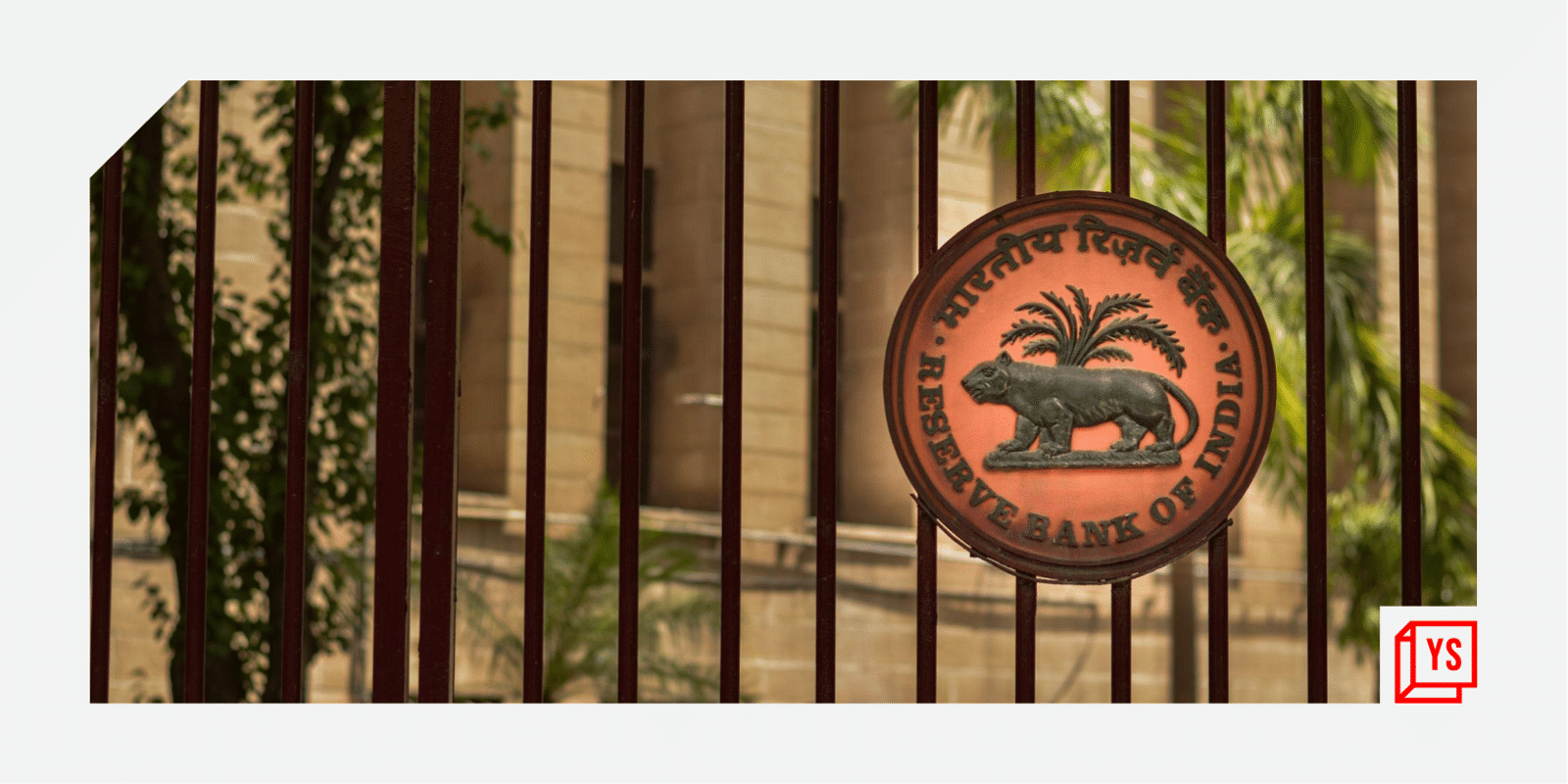

The Reserve Bank of India (RBI) has hiked the repo rate by another 50 basis, or 0.50 percent, making lending costlier, as it seeks to tame India’s stubborn inflation rate.

The central bank has projected the inflation rate to be 6.7 percent for fiscal year 2022-23 (FY23), up from 5.7 percent earlier. GDP forecast has been retained at 7.2 percent.

All these are expected to have a sharp bearing on the startup ecosystem as several companies have or are laying off staff citing pessimistic macroeconomic outlook. The hike in the repo rate—at which RBI lends short-term funds to commercial banks—would also likely impact the fintech sector, particularly companies involved in lending and ‘buy now, pay later’ (BNPL) products.

RBI Governor Shaktikanta Das

The repo rate hike to 4.9 percent is the second in a span of five weeks, following RBI Governor Shaktikanta Das’ surprise increase in May. The latest hike was an unanimous decision of the monetary policy committee.

In his post-policy statement, Governer Das highlighted that during these difficult and challenging times, the Indian economy has remained resilient, supported by strong macroeconomic fundamentals and buffers.

“The recovery has gained momentum despite the pandemic and the war,” Governor Das said. “On the other hand, inflation has steeply increased much beyond the upper tolerance level.”

A large part of the rise in inflation, in RBI’s view, is primarily attributed to a series of supply shocks linked to the war. “In these circumstances, we have started a gradual and orderly withdrawal of extraordinary accommodation instituted during the pandemic,” Governor Das added.

The increase, however, was on the expected lines for market participants. The stock markets opened lower in early morning trade though the decline was not very sharp.