SEBI is reportedly in internal discussions on why many stocks have fallen far below their IPO issue prices

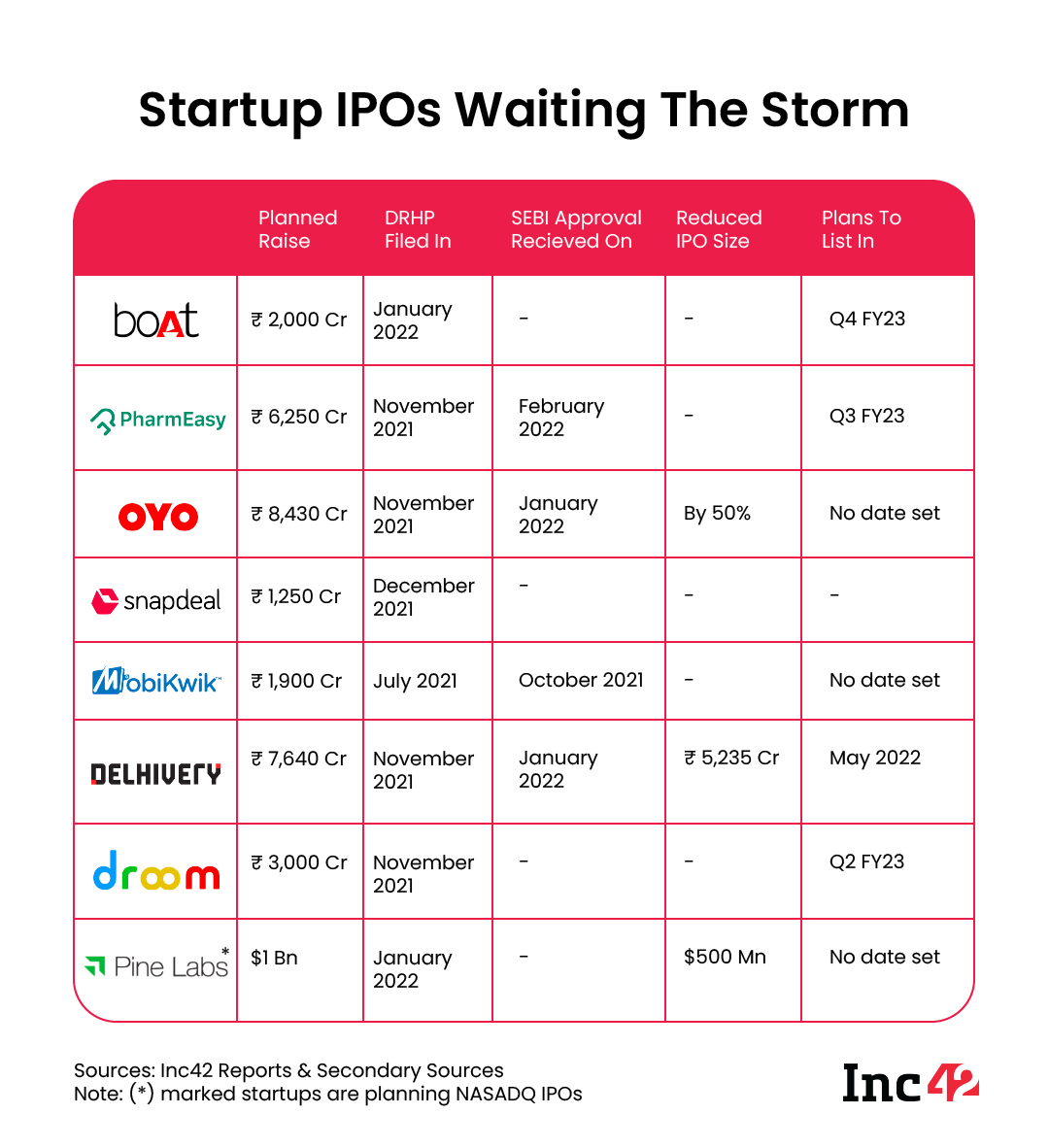

Currently, the likes of boAt (INR 2,000 Cr), Oyo Rooms (INR 8,430 Cr), and Droom (INR 3,000 Cr), among others, are waiting for kinder seas to set sail

SEBI has also been looking at ways to modify the IPO process, starting with allowing confidential submission of Pre-IPO documents

The Securities and Exchange Board of India (SEBI) is reportedly in internal discussions on why many stocks, most importantly, startup stocks, have fallen far below their IPO issue prices. The market regulator is also telling IPO hopefuls to reconsider their valuations.

A Mint report cited a source as saying, “The regulator is engaged in extensive discussions on many such startup listings to understand what went wrong and if there is a need for tighter regulations.”

Currently, the likes of boAt (INR 2,000 Cr), Oyo Rooms (INR 8,430 Cr), and Droom (INR 3,000 Cr), among others, are waiting for kinder seas to set sail.

Recently, SEBI has started a move to introduce changes in the process of taking a company to IPO. One of these changes includes an option to allow IPO-bound companies to submit their Pre-IPO documents confidentially. The market regulator said the same in a public report on comment dated May 11.

“It is gathered that one of the concerns for issuer companies is a disclosure of sensitive information in the DRHP, which may be beneficial to its competitors, without the certainty that the initial public issuance would be executed,” SEBI said.

In the discussion paper, SEBI added that the Primary Market Advisory Committee (PMAC) had deliberated the matter and favourably considered permitting a ‘pre-filed’ document with SEBI, and the market regulator has put the question to public comments till June 6.

The PMAC also suggested a regulatory framework for the aforementioned pre-filed documents.

Startup IPOs – What Next?

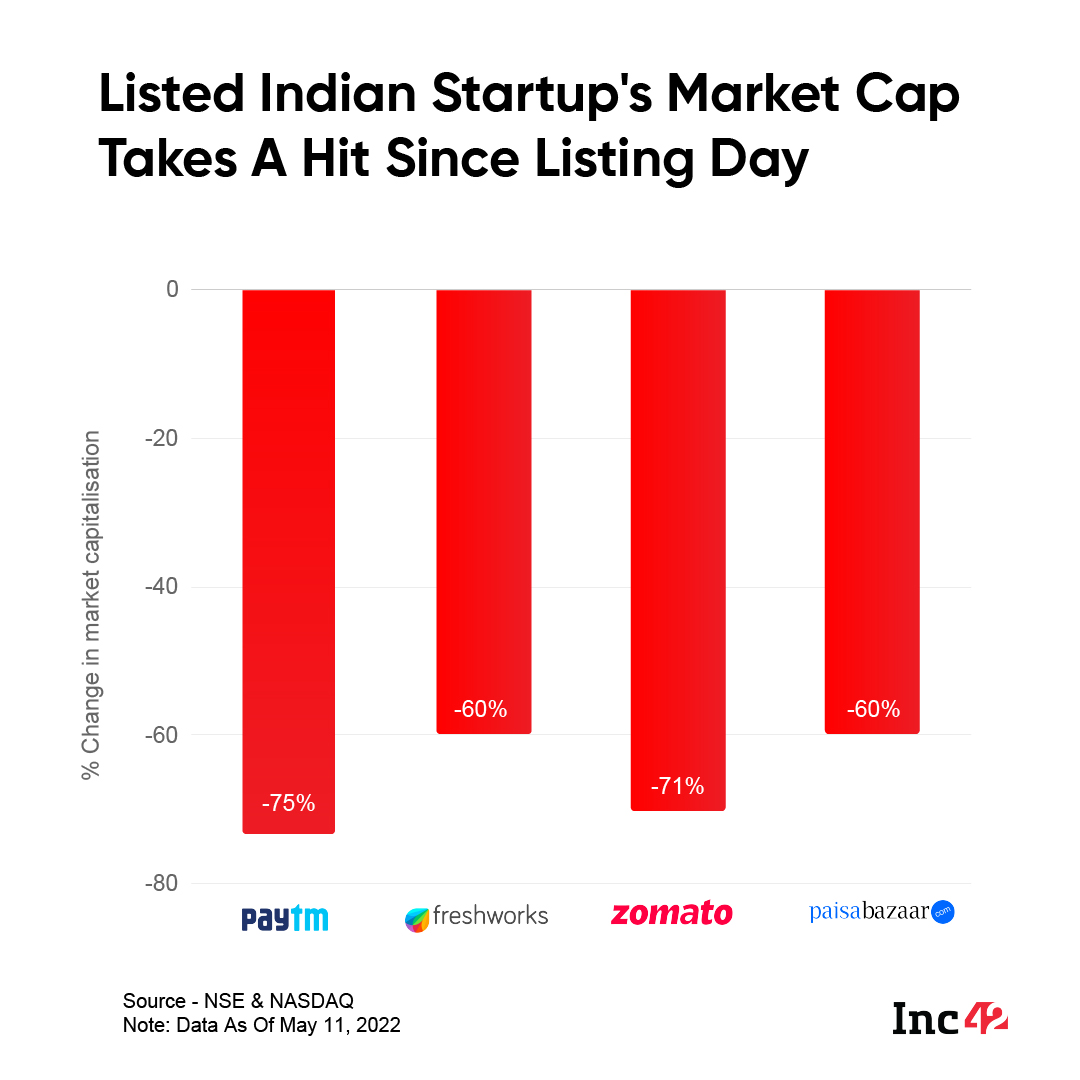

Last year, 11 Indian startups opted for the big leagues with IPOs, raising a total of $7.3 Bn through public issues. However, the case of startup IPOs and their valuations is not helped by the fact that multiple stocks have taken a nosedive post listing.

Apart from the market instability caused by the Russian invasion of Ukraine, the apprehension regarding another Covid-19 wave and the general performance of previous IPOs have also played a role in startups going for IPOs to either reconsider their offer sizes or wait for the storm to pass.

One of the most recent examples of this was the Delhivery IPO. The logistics unicorn opted to reduce its offer size by almost a third, going from an initial INR 7,640 Cr to INR 5,230 Cr.

Delhivery did achieve over 100% subscription by the end of the offer window, however, the logistics unicorn might have hoped for better.

Apart from Delhivery, many other IPO-bound startups have been considering this move. Some, such as FirstCry, have postponed their IPOs altogether.

FirstCry was looking to file its draft papers for a $1 Bn IPO up from its previous consideration of a $600 Mn-$700 Mn IPO. However, broader headwinds in global markets have seen the startup delay its listing plans.

Collectively, the slumping startup stock has been wiping off lakhs of crores of investor wealth, and this has justifiably prompted SEBI to look into valuations and correct them before the market does it for the companies listing, burning investor wealth into the ground.

![Read more about the article [Funding alert] B2B rental startup Settlrs raises undisclosed amount in pre-Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/funding-1615437662855-300x150.png)