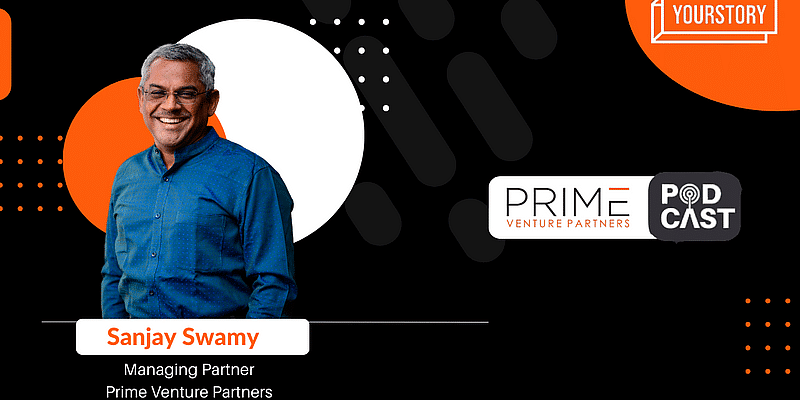

Startup veterans—Sanjay Swamy and Shripati Acharya—have left their mark on the entrepreneurial ecosystem. Today, they are stirring the new-age founders to lead the Digital India revolution with Prime Venture Partners.

2022 has been a challenging year for the Indian startup ecosystem and tech in general. But in 2023, a whole new world awaits, especially for the fintech sector.

In this holiday special episode, Sanjay and Shripati, the Managing Partners of Prime Venture Partners—who usually sit on the other side of the table—discuss the exciting possibilities awaiting the sector and how entrepreneurs can grow in it.

Fintech in 2023

Contrary to the obvious interpretation, the regulator is starting to put proper guardrails around what fintech is, what it is expected to do, and what the regulatory parties are intended to do. And, with things becoming more straight-jacketed, it will create a backdrop for plenty of opportunities.

With opportunities starting to emerge across lending, investment, insurance, payments, and new banks, the incumbents—the banks, NBFCs, etc.—will also need to up their game.

As the digital infrastructure is already set in India, consumer expectations of a digital-first experience, like getting a loan approval within minutes, e-KYC, and such, are already set.

“You’ll have fintech with more financial service providers who are either getting licences themselves, or partnering with those having them and bringing a customer-facing solution to the market,” Sanjay says.

He continues, “On the other hand, you’ll now have an opportunity for infrastructure technology providers, who are going to build on top of the bank’s core infrastructure and enable the banks or the NBFCs themselves in a much more digital experience for their customers.”

Making successful partnerships with banks

For a fintech to work, a strong, dependable, and trusting bank partnership is a core requirement. When it comes to a bank, the regulator is holding the bank accountable. So, what fintechs need is distribution, product innovation, and collection efficiency to distinguish themselves and create trust.

Drawing from his experience, Sanjay states that having an alumnus of the banking industry in the founding team always works. Besides, a fintech needs to have strong tech jobs. And, for a successful fintech, the co-founder should be an amazing product person.

“I think, the reason why fintech should exist is that they can provide a level of product capability, innovation, and customer experience the incumbents haven’t been able to in over the years,” he says.

Besides the team, startups need to build products by taking expectations of data privacy, PCI DSS compliance, software compliance, etc., into account from day zero.

“These things are best done when it’s a young company and you can maintain that rigour. The third important thing is that fintechs should not depend on one partner. Right from the beginning, you have to design it to be where it’s always gonna be a multi-partner, although you may launch with one,” Sanjay advises.

How to take your idea to Prime Ventures as a startup

“We started with fintech, probably even before the term existed, and it’s been a big part of our heart and our brain. And quite honestly, if you are a startup, a founder with an idea, just drop us a note on Twitter, WhatsApp, or email,” says Sanjay.

Prime has worked successfully with founders without an idea—whether it was at the beginning or during a happy pivoting.

“I think, when we approach this from a co-creation—from let’s create, let’s see where the big opportunities are, big pain points are, the big profit pools are, and if this team is well-suited for that opportunity—then we can do a lot of work together,” he says.

As fintech in India is going to be a massive space, Sanjay urges startups and founders to not wait; make some iterations and get something going. Concluding, he advises founders to keep an open mind about where the opportunities lie and how the market will evolve.

You can listen to the full episode here.

Note:

02:00: Fintech is a gift that keeps on giving

07:00: FLDG, the regulator, and the regulated

10:00: How to partner with banks

16:00: Flow-based lending and new opportunities

25:00: Opportunities in infrastructure for banking

30:00: Co-creation and big opportunities

![Read more about the article [Weekly funding roundup March 14-18] Steep decline in venture capital inflow into Indian startups](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/funding-roundup-1-1639749230575-300x150.png)