Customer retention is a problem for the ages. Every industry struggles with it—from media services that retain 84% of customers on average to retail brands that only find 63% people returning to them—but brands deeply care about customer retention.

Serial entrepreneurs Piyush Jain and Vivek Agarwal realised this while working on a previous venture called Limetray, a restaurant software company which counted Burger King, Domino’s, and Canada-based Tim Hortons among its clients.

“It became clear that we had to build something for the retention space,” says Piyush. He is the Co-founder and CEO of Loop Subscriptions, a subscription management app built on top of Shopify, a Canadian multinational ecommerce company.

The subscription management app, driven by an application programming interface, uses gamification and a subscription model to help brands retain customers.

Early success

The team launched the minimum viable product within 3-4 weeks of setting up the company. By October 2021, Loop Subscription app had started getting paid customers, with the first being a baby products company.

“Last year, we grew 14X in terms of overall revenue numbers,” says Piyush, without revealing the exact annual recurring revenue (ARR).

The startup experimented with a free product within the first couple of months from its launch to onboard as many customers as possible, and tweaked its pricing about 4-5 times. The Delhi-based co-founder claims that the startup’s product is priced 35-40% lower than its competition.

The founder says the SaaS platform turned profitable within six months of operations despite the holiday season lull in the North American and European markets in November and December in 2021.

Customer retention strategies

The startup solves for customer retention, as well as increasing merchant revenues, by gamifying the subscription management process. This enables brands to create offers, discounts, swapping, and free trial options with the subscription, reducing product cancellations by an average 30%, Piyush says.

Giving an example, he says that if a brand is giving a discount of 20% for subscribing to a particular product, then on the second order, it can be increased to 25%. On the fifth order, the brand can promise a free gift—such as giving a new trial product—and on the tenth, it could swap with another product.

“The product needs to be built for the marketing managers or the people who are responsible for retention or growth in the direct-to-consumer (D2C) companies. That’s our audience. They can experiment and play around with a couple of things,” he explains.

In addition, Piyush says the startup has also strived to make it easier for clients’ customers with user-friendly features. These include access to the customer portal without one-time password (OTP) and password, viewing subscriptions related to a brand in one place, rescheduling and skipping orders, swapping products, and cancelling subscriptions.

Though the platform works on a self-serve model to enable brands to set up Loop Subscriptions accounts, the startup also reaches out to its customers to help them use the product better. For enterprise customers on premium plans, the 12-member team holds one-on-one monthly meetings to assist them with their growth strategies.

The platform has also integrated with SMS marketing, analytics, and support tools. Among the key integrations is Klaviyo, a Boston-based marketing automation platform for email and SMS, whose Co-founder and Chief Product Officer Ed Hallen, is also one of the startup’s angel investors.

The product design and introduction of features such as solving for payment-related issues during the checkout process has helped brands reduce its customers’ tickets by about 40-45%, Piyush claims.

Team building Loop Subscriptions

Pricing advantage

With three pricing plans: free, growth ($99 per month), and enterprise ($399 per month), the startup’s annual contract value (ACV) is around $10,000. ACV is a SaaS metric that depicts the worth of an ongoing customer contract by averaging and normalising its value over a year.

Piyush says there is hardly any churn among “enterprise customers”, which account for about 90-95% of the startup’s total revenue. Though the customers at the lower end of their pricing do churn, the team does not track the numbers actively. Interestingly, Loop Subscriptions currently earns about a quarter of its revenues from companies that started with the free plan and have scaled to the ‘enterprise’ category.

The startup’s definition of “enterprise customers” is slightly different, and broadly speaking, these would classify as small and medium businesses (revenue-wise) in the overall ecosystem. Loop defines enterprise customers as those whose gross merchandise value—the sum of all merchandise sold in a period of time—is above $5 million and have the potential to earn over $1 million from subscriptions.

It works with a few brands that earn over $100 million in revenue, of which about 30-35% comes in via subscriptions.

Most of Loop Subscriptions’ customers are in the US, followed by Europe, the UK, Australia, and Southeast Asia. Typically, these brands sell products such as supplements, beverages, baby products, and home goods that are repeat purchases.

Though it has zero Indian customers currently, a few companies have reached out to the startup though Piyush says they will focus on the domestic market once subscriptions become a bit more relevant in India.

Referrals and migrations

The co-founder says that about 50% of their customers have onboarded through word of mouth and referrals. The rest have come from US-based agencies (advertisement and web development companies) and marketing campaigns targeting the ecommerce and D2C categories. Such a high percentage of customer referrals has been a contributing factor to the startup’s quick profitability.

Over the last year, the company has onboarded 1,600 customers, of which a quarter are paying customers. Over 12% have migrated from US competitors including Recharge, OrderGroove, and Bold.

Some of the customers the startup has migrated from its competitors’ platforms include Dr Livingood, a US-based health and wellness brand, Lilac St, a Seattle-based beauty brand, and Miami-based health brand Alkaline Herb Shop.

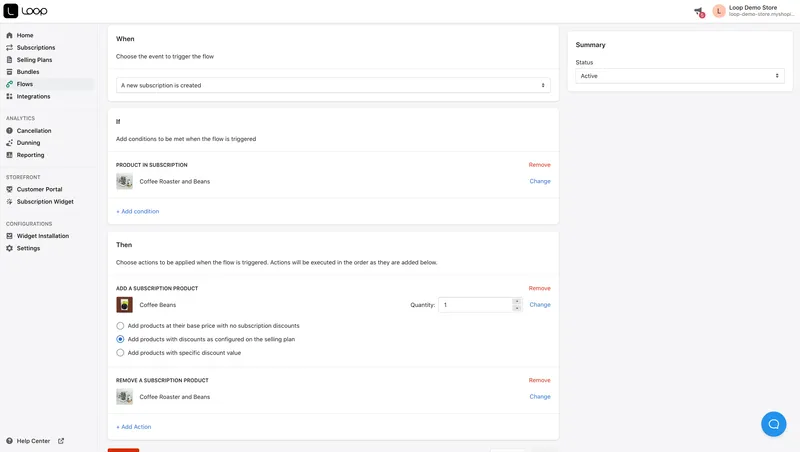

Loop Subscriptions’ platform screenshot

Investor interest

Within a few months of setting up shop in 2021, the Delaware-registered startup managed to raise $2 million in February 2022 from 58 angel investors. Piyush says venture capitalists showed huge interest but they decided to stick to angel investors for the pre-seed round.

“We didn’t have a huge network in the North American market. We wanted the investment round to also enable us to reach out to a lot of people. It was not necessarily an anti-VC (venture capital) move,” Piyush explains in a conversation with YourStory. “But the idea was to get more angel investors who can help us expand our network and be relatable at our current stage.”

Most of the angel investors are software-as-a-service (SaaS) founders based in the US and India including Gokul Rajaram of food delivery platform Doordash and Ed Hallen. Piyush says they helped the company reach out to potential customers, mainly in the US and Canadian markets, and scale the SaaS business.

The global subscription ecommerce market was valued at $96.6 billion in 2022 and is projected to grow 25X to $2.4 trillion by 2028, according to Research and Markets. Loop Subscriptions wants to ride on this massive wave.

“Ecommerce is at a very nascent stage right now and will evolve drastically. Our product vision is to build out the entire retention operating system,” says Piyush.

While the startup’s current strategies are short- to medium-based—thinking six months at a time—the team is looking to expand across all categories and integrate with loyalty and referral apps.

![Read more about the article [Jobs Roundup] Work at India’s latest unicorn and SaaS startup BrowserStack with these openings](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/BSteam-1623748421650-300x169.jpg)

![Read more about the article [Jobs Roundup] Fresh from $225M fundraise, SaaS unicorn Postman is hiring across these openings](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/AbhinavAsthana-53-1629455357287-300x150.png)

![Read more about the article [Startup Bharat] Why this boy from Bihar quit a government job to start a coworking startup](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/9de83379-8521-48d6-ac73-1eb37dda86461-1619594214839-300x150.jpg)