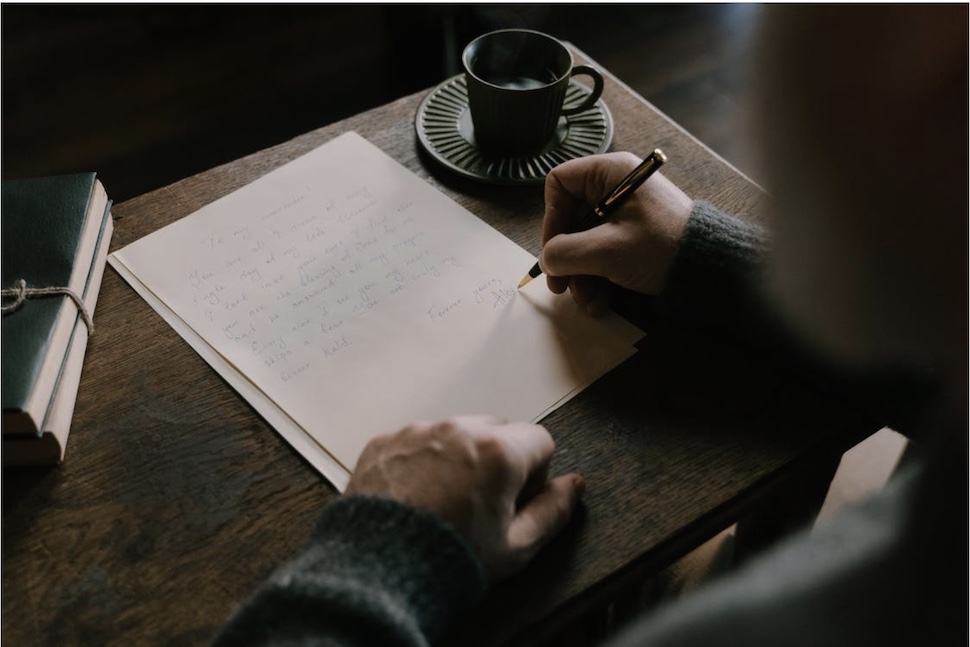

A trust is a legal arrangement between you (the trustor) and the trustee. A trustee is a person or entity that’s responsible for managing the trustor’s assets when they pass. The trustor can use a trust to assign beneficiaries and transfer assets, like property, bank accounts, and investments.

Business owners can transfer their business interests and assets to their beneficiaries, possibly without probate, to reduce the estate and gift taxes their beneficiaries have to pay on the assets.

Why Do Wealthy Individuals Use Trusts?

The term “the rich get richer” breeds a lot of frustration, and it isn’t hard to see why. Millions of Americans struggle daily while thousands of rich families continue to make more money across multiple generations. The secret of their continued success is dynastic wealth.

Wealthy individuals are able to transfer their money to the next generation by setting up a family trust. Dynasty trusts can further solidify a family’s wealth by removing or decreasing estate taxes. In the end, trusts protect your family from generational poverty and the taxman.

If you own a business, you should transfer your assets to your beneficiaries. This prevents the government from seizing your assets when you die, potentially leaving your family with nothing.

Best Trusts for Business Owners (and Why)

Not everyone needs the same type of trust. Personal trusts and business trusts aren’t made equally, so you need to find the right trust that offers the best benefits for your company.

1. Life Insurance Trust

If you don’t have a lot of liquid assets and your business is worth more than the limit of estate taxes, a life insurance trust is your best option. To set one up, take out a life insurance policy and place it in a life insurance trust. Keep in mind that the policy would be subject to estate tax.

However, the life insurance trust wouldn’t add extra tax on top of the life insurance, nor would it charge estate tax on the majority of your assets. Essentially, the policy would pay the estate taxes, which would allow you to give your business to your children without liquidating it.

2. Grantor Retained Annuity Trust

If you structure your business as an S corp, a grantor retained annuity trust should work for you. The business transfer would exclude estate tax because the trust offers the beneficiaries income from an annuity, which could be a fixed amount of money or a percentage of the trust.

Since a grantor retained annuity trust is irrevocable, you cannot adjust its terms once made. If a business wants to choose this trust, it should generate enough income to pay the beneficiary. You can also transfer bonds, mutual funds, shares, and stocks through this trust.

3. Charitable Trust

Business owners can use two types of charitable trusts: a lead or remainder trust. Both are irrevocable, so you have to be sure you want to give to the charity of your choice. Both trusts can be used as a reputation builder, and a means to leave money to your family when you pass.

The difference between a lead and remainder trust is slight. In a lead trust, the trustor gives a charity a set amount of assets over a period of time, and the beneficiaries are given what’s left. In a remainder trust, it’s the opposite. The beneficiary gets the assets first, then the charity.

Benefits of a Living Trust

Business owners can set up a living trust ahead of time to ensure their business continues to operate. This is typically why business owners will use a revocable trust, so both they and their families can continue earning assets. Upon their death, assets of the trust go to the beneficiary.

![Read more about the article [Funding alert] Join Ventures raises $10M in Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2022/02/Join-final-1-1645023341580-300x150.png)